Financial markets are very good at discounting future events. The anticipatory pricing-in of expected future Fed policy changes, for example, is already baked in the cake with respect to the shape of the yield curve today. We have to be careful, though, to consider how much of the future we can comfortably discount into current pricing. Feedback loops between expectations and economic fundamentals can cause havoc when conditions change unexpectedly.

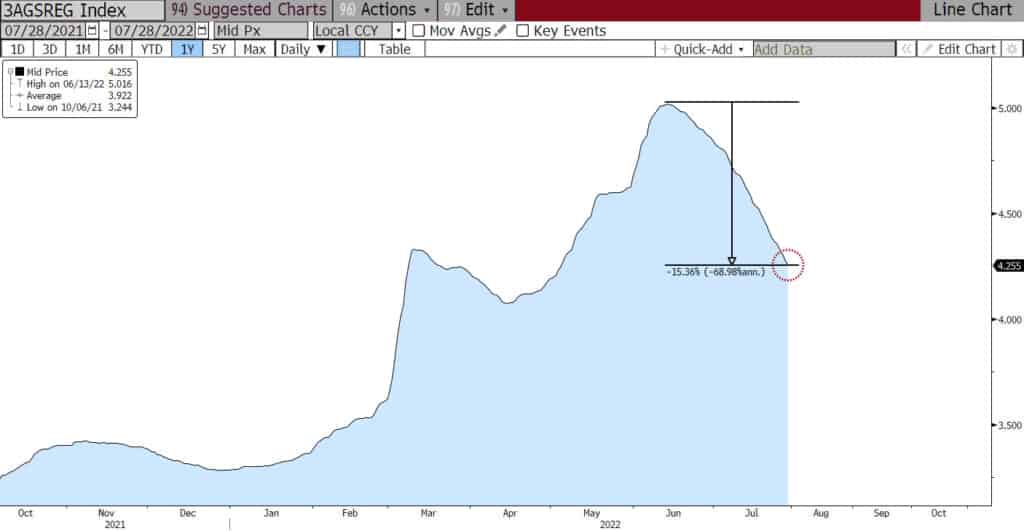

This week we got a ton of information and inputs into decision-making with respect to market conditions today, tomorrow and in the months ahead. The Fed’s open market committee meeting gave us a second consecutive 75bps rate hike, and signals that the magnitude of future hikes may be lessened. We also heard from the chairman that the Fed is unwavering in their fight against inflation. We then got news that the US economy has now seen two consecutive quarters of contraction, not growth, as the initial estimate of second quarter GDP came in at a disappointing -0.9%, following a -1.6% for Q1. We’ve also watched commodities prices continue to march lower. Gasoline prices have fallen every single day for a month and a half, and lumber prices are back to pre-pandemic levels.

So right now, the bond market has determined that it makes sense to assume the Fed will continue to ratchet up the fed funds rate until they’ve reached around 3.25% which is expected to happen by year-end. Thereafter we can expect a pause and then gradual easing of the policy rate. Now all of this, mind you, is according to the futures market which is a constantly moving target. So, beware and be nimble. All news is old news… markets are forever looking ahead.

The fall in bond yields has been impressive. The 10yr T-Note now sits at a 2.67% yield, down 83bps in 45 days, and the lowest level since the first week of April. The 2yr yield is now at 2.90% producing a healthy 23bps inversion, the deepest we’ve seen in decades and a good precursor to a recession that everyone knows is nearly or already upon us. It seems that bonds have been on a mission to price-in a complete tightening cycle from trough to peak, and then a reversal.

We also found this week that inflation-adjusted consumer spending in the US was barely positive in June after falling -0.4% in May, and real final sales (domestic demand in the GDP calculation) are now negative for the first time since trough of the last recession. Regional Fed surveys, consumer confidence, and new home sales were all reported to be worse than expected. Durable goods orders and capital expenditures were slightly better than estimates, however, and the inflation numbers released this morning were no lower than previously. PCE inflation (the Fed’s preferred measure) came in at 6.8%, right on the screws, while the core number was a tick higher at 4.8%. This inflation data is critical. These are the numbers that need to decline for the Fed to feel comfortable that they’ve accomplished the mission. Until that happens, we can expect continued rate hikes, continued inversion, and uncertain timing. Anticipate what will happen, but don’t try to predict when.

US Daily National Gasoline Prices: 2021 - Today

The Baker Group is one of the nation’s largest independently owned securities firms specializing in investment portfolio management for community financial institutions.

Since 1979, we’ve helped our clients improve decision-making, manage interest rate risk, and maximize investment portfolio performance. Our proven approach of total resource integration utilizes software and products developed by Baker’s Software Solutions* combined with the firm’s investment experience and advice.

Author

Jeffrey F. Caughron

Senior Partner

The Baker Group LP

800.937.2257

*The Baker Group LP is the sole authorized distributor for the products and services developed and provided by The Baker Group Software Solutions, Inc.

INTENDED FOR USE BY INSTITUTIONAL INVESTORS ONLY. Any data provided herein is for informational purposes only and is intended solely for the private use of the reader. Although information contained herein is believed to be from reliable sources, The Baker Group LP does not guarantee its completeness or accuracy. Opinions constitute our judgment and are subject to change without notice. The instruments and strategies discussed here may fluctuate in price or value and may not be suitable for all investors; any doubt should be discussed with a Baker representative. Past performance is not indicative of future results. Changes in rates may have an adverse effect on the value of investments. This material is not intended as an offer or solicitation for the purchase or sale of any financial instruments.