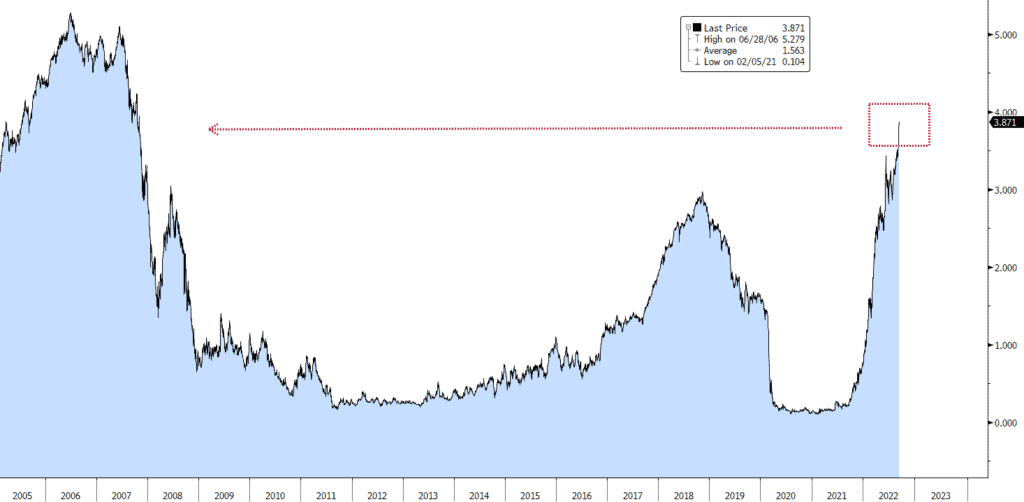

The cost of borrowing continues to rise in order to fight the rising cost of everything else. The great post-pandemic inflation is very much alive, but the Fed is intent on killing it. We learned this week that top-line consumer prices again rose faster than expected, causing stocks, bonds and just about everything else to sell off sharply. Particularly hard hit was the short end of the Treasury yield curve where, for example, the yield on a 2yr Note jumped to 3.90%, it’s highest level since the original iPhone was released in 2007. Longer-dated maturities followed suit to a lesser degree… the 10yr yield is re-testing its June high of 3.5%. So, the yield curve inversion (spread between 2s and 10s) again deepened to over 40bps as markets now expect the Fed to push the funds rate over 4% by year-end. The question is… can the Fed squash inflation without sending the economy into a long and painful recession.

Fed Chair Powell and his colleagues have told us in no uncertain terms that there will be some pain, but that they will be unwavering in their commitment to beating down inflation. The problem is one of timing. We all know that economic policy works with “long and variable time-lags”. Let’s not forget that just six months ago the fed funds rate was near zero, and the first rate-hike in March was a paltry 25bps. If we define “long and variable” as anywhere from six to eighteen months, then we’re just now at the point where that very first baby step of this tightening cycle might be felt. Imagine the impact of the subsequent 225bps as they become manifest in financing household and corporate economic activity. Some quite-reputable analysts, Dave Rosenberg and Jeff Gundlach for example, are sounding the alarm that the Fed risks overplaying their hand as they work to restore credibility and prove that they can accomplish their mission. Falling inflation expectations and the deepening yield curve inversion both seem to confirm this thinking. Moreover, global shipping colossus FedEx Corporation saw such a sudden and significant decline in business conditions that they felt compelled to withdraw their earnings forecast. A leading indicator indeed.

For now, the expectation is that the Fed will stay on task until they see actual, measurable and meaningful declines in inflation. The consensus is that we’ll see another 75bps hike next week, and as always, the accompanying FOMC statement will be heavily scrutinized for any nuanced change in tone. Meanwhile, bond yields are fully priced for another 150bps of tightening and may just want to range trade while incoming data tells us how painful the tightening process truly is for the economy.

It's worth noting that we also got fresh retail sales data this week which showed no nominal change in the control group for the month. We also saw improved consumer sentiment data, but a slight uptick in jobless claims data. In addition to the FOMC meeting, next week will bring the latest housing market data as well as leading economic indicators.

US 2yr Treasury Note Yield: 2003 — Today

The Baker Group is one of the nation’s largest independently owned securities firms specializing in investment portfolio management for community financial institutions.

Since 1979, we’ve helped our clients improve decision-making, manage interest rate risk, and maximize investment portfolio performance. Our proven approach of total resource integration utilizes software and products developed by Baker’s Software Solutions* combined with the firm’s investment experience and advice.

Author

Jeffrey F. Caughron

Senior Partner

The Baker Group LP

800.937.2257

*The Baker Group LP is the sole authorized distributor for the products and services developed and provided by The Baker Group Software Solutions, Inc.

INTENDED FOR USE BY INSTITUTIONAL INVESTORS ONLY. Any data provided herein is for informational purposes only and is intended solely for the private use of the reader. Although information contained herein is believed to be from reliable sources, The Baker Group LP does not guarantee its completeness or accuracy. Opinions constitute our judgment and are subject to change without notice. The instruments and strategies discussed here may fluctuate in price or value and may not be suitable for all investors; any doubt should be discussed with a Baker representative. Past performance is not indicative of future results. Changes in rates may have an adverse effect on the value of investments. This material is not intended as an offer or solicitation for the purchase or sale of any financial instruments.