As the first week of summer began, Federal Reserve Vice-Chair Lael Brainard stuck to the script on aggressive monetary policy by clarifying her support for raising rates in 50bps chunks at the next two FOMC meetings, and tamping down speculation that there will be some sort of “pause” in September. That echoes Chairman Powell who said there will be no “looking around” for “nuanced readings of inflation”. The plan, it seems, is to tighten until inflation is coming down in a “clear and convincing way.” Otherwise, they’ll keep going. Markets have taken note, but now policymakers must follow-through.

The Fed’s reiteration of aggressive and unambiguous policy is welcome and necessary to weed out any inflationary psychology that’s becoming embedded in the decision-making of households or firms. The cost of that policy, as is well understood, is demand destruction and a likely recession beginning sometime in the next year. The Fed’s weaponry now includes steady reduction of their balance sheet (Quantitative Tightening) as this week saw the beginning of their process to shrink the $8.9 trillion asset portfolio. The plan for steadfast monetary tightening is designed to reverse the excess stimulus that was produced in response to the pandemic in 2020-21, and hopefully unwind the inflationary impulse that it created. The excess stimulus led to spending rather than production, and speculation rather than investment. If the Fed stays on task, the resulting recession will likely be painful in order to squash inflation, and it may be exacerbated by the collapse of price bubbles in speculative assets that resulted from the over-stimulus. Strong but necessary medicine.

The week’s economic data releases showed still-strong home price appreciation, and still-solid job creation, but the sky seems to be getting a bit darker for the economy in subtle but important ways. Productivity growth (output per worker) for the month of May fell by a stunning 7.1%, the lowest in fifty years at least. Corporate profits in the first quarter declined as firms continued to higher workers despite negative output. Also, part time employment for economic reasons jumped last month, pushing the “underemployment” rate up for a second consecutive month to 7.1%. We saw that the ISM employment index fell below 50%, an indication of contraction in the manufacturing sector. That was reinforced by the fact that payrolls creation for manufacturing jobs was just 18K, far short of the estimates and well below the prior month’s 55K.

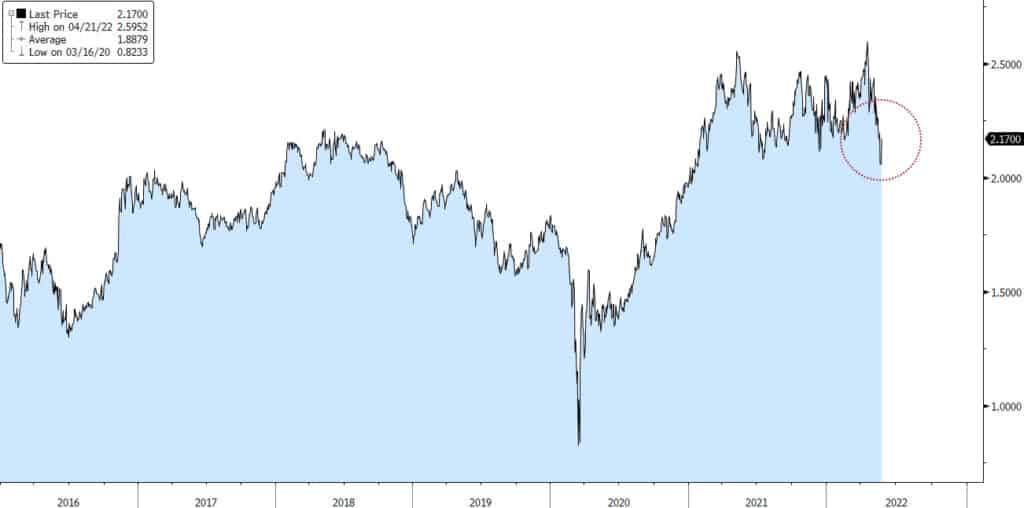

The 10yr US T-Note yield traded in a 25bps range from 2.75% to 3%, and the futures market was priced for a 3% fed funds rate by early next year. The slope of the yield curve (2s / 10s spread) has been stuck around 25-30bps for several weeks. Some good news… the Fed’s favorite measure of inflation expectations fell this week to the lowest level in well over a year, lower even than the average for all of 2018. Maybe the inflation psychology is breaking. Time will tell.

Fed’s Five Year Forward Breakeven Inflation: 2015 – Today

The Baker Group is one of the nation’s largest independently owned securities firms specializing in investment portfolio management for community financial institutions.

Since 1979, we’ve helped our clients improve decision-making, manage interest rate risk, and maximize investment portfolio performance. Our proven approach of total resource integration utilizes software and products developed by Baker’s Software Solutions* combined with the firm’s investment experience and advice.

Author

Jeffrey F. Caughron

Senior Partner

The Baker Group LP

800.937.2257

*The Baker Group LP is the sole authorized distributor for the products and services developed and provided by The Baker Group Software Solutions, Inc.

INTENDED FOR USE BY INSTITUTIONAL INVESTORS ONLY. Any data provided herein is for informational purposes only and is intended solely for the private use of the reader. Although information contained herein is believed to be from reliable sources, The Baker Group LP does not guarantee its completeness or accuracy. Opinions constitute our judgment and are subject to change without notice. The instruments and strategies discussed here may fluctuate in price or value and may not be suitable for all investors; any doubt should be discussed with a Baker representative. Past performance is not indicative of future results. Changes in rates may have an adverse effect on the value of investments. This material is not intended as an offer or solicitation for the purchase or sale of any financial instruments.