That great monetary economist William Shakespeare wrote that “Those who rush, stumble and fall”. This observation may be starting to take hold with respect to the speed and magnitude of the Fed’s tightening campaign. Make no mistake, the single goal, purpose and objective of the aggressive Fed policy is to stamp out inflation. But after 300bps of rate hikes since March (soon to be 375bps), there seems to be a lot of chatter about time lags, over-tightening, and the rising odds of recession. Still, it’s a dueling narrative. If the Fed pulls back too soon, they run the risk of letting inflationary psychology become deeply embedded in household and business decision-making. Nobody wants that. If they go too far and over-tighten, however, they’re inviting a much deeper recession than might otherwise be the case. The debate is already playing out on the Fed’s speaking circuit. Jim Bullard the St. Louis Fed President notes that the strong US labor market gives the central bank room to continue the aggressive rate hikes, but his counterpart in San Francisco, Mary Daly, suggests that now is the time to start talking about stepping down to smaller increases. Fed governor Christopher Waller got in the middle and said, “we’ll have a very thoughtful discussion about the pace of tightening at our next meeting.” Shakespeare would approve.

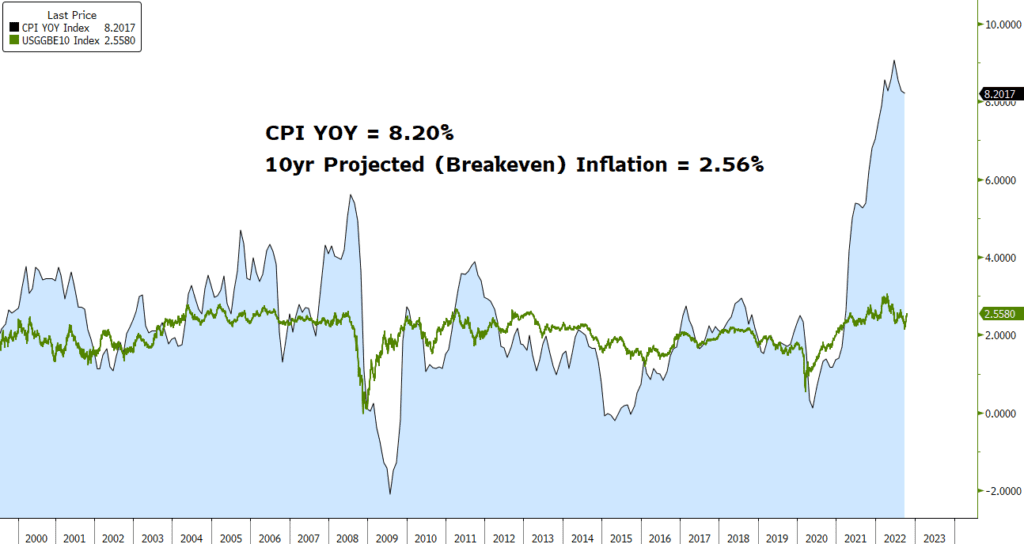

We all know that monetary policy works with “long and variable time-lags”. It’s also worth remembering that, as is often said on Wall Street, “all news is old news”. By the time the survey period is complete, the data is compiled, and the report is released, much economic news is stale. This is certainly true for inflation data. Fortunately, financial markets can provide forward looking measures like breakeven inflation rates which are embedded into the pricing of inflation-protected bonds. And when overlayed, the difference between observed historical inflation (8.20%) and projected future inflation (2.56%) is currently historic. To be clear, the market is expecting inflation to revert to the mean and come down from its current lofty levels, and that this will happen in fairly short order. As we move through the fourth quarter, it feels like we’re approaching a critical juncture on all of this.

The economic data released this week included housing starts which were weaker than expected at -8.1%, and existing home sales which clocked -1.5%… slightly less-weak than estimates. Importantly, Leading Economic Indicators (LEI) dropped 1.4% YOY. The six-month annualized growth rate for LEI has now fallen for five consecutive months… not good. As for bond yields, the 10yr looks set to close the week around a 4.22% yield… the highest weekly close since the first half of 2008. But the 2yr yield actually fell 12bps and the yield curve inversion (2s vs 10s) came in to -27bps from -54bps a week ago. Next week we’ll get a veritable smorgasbord of data on consumer sentiment, new home sales, capital expenditures and GDP among other things. All just in time for Halloween… tricks or treats… either way it should be fun.

US CPI and 10yr Breakeven Inflation: 1990 - Today

The Baker Group is one of the nation’s largest independently owned securities firms specializing in investment portfolio management for community financial institutions.

Since 1979, we’ve helped our clients improve decision-making, manage interest rate risk, and maximize investment portfolio performance. Our proven approach of total resource integration utilizes software and products developed by Baker’s Software Solutions* combined with the firm’s investment experience and advice.

Author

Jeffrey F. Caughron

Senior Partner

The Baker Group LP

800.937.2257

*The Baker Group LP is the sole authorized distributor for the products and services developed and provided by The Baker Group Software Solutions, Inc.

INTENDED FOR USE BY INSTITUTIONAL INVESTORS ONLY. Any data provided herein is for informational purposes only and is intended solely for the private use of the reader. Although information contained herein is believed to be from reliable sources, The Baker Group LP does not guarantee its completeness or accuracy. Opinions constitute our judgment and are subject to change without notice. The instruments and strategies discussed here may fluctuate in price or value and may not be suitable for all investors; any doubt should be discussed with a Baker representative. Past performance is not indicative of future results. Changes in rates may have an adverse effect on the value of investments. This material is not intended as an offer or solicitation for the purchase or sale of any financial instruments.