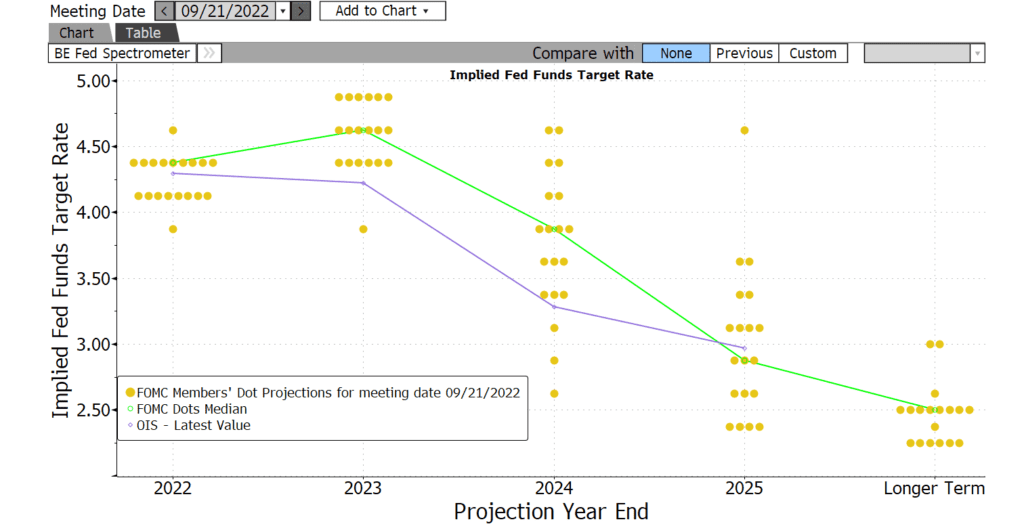

Bond yields surged 21-29bp in the 2-10yr part of the curve this week as the Fed hiked rates 75bp for the 3rd consecutive meeting, the first time that’s happened since 1980. It was not only the large rate hike that sent yields surging higher, it was also the unusually hawkish press conference where Chairman Powell reiterated over and over that the Fed would do everything it takes to bring down inflation and that it would require “pain” to get there. The Fed emphasized this “pain” in their Summary of Economic Projection (SEP) where they downgraded their assessment of GDP growth for 2022-23 and raised their forecast for the Unemployment Rate to 3.8% in 2022 and 4.4% in 2023. The economy has never seen a 0.9% increase (from the 3.5% low) in unemployment and not had a recession – and yet Chairman Powell, when pressed about whether they were forecasting a recession, would never say they were. An increase to 4.4% unemployment means about 1.2 million people would need to lose their job and that is only if unemployment holds at 4.4% which seems unlikely. Unemployment has never risen 0.9% and stopped – once it begins to rise, it normally rises 2-3% and sometimes as high as 6% like in the 2008-09 recession.

The aggressively hawkish Fed was a sharp contrast to the slew of weak economic data released this week. Although Housing Starts unexpectedly rose in August, Building Permits plunged 10%, Existing Home Sales fell for the 7th consecutive month, the NAHB Housing Market Index fell for the 9th consecutive month to the lowest level since 2014 (absent the pandemic low) and Leading Economic Indicators fell for the 6th consecutive month. The problem for the Fed is they have a congressionally imposed dual mandate to seek maximum employment and price stability and to achieve that they focus largely on the Unemployment Rate and PCE/CPI inflation. The only problem with that is both unemployment and inflation are lagging indicators. To know why that is a problem, think about what normally happens during economic downturns. First, the stock market falls, then the economy slows, then unemployment rises and finally inflation falls. The stock market is a leading indicator because markets are always looking to the future and focused on estimating future growth and profits. For this reason, stock prices tend to fall before the economy enters recession. Then the economy slows which leads to lower sales and profits and companies must cut expenses to stay profitable so they lay off employees and unemployment rises. Once people are out of work, they can’t spend money as freely as before and that brings down demand and inflation.

The Fed is focused on lagging indicators which will not turn until after we are in recession. The markets are focused on leading indicators like Building Permits, Consumer Sentiment and the 10yr-2yr spread. All this weak economic data coming the same week of an aggressively hawkish FOMC meeting is a good reminder that the Fed is driving the economic bus looking in the rear-view mirror and they’re heading for a cliff.

The Baker Group is one of the nation’s largest independently owned securities firms specializing in investment portfolio management for community financial institutions.

Since 1979, we’ve helped our clients improve decision-making, manage interest rate risk, and maximize investment portfolio performance. Our proven approach of total resource integration utilizes software and products developed by Baker’s Software Solutions* combined with the firm’s investment experience and advice.

Author

Ryan W. Hayhurst

President

The Baker Group LP

800.937.2257

*The Baker Group LP is the sole authorized distributor for the products and services developed and provided by The Baker Group Software Solutions, Inc.

INTENDED FOR USE BY INSTITUTIONAL INVESTORS ONLY. Any data provided herein is for informational purposes only and is intended solely for the private use of the reader. Although information contained herein is believed to be from reliable sources, The Baker Group LP does not guarantee its completeness or accuracy. Opinions constitute our judgment and are subject to change without notice. The instruments and strategies discussed here may fluctuate in price or value and may not be suitable for all investors; any doubt should be discussed with a Baker representative. Past performance is not indicative of future results. Changes in rates may have an adverse effect on the value of investments. This material is not intended as an offer or solicitation for the purchase or sale of any financial instruments.