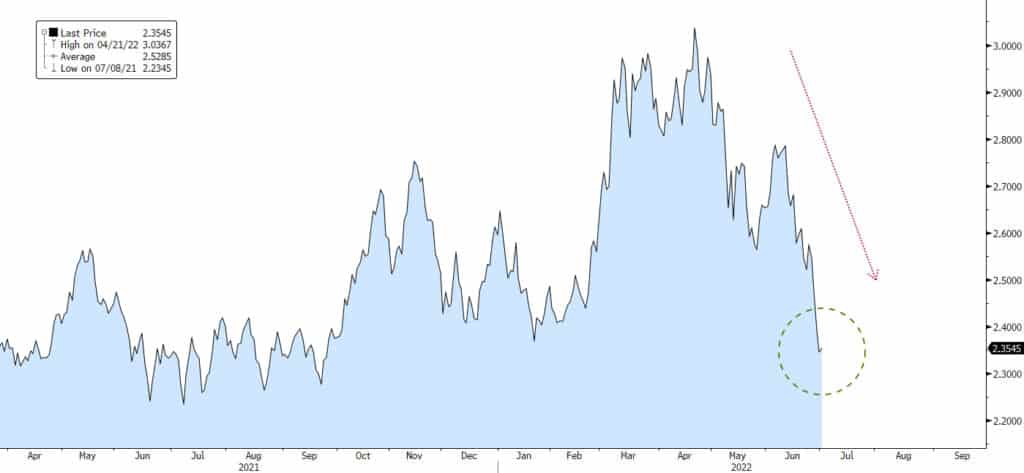

Don’t look now, but the bond market has rallied like a monster in the last two weeks. After reaching 3.50%, the highest level in eleven years, the 10yr T-Note yield has now collapsed by 70bps to 2.80% on mounting concerns about a slowdown in the US economy and a sense of relief that inflation fears seem to be fading. Indeed, the fall in bond yields corresponds to an equally impressive drop in projected inflation. The Fed, still walking a tightrope between inflation and recession, must now stick to their guns and follow-through with tightening until “price stability” is restored. Otherwise, previous criticism about policymakers’ credibility will justifiably return. For now, the market seems pleased with the forceful-inflation-fighting Fed as opposed to the never-ending-quantitative-ease Fed. The yield curve from 2- to 10-years has flattened to a spread of 5 or 6 basis points, very nearly another inversion. Stay tuned on that.

One of the reasons for concern about US growth is the loss of momentum from consumer spending in the second quarter. Personal income and spending data revealed that real consumption fell by 0.4% in May while April’s 0.7% gain was revised down to just 0.2%, with downward revisions to prior months as well. As consumption expenditures represent the lion’s share of GDP, the likely effect on overall output for the second quarter will be to keep GDP growth to no more than 1% annualized at best. That comes after a 1.6% contraction in Q1. Not a picture of health. It remains a very real possibility that we are already in recession, but must wait for the data to confirm. In any case, none of this news is inflationary… hence the bond market relief.

On the inflation data front, we saw this week that the Fed’s preferred measure of inflation fell in May for the third consecutive month. The core PCE price index now sits at 4.69%, down 63bps from the 5.31% high in February. We’ve also seen a substantial falloff in commodities prices as the CRB composite index of all commodities is down 7.4% (33% annualized) in two months. Moreover, the Institute for Supply Management (ISM) “prices-paid” index was weaker than both the prior month’s reading and the consensus estimate.

As for Fed policy, there’s nothing at this point to suggest the Fed will be ready to slow the pace of tightening next month, and there remains strong sentiment among policymakers for another 75bps. That would get the funds rate roughly to “neutral” by summer’s end. Before that meeting, policymakers will assess the coming stream of data which include the June employment report next week as well as CPI and retail sales among other data. Powell recently reiterated that the Fed is “strongly committed to bringing inflation back down” and described price stability as “the bedrock of the economy”. Still, the collateral damage of a war on inflation, including a possible recession, is something the Fed must consider. The tightrope remains a perilous trek.

US 10yr Breakeven Inflation Rate (TIPS Spread): 2021 - Today

The Baker Group is one of the nation’s largest independently owned securities firms specializing in investment portfolio management for community financial institutions.

Since 1979, we’ve helped our clients improve decision-making, manage interest rate risk, and maximize investment portfolio performance. Our proven approach of total resource integration utilizes software and products developed by Baker’s Software Solutions* combined with the firm’s investment experience and advice.

Author

Jeffrey F. Caughron

Senior Partner

The Baker Group LP

800.937.2257

*The Baker Group LP is the sole authorized distributor for the products and services developed and provided by The Baker Group Software Solutions, Inc.

INTENDED FOR USE BY INSTITUTIONAL INVESTORS ONLY. Any data provided herein is for informational purposes only and is intended solely for the private use of the reader. Although information contained herein is believed to be from reliable sources, The Baker Group LP does not guarantee its completeness or accuracy. Opinions constitute our judgment and are subject to change without notice. The instruments and strategies discussed here may fluctuate in price or value and may not be suitable for all investors; any doubt should be discussed with a Baker representative. Past performance is not indicative of future results. Changes in rates may have an adverse effect on the value of investments. This material is not intended as an offer or solicitation for the purchase or sale of any financial instruments.