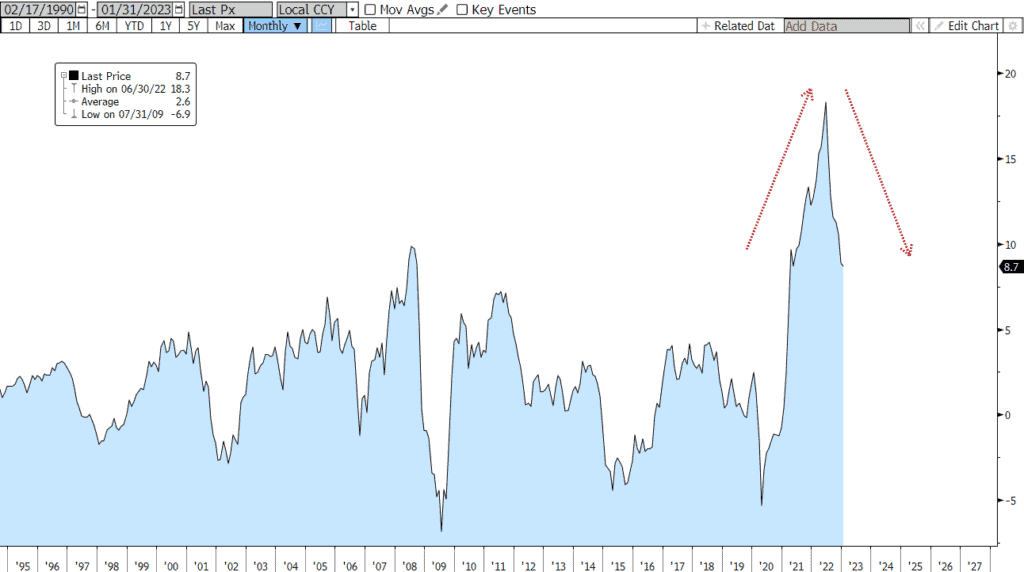

Fed Chairman Jay Powell warned us that the path to bringing down inflation was “probably going to be bumpy,” and indeed the bond market is experiencing some clear-air turbulence. After raising the fed funds rate nearly 500bps in less than a year, progress in the war on inflation has been made for sure. The consumer price index has fallen for seven consecutive months from a high of 9.1% last summer to 6.4% YOY through January. Producer prices have followed the same trajectory, down sharply and steadily from the high. Moreover, consensus estimates put the inflation rate at just 3.1% by year-end… all good. But the easy part seems to be in the rear-view mirror and further progress on inflation-reduction now becomes a grind. The “fasten seat belt” sign is back on.

In the last couple of weeks, we’ve seen that job growth is stellar, real incomes are rising, consumers are spending and the manufacturing sector is (re)expanding. Overall demand remains well in excess of supply and, though still falling, overall price pressures remain unacceptably high. It’s a Catch-22 (to coin a phrase). The improvement in inflation translates into higher real wages and therefore greater spending power. That fed into a rebound of Retail Sales for January, rising 3% on the month following back-to-back declines at the end of last year. So, the Fed’s “demand-destruction” rate-hike campaign is, in a sense, a victim of its own success. That reality has prompted policymakers like Fed Governor Michelle Bowman to offer the reminder: “We’re not finished yet. We haven’t beaten inflation”.

All of this has had an impact on market expectations regarding how much more the Fed will need to do, and how long to keep fed funds at whatever terminal rate is achieved. At this point, everything is a data-dependent moving-target. But for now, investors have backed-off bets on when the Fed would actually cut rates. Futures markets at the start of February signaled that the risk of recession was rising and that the Fed would be forced to reduce interest rates at least two times by the end of the year. This week they suggested roughly equal chances of one rate-cut or none by the end of 2023. Prior to the release of the January jobs report, the market projected a 5% funds rate by the second quarter, then dropping to about 4.4 per cent by year-end. Now, the terminal rate is projected to be 5.25% and to remain over 5% through year-end. Still, like the weather in Oklahoma, just stick around for a few minutes and conditions will change.

All this “rough air” disturbing the bond market has pushed the 10yr Treasury yield back to up over 3.83% and the 2yr to 4.63%. That’s within spitting distance of its cycle high at 4.72%. But remember. That -80bps yield curve inversion is substantial and it’s not something to be ignored. The timing can be tricky, but almost without exception an inversion like that will lead to recession, Fed ease, and lower bond yields.

US Producer Price Index: 1990 - Today

The Baker Group is one of the nation’s largest independently owned securities firms specializing in investment portfolio management for community financial institutions.

Since 1979, we’ve helped our clients improve decision-making, manage interest rate risk, and maximize investment portfolio performance. Our proven approach of total resource integration utilizes software and products developed by Baker’s Software Solutions* combined with the firm’s investment experience and advice.

Author

Jeffrey F. Caughron

Senior Partner

The Baker Group LP

800.937.2257

*The Baker Group LP is the sole authorized distributor for the products and services developed and provided by The Baker Group Software Solutions, Inc.

INTENDED FOR USE BY INSTITUTIONAL INVESTORS ONLY. Any data provided herein is for informational purposes only and is intended solely for the private use of the reader. Although information contained herein is believed to be from reliable sources, The Baker Group LP does not guarantee its completeness or accuracy. Opinions constitute our judgment and are subject to change without notice. The instruments and strategies discussed here may fluctuate in price or value and may not be suitable for all investors; any doubt should be discussed with a Baker representative. Past performance is not indicative of future results. Changes in rates may have an adverse effect on the value of investments. This material is not intended as an offer or solicitation for the purchase or sale of any financial instruments.