In the last forty-five days, the yield on the 10yr T-Note has traded in a 100bps range, from a low of 2.51% to a high of 3.50%. It currently hovers around 2.85%. During that month and a half, we have gotten several key pieces of information about the strength and resilience of US economic growth trends, inflation and other Fed policy considerations. For example, we learned that year-over-year CPI inflation in June clocked a multi-decade high of 9.10%, but since that survey period we’ve also watched average gasoline prices fall for 52 consecutive days. Similarly, GDP growth was reported to have been negative through the entire first half of the year, a common baseline definition of recession. But at the very same time, job creation remains extremely, even historically, strong as we cranked out over half a million new jobs in the month of July. Through it all, the Fed continues to collectively talk tough about their commitment to squash inflation, and the yield curve is as inverted as it’s been since the turn of the century. So, in the midst of this crossfire, what’s a reasonable view about the future?

Though it’s a moving target, the wisdom of markets and investor expectations at a point in time is worth considering. Right now (post-employment report) futures markets project a 3.5% fed funds rate by year-end, rising further in early 2023 before bending back in the second half of next year. The deeply inverted yield curve suggests a similar trajectory. The Fed can be expected to stay on task with aggressive tightening up to a point… somewhere around 3.5%, then let off the brake and cruise for a while, maybe eventually some slight reacceleration if the recession gets ugly. But all bets are off if inflation data doesn’t behave. It’s not a stretch to say that everything else is secondary. We get another CPI number next week… currently expected to drop by 40bps to 8.7%. All eyes will be on that one. Later in the month we’ll see the Fed’s preferred measure, PCE inflation, as well. These are the numbers that will give the Fed what they need to justify continuing their policy stance, or tweaking it as they deem appropriate.

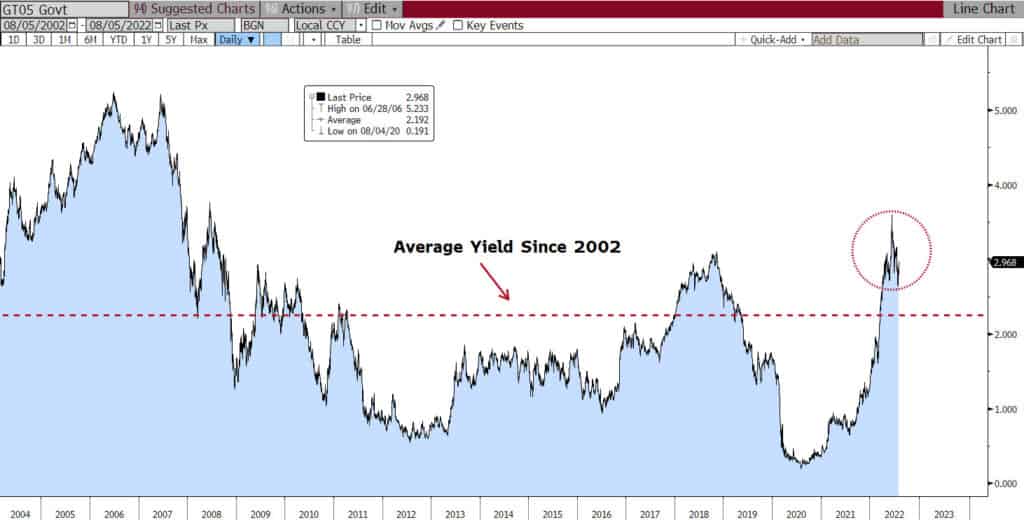

While wondering where we go from here, it’s also worth considering how much has already been baked in the cake. Let’s remember how far we’ve come in terms of the yield increases that we’ve seen to date. Take the 5yr T-Note yield, for example… a bond that anchors the “belly” of the yield curve. Over the last twenty years, that mid-maturity treasury has averaged 2.25%. Today it sits at 2.96%… 71bps above the average of the prior two decades. The enormous jump in yield that we’ve seen in the last year has produced far greater value relative to the average of what’s been seen in the lifetimes of this year’s college graduates. A point worth pondering.

In addition to CPI, we’ll get a look at the latest consumer sentiment survey data as well as some key treasury auctions. Nearly $100 billion of threes, tens, and long-bonds will come to market. How well those are received will tell us a lot about the underlying strength of the bond market.

US 5yr Treasury-Note Yield: 2002 – Today

The Baker Group is one of the nation’s largest independently owned securities firms specializing in investment portfolio management for community financial institutions.

Since 1979, we’ve helped our clients improve decision-making, manage interest rate risk, and maximize investment portfolio performance. Our proven approach of total resource integration utilizes software and products developed by Baker’s Software Solutions* combined with the firm’s investment experience and advice.

Author

Jeffrey F. Caughron

Senior Partner

The Baker Group LP

800.937.2257

*The Baker Group LP is the sole authorized distributor for the products and services developed and provided by The Baker Group Software Solutions, Inc.

INTENDED FOR USE BY INSTITUTIONAL INVESTORS ONLY. Any data provided herein is for informational purposes only and is intended solely for the private use of the reader. Although information contained herein is believed to be from reliable sources, The Baker Group LP does not guarantee its completeness or accuracy. Opinions constitute our judgment and are subject to change without notice. The instruments and strategies discussed here may fluctuate in price or value and may not be suitable for all investors; any doubt should be discussed with a Baker representative. Past performance is not indicative of future results. Changes in rates may have an adverse effect on the value of investments. This material is not intended as an offer or solicitation for the purchase or sale of any financial instruments.