As we say at the Baker Group, Happy Jobs Friday everyone! What a world we live in today when the breaking news headline on CNBC this morning is “Stocks fall on hotter-than-expected November jobs report, Dow slides more than 300 points.” I thought jobs were good for the economy and therefore the stock market…I digress. Let’s dive into that jobs report!

Non-farm payrolls increased 263,000 in November, a bigger gain than the 200,000 increase expected by economists. The separate Household Survey showed the economy lost 138,000 jobs, which would be the second consecutive month of job losses according to that survey. The Unemployment Rate remained unchanged from the previous month at 3.7%. The Labor Force Participation Rate unexpectedly fell to 62.1% with expectations for a 0.1% rise to 62.3%. At this point in time, the supply of workers remains below the demand for workers. As a result of this supply and demand imbalance, wages grew more than expected. Average hourly wages rose 0.6% last month, doubling expectations for a 0.3% rise. Annual wage growth of 5.1% topped forecasts of 4.6% and accelerated from October’s upwardly revised 4.9%. This is troubling data in the Fed’s battle against inflation as wage increases put inflationary pressure on the economy. Today’s job’s report is the final monthly employment report before the Fed’s two-day meeting on December 13th and 14th where they are expected to raise the Fed Funds rate by 50 basis points, a 25 basis point decrease from the previous 75 basis point rate hikes.

Yesterday, the monthly Job Openings and Labor Turnover Survey (JOLTS) showed there were 10.33 million job openings for the month, a decline of 353,000 from September and down 760,000 compared with a year ago. The JOLTS report is a closely watched gauge to show the amount of “slack in the labor force.” The quits level, a measure of worker confidence that they can easily move from one job to another, declined lower to 4.026 million. This is well below the record 4.5 million in November 2021 during what many were calling the “Great Resignation.”

Yesterday also brought some data on inflation and consumer spending. Consumer spending, which accounts for more than two-thirds of U.S. economic activity, increased 0.8% after an unrevised 0.6% increase in September. The Personal Consumption Expenditures (PCE) price index rose 0.3% after increasing by the same amount in September. The year over year increase of the PCE index increased by 6.0%. That was the smallest year over year gain since December 2021. Excluding the more volatile food and energy components, the Core PCE index rose 0.2% for the month and 5.0% year over year. Cooling PCE data is very positive for the Fed as they track the PCE price indexes for its 2% inflation target.

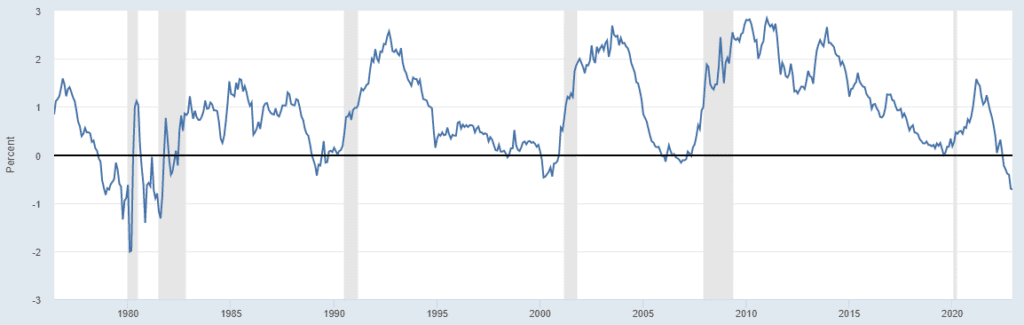

Let’s check in with the markets. Stocks still are still off early in today’s trading day as Treasuries are selling off with the 10-Year Treasury Bond yield rising to 3.59%. The 2-Year Treasury Yield is at 4.35%, producing a negative 76 basis point 10s and 2s spread to highlight just how inverted the Treasury Yield Curve currently is.

We start off next week with factory and durable goods orders. Later in the week we get the latest release of the Producer Price Indexes as well as the University of Michigan’s Consumer Sentiment and Expectations survey information. The following week brings us the Federal Reserve’s final rate setting policy meeting of the year. Have a great weekend everyone!

10-Year Treasury Constant Maturity Minus 2-Year Treasury Constant Maturity

(July 1976 to Present)

The Baker Group is one of the nation’s largest independently owned securities firms specializing in investment portfolio management for community financial institutions.

Since 1979, we’ve helped our clients improve decision-making, manage interest rate risk, and maximize investment portfolio performance. Our proven approach of total resource integration utilizes software and products developed by Baker’s Software Solutions* combined with the firm’s investment experience and advice.

Author

Dale Sheller

Managing Director

Director of Financial Strategies Group

The Baker Group LP

800.937.2257

*The Baker Group LP is the sole authorized distributor for the products and services developed and provided by The Baker Group Software Solutions, Inc.

INTENDED FOR USE BY INSTITUTIONAL INVESTORS ONLY. Any data provided herein is for informational purposes only and is intended solely for the private use of the reader. Although information contained herein is believed to be from reliable sources, The Baker Group LP does not guarantee its completeness or accuracy. Opinions constitute our judgment and are subject to change without notice. The instruments and strategies discussed here may fluctuate in price or value and may not be suitable for all investors; any doubt should be discussed with a Baker representative. Past performance is not indicative of future results. Changes in rates may have an adverse effect on the value of investments. This material is not intended as an offer or solicitation for the purchase or sale of any financial instruments.