Bond yields rose 10-16bp in the 3-10yr part of the curve this week despite weak housing data as multiple Fed officials gave mixed signals on the size of the September rate hike. St. Louis Fed President James Bullard, considered to be the most hawkish voting member of the FOMC, said he leaned towards a 75bp hike and said “we should continue to move expeditiously to a level of the policy rate that will put significant downward pressure on inflation.” On the other side of the hawk/dove divide is Kansas City Fed President Esther George who dissented in June in favor of a smaller 50bp hike and said this week “we have done a lot, and I think we have to be very mindful that our policy decisions often operate on a lag. We have to watch carefully how that’s coming through.” The markets seem to be trying to determine whether the hawks or the doves will win out as fed fund futures are currently pricing in a 55% probability of a 50bp hike net month and a 45% chance it will be 75bp. That debate could be resolved next Friday when Fed Chairman Jerome Powell speaks on the economic outlook at the Kansas City Fed’s annual policy retreat in Jackson Hole, WY.

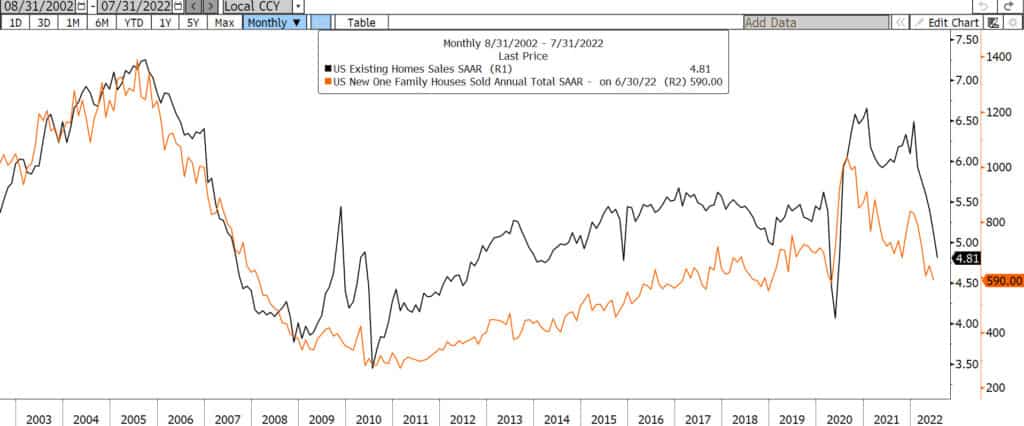

Economic data released this week showed housing fell deeper into recession while the consumer continues to spend in the face of higher inflation and industrial production expanded. Retail Sales were flat in July, but outside of gas and autos, sales rose a better than expected 0.7%. Industrial Production also rose 0.6%, double the expectation, while Capacity Utilization rose to 80.3%. Housing Starts fell 9.6% in July and are down 20% since April while Existing Home Sales fell another 5.9% and are now down a whopping 45% since January. The sharp drop in housing activity should be an early warning for the Fed as they try to anticipate the impact of recent rate hikes. Housing is leading the economy into a downturn since market yields tend to rise before the Fed hikes and mortgage rates had already risen 200bp by the time the Fed made their first move in March. The broader economy won’t see the full impact of the 150bp of rate hikes in June and July until this fall at the earliest, just as Ester George warned earlier this week.

Next week could be a busy one in financial markets with a slew of economic releases including New Home Sales, Durable Goods Orders, the second estimate of Q2 GDP, Personal Income/Spending and the Fed’s preferred measure of inflation, the PCE Deflator. But all eyes will be on Jackson Hole, WY next Friday as the market dissects every word of Fed Chairman Powell’s speech for any indication of how big the next rate hike will be and how long before the Fed takes their foot off the economic brakes.

New and Existing Home Sales – Last 20 Years

The Baker Group is one of the nation’s largest independently owned securities firms specializing in investment portfolio management for community financial institutions.

Since 1979, we’ve helped our clients improve decision-making, manage interest rate risk, and maximize investment portfolio performance. Our proven approach of total resource integration utilizes software and products developed by Baker’s Software Solutions* combined with the firm’s investment experience and advice.

Author

Ryan W. Hayhurst

President

The Baker Group LP

800.937.2257

*The Baker Group LP is the sole authorized distributor for the products and services developed and provided by The Baker Group Software Solutions, Inc.

INTENDED FOR USE BY INSTITUTIONAL INVESTORS ONLY. Any data provided herein is for informational purposes only and is intended solely for the private use of the reader. Although information contained herein is believed to be from reliable sources, The Baker Group LP does not guarantee its completeness or accuracy. Opinions constitute our judgment and are subject to change without notice. The instruments and strategies discussed here may fluctuate in price or value and may not be suitable for all investors; any doubt should be discussed with a Baker representative. Past performance is not indicative of future results. Changes in rates may have an adverse effect on the value of investments. This material is not intended as an offer or solicitation for the purchase or sale of any financial instruments.