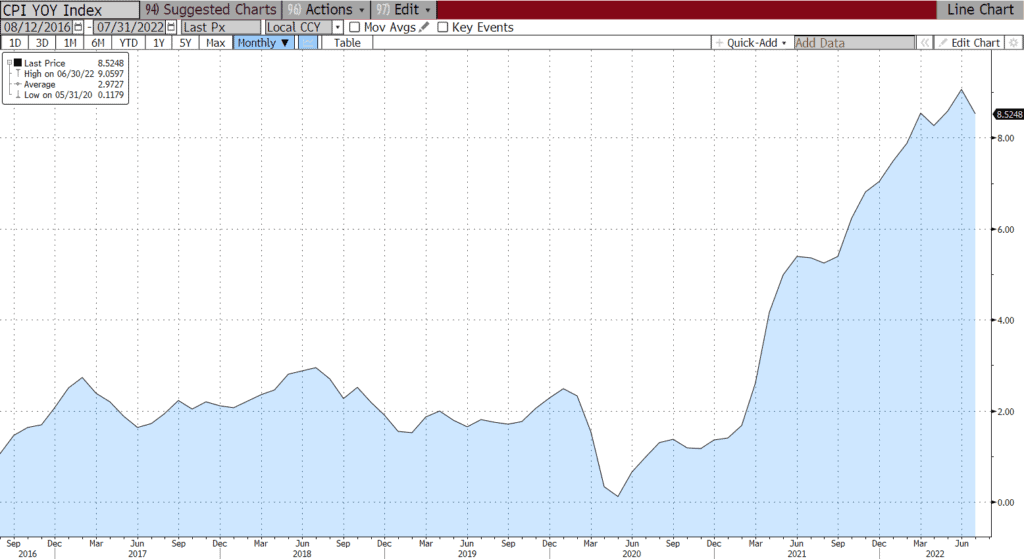

“Today we received news that our economy had 0 percent inflation in the month of July.” stated President Biden last Wednesday morning after Consumer Price Index was released. Additionally, he stated “Zero percent. Here’s what that means. While the price of some things went up last month, the price of other things went down by the same amount. The result, 0 inflation last month.” Technically, he isn’t wrong, the headline consumer price index (CPI) month over month change was 0.00% for the month of July, below expectations for a 0.2% month over month change. However, the year over year change of 8.5% is still a high print, even though it was below expectations of an 8.7% increase and a reduction from the previous month. A reduction in energy price including what we pay at the pump helped to cool inflation some. Core CPI (excludes food and energy) increased 0.3% month over month, lowered than the expected 0.5% increase. The year over year Core CPI also came in lower than expected at 5.9%. Is it time to print out and setup the “Mission Accomplished” banners? Not quite yet! The is all good news for the Fed, but they still know they have a long way to go. Only time will tell if inflation is truly moving lower towards the Fed’s goal of averaging 2 percent over time. The month over month and year over year decline in both measurements of CPI brought joy to the equity investors this week.

More news hot off the press this morning is this month’s University of Michigan index of consumer sentiment. The index rose to 55.1 this month from a July reading of 51.1, which also beat expectations of a smaller increase to 52.5. Americans remain concerned about the rapidly rising cost of key goods like food and rent, thought declines in the price of gasoline in recent weeks has helped the overall mood of the consumer. Inflation still remains a top concern for Americans, as the share of consumers blaming inflation for eroding their living standards remained near 48%.

This morning, we are seeing a rally in the longer part of the yield curve with the 30-year Treasury bond yielding a 3.13%. The yield curve remains inverted from the 1-year bill to the 30-year bond, with the 1-year bill yield 11 basis points more than the long bond. Stocks have had a strong week with continued momentum this morning as the Dow Jones Industrial Average is up 200 points early.

Next week’s key releases bring of a variety of insight on the real estate market and retail sales. On Tuesday, we will get new building permits and housing starting and existing home sales on Friday. Important retail sales data comes mid-week alongside the Fed’s July meeting minutes release.

I hope everyone has a great and relaxing weekend! Until next time!

Headline Consumer Price Index YOY Change: 2016 - Today

The Baker Group is one of the nation’s largest independently owned securities firms specializing in investment portfolio management for community financial institutions.

Since 1979, we’ve helped our clients improve decision-making, manage interest rate risk, and maximize investment portfolio performance. Our proven approach of total resource integration utilizes software and products developed by Baker’s Software Solutions* combined with the firm’s investment experience and advice.

Author

Dale Sheller

Managing Director

Director of Financial Strategies Group

The Baker Group LP

800.937.2257

*The Baker Group LP is the sole authorized distributor for the products and services developed and provided by The Baker Group Software Solutions, Inc.

INTENDED FOR USE BY INSTITUTIONAL INVESTORS ONLY. Any data provided herein is for informational purposes only and is intended solely for the private use of the reader. Although information contained herein is believed to be from reliable sources, The Baker Group LP does not guarantee its completeness or accuracy. Opinions constitute our judgment and are subject to change without notice. The instruments and strategies discussed here may fluctuate in price or value and may not be suitable for all investors; any doubt should be discussed with a Baker representative. Past performance is not indicative of future results. Changes in rates may have an adverse effect on the value of investments. This material is not intended as an offer or solicitation for the purchase or sale of any financial instruments.