Former Fed Chairman Alan Greenspan once observed that asset price bubbles go up very slowly, then when you least expect it, they reverse very sharply. We may be seeing that same dynamic with the general inflation level for the post-pandemic US economy. Over the two-and-a-half-year period from the beginning of 2020 to the middle of last year, we saw the Fed’s preferred measure of inflation (the PCE deflator) steadily rise from 1.50% to 7.00%… an increase of enormous magnitude. Since the peak last June, however, we’ve seen inflation decline even more rapidly than it went up, and the rate of decline is accelerating. This morning we learned that overall PCE inflation is now 5% year-over-year. That’s the sixth consecutive decline, and down from 5.5% the prior month. Other inflation measures show much the same pattern. Commodities prices, for example, are now at a 28-month low, and supply-side challenges like clogged ports, slow transport and long delivery timelines have been almost completely eliminated.

Perhaps none of this should be a surprise given that the Fed has raised the cost of borrowing by 425bps in less than a year. The speed and magnitude of those rate hikes is unprecedented and cannot be overstated. And given the well-known “long- and variable-time lags” which affect monetary policy, it’s worth noting that most of the Fed’s rate hikes haven’t had time yet to filter through into the economy. We also learned this week that US economic growth for the entire year 2022 came in at 2.1%. That’s following the 5.4% reopening snapback (an inflationary pace to be sure) in 2021. But the outlook going forward is weak and growing weaker. Residential investment slumped at a 26.7% annual pace last year, a seventh consecutive quarterly decline, and home sales for all of last year fell by the most since the “great recession” of 2008-09. Consumer spending has slowed as well. Among other things, less home buying means less spending on appliances, furniture, paint, and other related goods.

We’re also seeing a shift in the international economic landscape as US imports have slowed and exports in particular have hit a wall in response to last year’s extreme increase in the value of the US dollar versus other currencies. Like the trend in inflation, dollar-strength has also waned in recent months as foreign exchange markets anticipate that the Fed’s tightening campaign is nearing an end. This also aligns with the deeply inverted Treasury yield curve as markets give a clear signal that recession may not be far off. Most estimates now put the probability of recession this year at nearly two-thirds.

Next week brings a slew of important data: durable goods and capital expenditures, factory orders and ISM data are all on tap, as well as the very important employment report next Friday. And of course, we’ll also have an FOMC meeting which will likely result in a 25bps rate hike bringing the funds rate to 4.75%. A level we haven’t seen since the summer of 2007, when Apple introduced the iPhone.

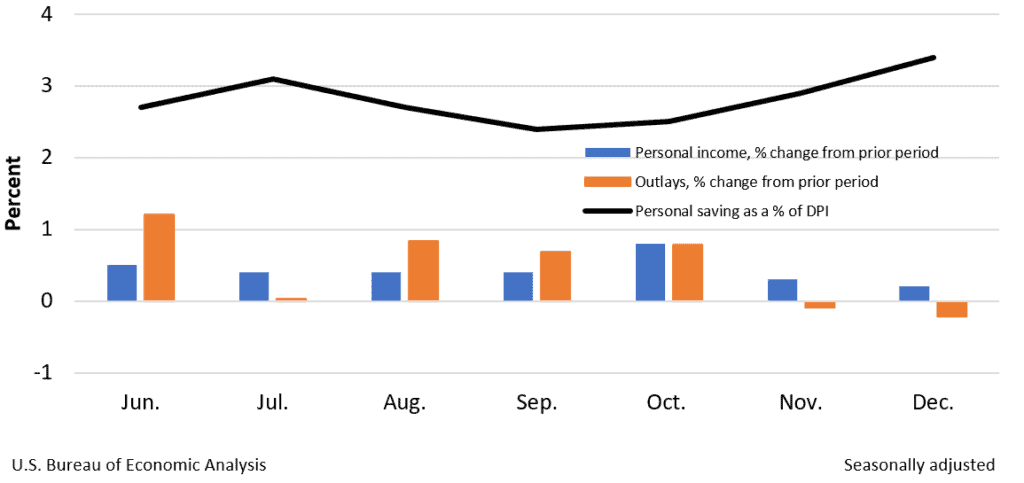

Personal Income, Outlays, and Savings

The Baker Group is one of the nation’s largest independently owned securities firms specializing in investment portfolio management for community financial institutions.

Since 1979, we’ve helped our clients improve decision-making, manage interest rate risk, and maximize investment portfolio performance. Our proven approach of total resource integration utilizes software and products developed by Baker’s Software Solutions* combined with the firm’s investment experience and advice.

Author

Jeffrey F. Caughron

Senior Partner

The Baker Group LP

800.937.2257

*The Baker Group LP is the sole authorized distributor for the products and services developed and provided by The Baker Group Software Solutions, Inc.

INTENDED FOR USE BY INSTITUTIONAL INVESTORS ONLY. Any data provided herein is for informational purposes only and is intended solely for the private use of the reader. Although information contained herein is believed to be from reliable sources, The Baker Group LP does not guarantee its completeness or accuracy. Opinions constitute our judgment and are subject to change without notice. The instruments and strategies discussed here may fluctuate in price or value and may not be suitable for all investors; any doubt should be discussed with a Baker representative. Past performance is not indicative of future results. Changes in rates may have an adverse effect on the value of investments. This material is not intended as an offer or solicitation for the purchase or sale of any financial instruments.