Bond prices continued to rally this week with the 3-year Treasury yield falling 24bp and the 10-year down 11bp as of this writing. On the short-end of the curve, 3- and 6-month bills rose 7bp and 24bp respectively. The yield curve has flattened sharply since mid last week as the market continues to “unwind” some of the Fed rate hikes that had been initially priced in. The 10-year yield is now down 37bp since June 14. Attention appears to be shifting away from the threat of inflation and focusing more on the threat of an impending recession.

Fed Chairman Powell presented his semi-annual monetary policy report to Congress this week and reiterated the Fed’s unwavering commitment to bring down inflation that is running at a 40-year high. Powell was repeatedly asked if the Fed would continue to hike rates if unemployment began to rise and inflation had not yet moderated. His answers were always diplomatic, but unmistakable: yes! The Fed is willing to risk a recession to cool inflation. Even the Fed’s own internal summary of economic projections show they believe the unemployment rate will rise to 4.1% in 2024 from 3.6% today. As economist David Rosenberg showed at a recent Baker seminar, all it takes to trigger a recession is a small rise in unemployment of around 0.3%. While a recession is not the Fed’s preferred outcome, Powell said “It’s certainly a possibility” and achieving a “soft landing” will be difficult. That is clear given the fact that the Fed has embarked on 14 tightening cycles since WWII and a recession has followed 11 times or nearly 80% of the time. The Fed does not have a great track record in preventing recessions as they raise rates and markets are beginning to accept this.

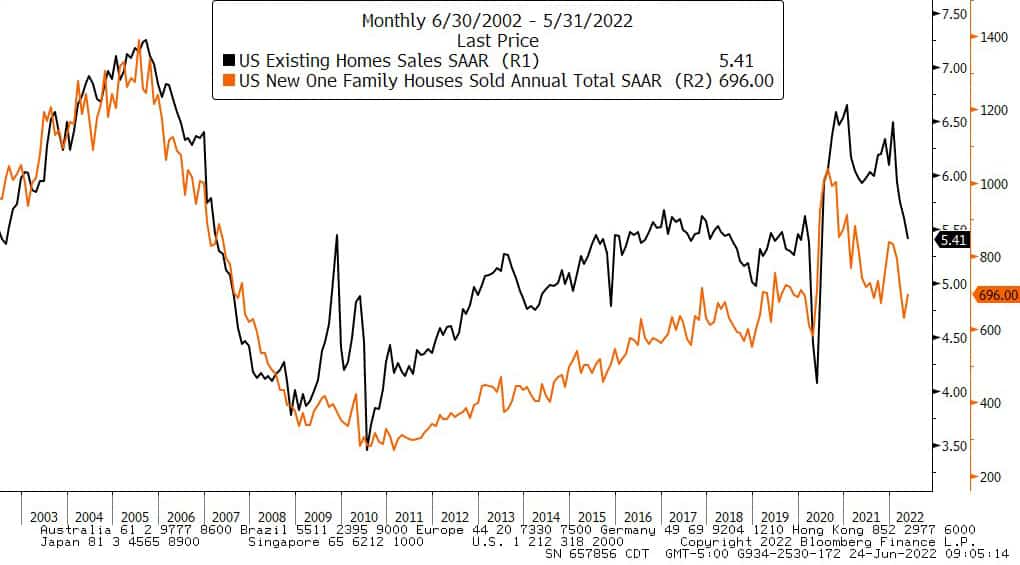

This week saw mixed reports for housing with existing sales down 3.4% and new home sales unexpectedly rose 10.7%. Rising mortgage rates and surging inventories of homes for sale will continue to pressure housing in the near-term. Next week we’ll get a slew of economic data on Durable Goods Orders, Pending Home Sales, Personal Income & Spending, PCE inflation and ISM Manufacturing PMI.

New and Existing Home Sales – Last 20 Years

The Baker Group is one of the nation’s largest independently owned securities firms specializing in investment portfolio management for community financial institutions.

Since 1979, we’ve helped our clients improve decision-making, manage interest rate risk, and maximize investment portfolio performance. Our proven approach of total resource integration utilizes software and products developed by Baker’s Software Solutions* combined with the firm’s investment experience and advice.

Author

Ryan W. Hayhurst

President

The Baker Group LP

800.937.2257

*The Baker Group LP is the sole authorized distributor for the products and services developed and provided by The Baker Group Software Solutions, Inc.

INTENDED FOR USE BY INSTITUTIONAL INVESTORS ONLY. Any data provided herein is for informational purposes only and is intended solely for the private use of the reader. Although information contained herein is believed to be from reliable sources, The Baker Group LP does not guarantee its completeness or accuracy. Opinions constitute our judgment and are subject to change without notice. The instruments and strategies discussed here may fluctuate in price or value and may not be suitable for all investors; any doubt should be discussed with a Baker representative. Past performance is not indicative of future results. Changes in rates may have an adverse effect on the value of investments. This material is not intended as an offer or solicitation for the purchase or sale of any financial instruments.