Here in the great plains, the month of May is traditionally considered “storm season” when the likelihood of tornados and severe weather is at its height. The first week of the month has also been volatile and stormy for financial markets. Indeed, it seems none have been spared. Stocks, bonds, gold… every asset class got hit hard at some point this week. To be sure, the trade-weighted dollar remains strong as an ox as it sits at 20-year highs, but assets denominated in the dollar (or any other currency for that matter) have gotten clocked. Remember, though, that nothing moves in a straight line. Volatility has been the word for the week as comments from the Fed chairman on Wednesday at first triggered a massive rally in both stocks and bonds, pushing the 10yr T-Note yield down below 2.90%, only to see a complete reversal of all that price action the next day, plus some. So what gives?

As the Fed strives to impress upon markets their seriousness in fighting inflation, the magnitude of

their task is becoming more apparent. In their zest to get the fed funds rate to neutral (considered 2.5%-projected) or higher, they run the very real risk of choking the growth out of the economy and sending us into recession. The worst case would be a 1970’s-style period of “stagflation”. Historical reminder: As Fed Chairman, Paul Volker successfully crushed inflation during this period, but not without some pain. The level of the S&P 500 Index at the trough of the 1982 recession was about where it had been in 1976. Food for thought indeed. And this time around, there’s a gigantic Fed balance sheet that needs to be deflated. Storm season may be with us for a while.

The big data release for the week was this morning’s jobs report. On its face, the April employment report doesn’t rock anybody’s world… payrolls up 428K vs 380K projected, average hourly earnings YOY 5.5% vs 5.6% last month, and the UE rate remained at 3.6%. So at first glance we see slightly better payrolls growth and slightly less wage inflation than expected. There was an interesting downtick in labor force participation to 62.2% from 62.4% prior which feeds the narrative that the labor market continues to adjust to a post-pandemic world where labor supply is a major issue and the wide gulf between job openings and hires remains a head-scratcher. This keeps intact the fear that continuing (or resuming) upward pressure on wages will persist making the Fed’s job even more treacherous.

So, as we approach the weekend, we see the 10yr T-Note sitting at a lofty 3.10%. The range between 3.0 and 3.25% should serve as key yield resistance, but if we punch through 3.25%, it will bring us to the highest level in eleven years. We’ve also seen the yield curve steepen. The 2s / 10s yield spread is now out to 4bps, a notable difference from the inversion we had at the first of last month. More recession indicators (like the yield curve inversion) are starting to flash warning signs. The downdraft in financial markets may simply be adjusting to, and embracing the reality of an aggressive Fed. Bonds have led the way as the jump in yields has been rapid and substantial already. The wall clouds are forming, watch for rotation.

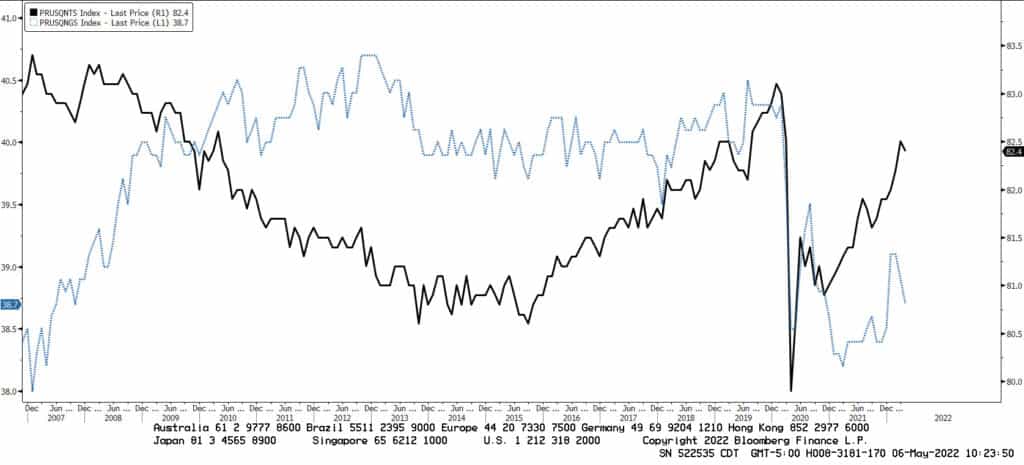

US Labor Force Participation: 2005 – Today

Prime-Age (solid line) and 55+ (dotted line)

The Baker Group is one of the nation’s largest independently owned securities firms specializing in investment portfolio management for community financial institutions.

Since 1979, we’ve helped our clients improve decision-making, manage interest rate risk, and maximize investment portfolio performance. Our proven approach of total resource integration utilizes software and products developed by Baker’s Software Solutions* combined with the firm’s investment experience and advice.

Author

Jeffrey F. Caughron

Senior Partner

The Baker Group LP

800.937.2257

*The Baker Group LP is the sole authorized distributor for the products and services developed and provided by The Baker Group Software Solutions, Inc.

INTENDED FOR USE BY INSTITUTIONAL INVESTORS ONLY. Any data provided herein is for informational purposes only and is intended solely for the private use of the reader. Although information contained herein is believed to be from reliable sources, The Baker Group LP does not guarantee its completeness or accuracy. Opinions constitute our judgment and are subject to change without notice. The instruments and strategies discussed here may fluctuate in price or value and may not be suitable for all investors; any doubt should be discussed with a Baker representative. Past performance is not indicative of future results. Changes in rates may have an adverse effect on the value of investments. This material is not intended as an offer or solicitation for the purchase or sale of any financial instruments.