We’re three weeks into a new year and across the curve the bond market is off to one of its best starts in decades. The 10yr T-Note yield is now down 75bps since the 4.25% peak last October. To be sure, this follows one of the worst years on record for stocks, bonds and virtually all financial assets. Nonetheless, after 425 basis points of Fed tightening, sentiment has clearly changed, the frenzied fear of inflation has lessened, and bond yields have fallen sharply. Now the concern is about recession and whether the Fed’s demand destruction has gone too far. We know that the effect of all those rate hikes has yet to be fully felt. Indeed, the “long and variable” time lags through which monetary policy works are particularly important given the fact that most of last year’s tightening took place in the final six months of the year. The speed and magnitude of the initial increases in the cost of money is just now being felt. Beware of what’s to come.

Most forecasts now call for a contraction in economic activity over consecutive quarters this year. The question is whether it will be a mild or severe recession. In the final quarter of last year, retail sales fell 2.5% annualized, industrial production was down 1%, and housing starts dropped at a 12.4% annual rate. Companies are now becoming defensive and announcing layoffs as economists forecast the unemployment rate to rise from 3.5% to 5% by year-end. And then there’s inflation. After last year’s historic spike, the broad-based inflation trends are all showing notable improvement. By some measures, inflation over the last six months has essentially drifted back to pre-pandemic levels. The Fed’s preferred index, PCE inflation, will be reported next week and is likely to remain very well behaved at a 2.3% annualized rate over the last three months. Is it any wonder that the yield curve is deeply inverted?

In fairness to the Fed hawks, the worst mistake they could make would be to stop and reverse policy too early, then allowing the genie back out of the bottle. Policymakers are determined not to make that mistake, so they tell us to still look for a terminal fed funds rate at or above 5%, even if they just get there in 25bps increments. Afterward, time will tell if/when we’ll see a pivot or shift in response to an economic slowdown. Right now, the bond market is betting that the Fed won’t have the luxury of waiting too long before easing again. At the moment, futures markets are looking for something less than a 5% peak for the funds rate, and expect that to drift more than a half-percent lower by the beginning of 2024.

Next week we’ll get to see the latest reading on Leading Economic Indicators, and the initial GDP tally for Q4 of last year as well as data on durable goods and capital expenditures. Then on Friday, we get the PCE data including the all-important inflation-index, plus consumer sentiment. Plus we’ll know who’s in the Super Bowl.

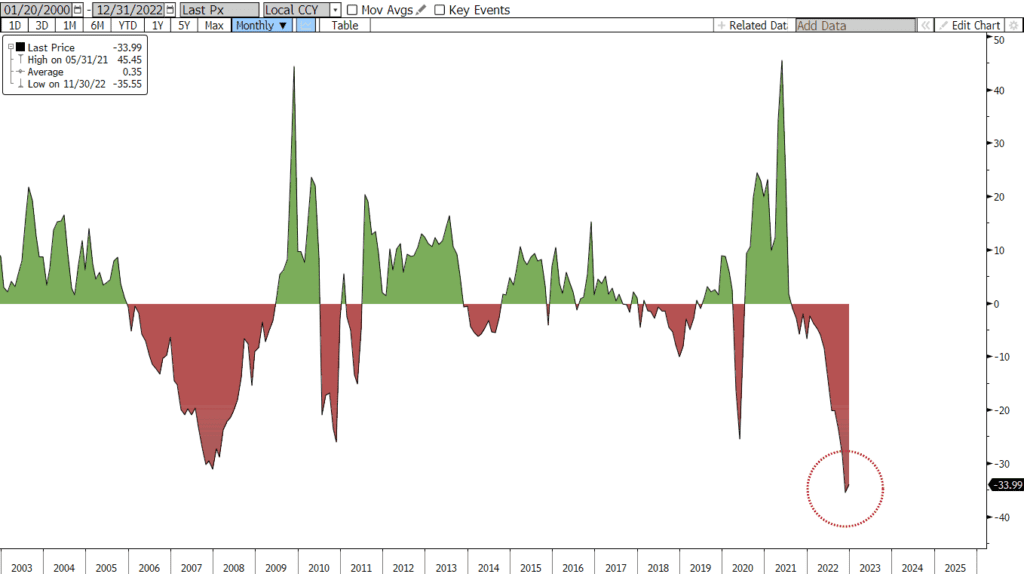

US Existing Home Sales YOY: 2000 - Today

The Baker Group is one of the nation’s largest independently owned securities firms specializing in investment portfolio management for community financial institutions.

Since 1979, we’ve helped our clients improve decision-making, manage interest rate risk, and maximize investment portfolio performance. Our proven approach of total resource integration utilizes software and products developed by Baker’s Software Solutions* combined with the firm’s investment experience and advice.

Author

Jeffrey F. Caughron

Senior Partner

The Baker Group LP

800.937.2257

*The Baker Group LP is the sole authorized distributor for the products and services developed and provided by The Baker Group Software Solutions, Inc.

INTENDED FOR USE BY INSTITUTIONAL INVESTORS ONLY. Any data provided herein is for informational purposes only and is intended solely for the private use of the reader. Although information contained herein is believed to be from reliable sources, The Baker Group LP does not guarantee its completeness or accuracy. Opinions constitute our judgment and are subject to change without notice. The instruments and strategies discussed here may fluctuate in price or value and may not be suitable for all investors; any doubt should be discussed with a Baker representative. Past performance is not indicative of future results. Changes in rates may have an adverse effect on the value of investments. This material is not intended as an offer or solicitation for the purchase or sale of any financial instruments.