Chaos and confusion in UK economic policy sent shockwaves rippling through markets this week, right on the heels of the Fed’s third consecutive 75bps rate hike. That rate hike brought the fed funds rate up to 3.25% and was accompanied by continued tough talk on fighting inflation from a variety of Fed policymakers, all sticking to script. The speed and magnitude of the tightening, however, is not without risk. Remember that the US dollar is the world’s reserve currency and the Fed, in essence, is a central bank to the globe. That being the case, US trading partners and others normally will defend their currencies by raising their own policy rates and conducting fiscal policy that compliments, not contradicts the Fed. This week the UK upset the apple cart by announcing an enormously expensive unfunded tax cut and other stimulus measures that would blow up their deficit and force massive government borrowing. This happened, mind you, right as the Bank of England (BOE) was preparing to raise rates aggressively in sympathy with the Fed. They suddenly found themselves stomping on the accelerator and the brakes at the same time. It was a colossal policy mistake and the UK gilt (bond) market fell into a chaotic collapse. By week’s end the BOE had been forced to stop-and-reverse, announcing bond purchases in order to calm the panic and restore smooth functioning markets. In the wake of all this, the US Treasury market may have hit a key inflection point. As the UK cluster was unfolding, the 10yr T-Note yield hit a 12-year high of 4%, then moved sharply lower to close 30bps lower as buyers came swooping in.

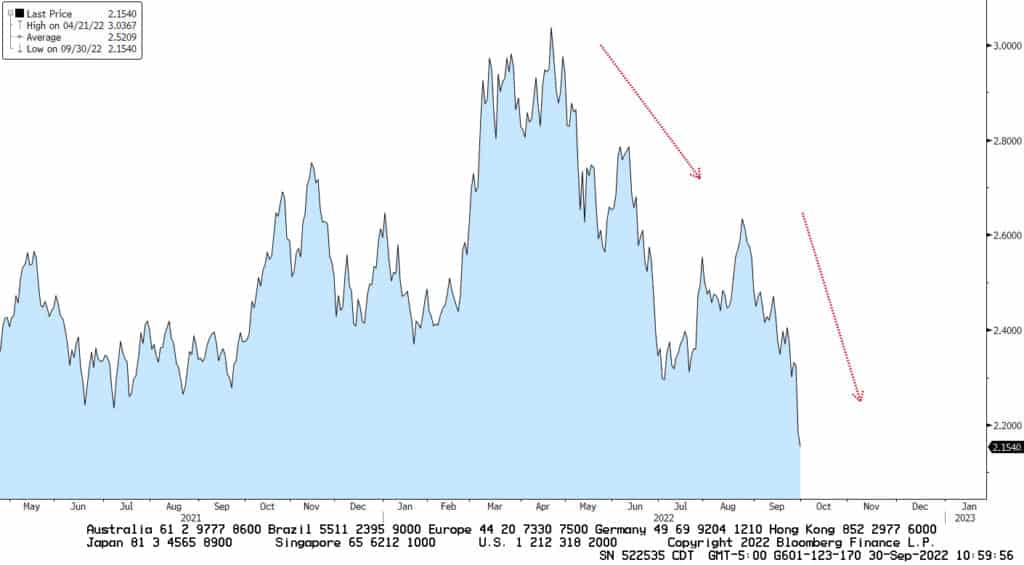

Let’s not forget that this whole mess started with excess stimulus in the US during 2020-21. Then the slow response to inflation that was deemed “transitory” for way too long. Since March the Fed has massively increased the cost of borrowing in the banking system… unprecedented in speed and magnitude… very little of which has actually been felt yet domestically. To be sure, the aggressive Fed tightening along with policymakers’ tough talk seems to be having the desired effect on inflation expectations. Markets now seem to be more focused on the coming demand destruction and depth of a likely recession, rather than continued high rates of inflation. It’s quite possible that 4% was the cycle high for the 10yr…. even if the funds rate ends up higher than that. The yield curve inversion is entrenched for now.

The week’s data releases were mixed, showing that consumer spending, new home sales, and capital goods orders were better than expected, and jobless claims were lower than estimates. But core PCE inflation (closely watched by the Fed) remained stubbornly higher than expected at 4.9% YOY. We also learned that revisions to GDP failed to change the picture of weakness in the first half, though the previously large gap between GDP and GDI (Gross Domestic Income) was narrowed by downward revisions to the latter. The best thing that can be said about Q2 was that real final sales (GDP minus inventory adjustment and net exports) was actually up 0.5% in the second quarter. Forward rates and futures markets are pricing-in slightly lower terminal funds rate than was the case a week ago.

US 10yr Breakeven (Projected) Inflation Rate: 2021 - Today

The Baker Group is one of the nation’s largest independently owned securities firms specializing in investment portfolio management for community financial institutions.

Since 1979, we’ve helped our clients improve decision-making, manage interest rate risk, and maximize investment portfolio performance. Our proven approach of total resource integration utilizes software and products developed by Baker’s Software Solutions* combined with the firm’s investment experience and advice.

Author

Jeffrey F. Caughron

Senior Partner

The Baker Group LP

800.937.2257

*The Baker Group LP is the sole authorized distributor for the products and services developed and provided by The Baker Group Software Solutions, Inc.

INTENDED FOR USE BY INSTITUTIONAL INVESTORS ONLY. Any data provided herein is for informational purposes only and is intended solely for the private use of the reader. Although information contained herein is believed to be from reliable sources, The Baker Group LP does not guarantee its completeness or accuracy. Opinions constitute our judgment and are subject to change without notice. The instruments and strategies discussed here may fluctuate in price or value and may not be suitable for all investors; any doubt should be discussed with a Baker representative. Past performance is not indicative of future results. Changes in rates may have an adverse effect on the value of investments. This material is not intended as an offer or solicitation for the purchase or sale of any financial instruments.