A week ago today, we found out that the US unemployment rate for January was 3.4%, the lowest level since “Broadway Joe” Namath guaranteed the NY Jets would win Super Bowl III in 1969. The Jets won, but the US economy entered recession in the fourth quarter of that year and the jobless rate steadily rose to 6%. Things can turn quickly indeed between Super Bowl Sunday and the end of a year.

The most recent data are confusing. We added more than half a million jobs last month, roughly triple what economists had expected, and wage growth was reasonably tame at 4.4% year-over-year. Other recent inflation data has also been well-behaved. The Fed’s preferred measure was running at an annualized three-month rate of 2.9% in December, down from 6.7% last summer. However, leading economic indicators are sharply negative and there’s a “calm before the storm” feeling that employment growth, a lagging indicator, has seen its best days for this cycle. The University of Michigan’s Consumer Sentiment data shows a sharp difference between confidence about “current conditions” versus “expectations,” and it seems that layoff announcements continue to drip out daily.

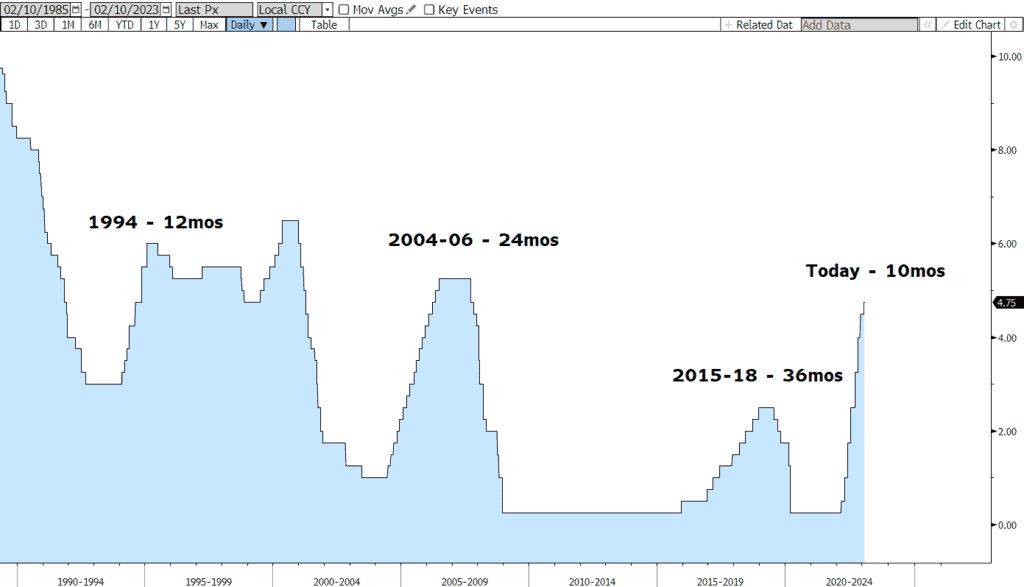

As for the Fed, Chairman Powell largely reiterated the commentary he made at last week’s FOMC meeting when policymakers slowed the pace of interest rate hikes, delivering a 25bps increase. He was given several opportunities to turn more hawkish in a subsequent interview, but seems content to stick with the script. They’ve got more to do, but we’re in late innings of the tightening campaign. Powell wants everyone to “chill” a bit regarding when we’d see rate cuts… that’s not something on their radar. Higher for longer is what the Chairman wants us to expect.

So, market-based bets about the path of fed funds continue to shift. Today, probabilities derived from futures contracts are suggesting a 5.125% rate by the end of the third quarter, then a gradual drift down to less than 4.75% a year from now. Those levels have shifted higher this week. But the real noticeable bond market characteristic these days is the deeply inverted yield curve. Reaching -87bps during the week, the yield spread between 2yr and 10yr T-Notes is flashing bright red and warning of impending recession. Paying more to borrow for shorter periods makes little sense… but there’s a reason. If the aggregate wisdom of investors in the $22 trillion Treasury market is that we should expect lower inflation and slower growth in the near future, then those expectations will be built into current pricing. And that’s exactly the case right now regardless of Powell’s comments. Who are you going to believe… the Fed, or the market?

Another point worth pondering is the impressive demand for US Treasuries. Wednesday’s $35 billion auction of 10yr Notes was very well received. A bid/cover ratio of 2.66, much higher than average, and 95% of the bonds went to “real” accounts, not into street inventories. This tells you that a whole lot of investors around the world want to own bonds at these levels. They must think yields are heading lower regardless of who wins on Sunday.

US Fed Funds Rate: 1985 - Today

The Baker Group is one of the nation’s largest independently owned securities firms specializing in investment portfolio management for community financial institutions.

Since 1979, we’ve helped our clients improve decision-making, manage interest rate risk, and maximize investment portfolio performance. Our proven approach of total resource integration utilizes software and products developed by Baker’s Software Solutions* combined with the firm’s investment experience and advice.

Author

Jeffrey F. Caughron

Senior Partner

The Baker Group LP

800.937.2257

*The Baker Group LP is the sole authorized distributor for the products and services developed and provided by The Baker Group Software Solutions, Inc.

INTENDED FOR USE BY INSTITUTIONAL INVESTORS ONLY. Any data provided herein is for informational purposes only and is intended solely for the private use of the reader. Although information contained herein is believed to be from reliable sources, The Baker Group LP does not guarantee its completeness or accuracy. Opinions constitute our judgment and are subject to change without notice. The instruments and strategies discussed here may fluctuate in price or value and may not be suitable for all investors; any doubt should be discussed with a Baker representative. Past performance is not indicative of future results. Changes in rates may have an adverse effect on the value of investments. This material is not intended as an offer or solicitation for the purchase or sale of any financial instruments.