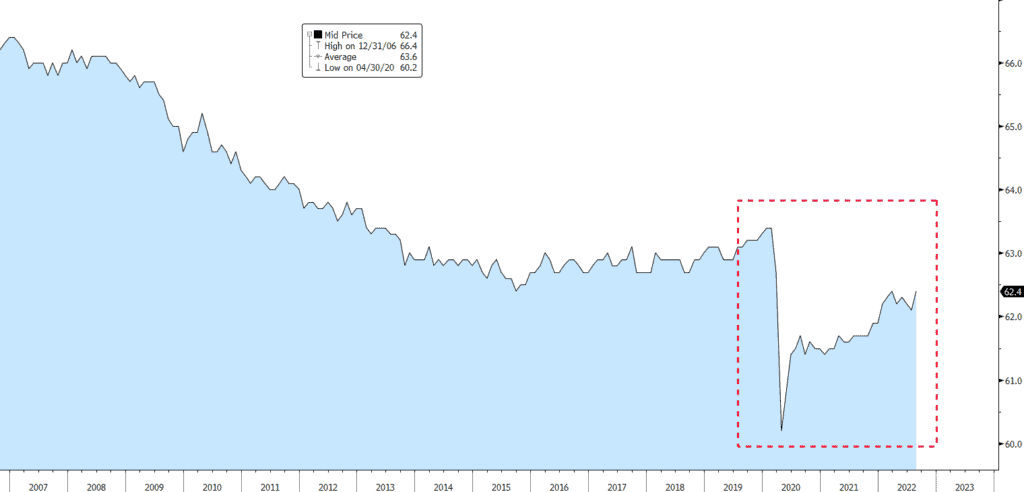

Bond yields drifted higher this week as markets continued to digest the blunt words of Fed Chairman Powell last Friday regarding the central bank’s “overarching focus” on fighting inflation even if it involves a lengthy and painful process. New York Fed President Williams reiterated on Tuesday that we should expect restrictive policy for some time, and that the size of the next rate hike will depend on the totality of income data. Some of that data came this morning with the August employment report which showed that a healthy 315K new payrolls were created for the month, but because of an uptick in labor force participation the unemployment rate jumped two-tenths of a percent to 3.7%. The participation rate is key to understanding how much slack remains in the labor market, and there clearly seems to be room for more people to re-enter the workforce. At 62.4%, participation remains well below pre-pandemic levels, but it’s grinding higher. Overall, with total employment now above pre-pandemic levels, it seems that job creation is on a sustainable but slowing pace. The wage component of the report showed a 5.2% YOY change in average hourly earnings, lower than expected and fairly benign in the current environment. So as summer comes to an end, the labor market is healthy… but keep an eye on what’s coming down the pipe. Remember, less than six months ago the Fed Funds rate was near zero…. Now it sits at 2.50%. That substantial increase in overnight borrowing cost is just now starting to filter through into the” real economy”, and it will no-doubt hit the jobs market.

As Gary Shilling and others have noted, a growth downshift is already well underway. Real wages (adjusted for inflation) have declined every month for well over a year, and though nominal retail sales have risen nearly 7%, they are down over 4% when adjusted for inflation. We’ve also seen five consecutive months of decline in leading economic indicators, and the banking system has experienced a massive drain of reserves as the Fed has tightened. To be sure, the cessation of fiscal stimulus at the end of last year combined with the 225bps of rate hikes since March have begun the process of demand destruction, but much more will be seen before it’s all over. Indeed, the only reason not to call this a recession is that GDI (Gross Domestic Income) remains positive, a lingering effect of the enormous ’20-21 fiscal stimulus. That will not last. Recession, however defined, is here or soon to arrive.

Earlier in the week, we also got fresh data on Durable Goods Orders (which were slightly negative) and Capital Expenditures (up less than expected). Also, consumer sentiment unexpectedly rose, and the ISM Manufacturing Index remained above 50%. Productivity growth, however, remained near historic lows. Next week we’ll get updated numbers for consumer and producer price inflation… key inputs for the Fed.

US Labor Force Participation Rate: 2005 – Today

The Baker Group is one of the nation’s largest independently owned securities firms specializing in investment portfolio management for community financial institutions.

Since 1979, we’ve helped our clients improve decision-making, manage interest rate risk, and maximize investment portfolio performance. Our proven approach of total resource integration utilizes software and products developed by Baker’s Software Solutions* combined with the firm’s investment experience and advice.

Author

Jeffrey F. Caughron

Senior Partner

The Baker Group LP

800.937.2257

*The Baker Group LP is the sole authorized distributor for the products and services developed and provided by The Baker Group Software Solutions, Inc.

INTENDED FOR USE BY INSTITUTIONAL INVESTORS ONLY. Any data provided herein is for informational purposes only and is intended solely for the private use of the reader. Although information contained herein is believed to be from reliable sources, The Baker Group LP does not guarantee its completeness or accuracy. Opinions constitute our judgment and are subject to change without notice. The instruments and strategies discussed here may fluctuate in price or value and may not be suitable for all investors; any doubt should be discussed with a Baker representative. Past performance is not indicative of future results. Changes in rates may have an adverse effect on the value of investments. This material is not intended as an offer or solicitation for the purchase or sale of any financial instruments.