Today is the first anniversary of the Fed’s initial rate hike in its campaign to crush inflation, and it’s Saint Patrick’s Day as well. Perfect timing. Let the drinking begin!

Let’s remember that the Fed’s rate hikes began after two years of pumping enormous amounts of liquidity into the system, causing massive growth in deposits, and forcing banks to deploy said liquidity (buy bonds) at historically low yields. The speed and magnitude of rate hikes has been unprecedented and the most painful effects are now starting to be felt, specifically in the banking system. With respect to the percentage change in borrowing costs, we’ve never seen a more aggressive tightening… not even in the Volker years. In my opinion this cannot be overstated. Moreover, much of the tightening is still in the pipeline due to the proverbial “long- and variable-time lags” of monetary policy. It’s no wonder the banking sector is creaking. Recession risk has risen notably… many would say it’s already baked in the cake.

All of this helps to explain why markets remained focused this week on continuing turmoil in some corners of the banking system, particularly those funded largely by uninsured deposits. Initially, it was two or three West Coast banks with extreme dependency on volatile liabilities related to the tech sector. Silicon Valley Bank was over 90% funded by hot money from venture capital firms related to crypto/tech startups. Unlike traditional community banks, they had very little funding from sticky “core deposits” or solid legacy retail accounts. Silvergate, Signature Bank, and First Republic had similar profiles to SVB. Now, however, it’s becoming clear that the sea-change in the Fed’s monetary policy is putting stress on the entire system.

As for the Fed’s war on inflation, we learned this week that the consumer price index continued its downtrend as core CPI fell to 5.5% from 5.6%. It was the eighth consecutive month of declines for headline CPI. Producer prices fell even faster as the core PPI dropped a full percentage point to 4.4%. It seems the war on inflation is steadily being won. Maybe not as fast as we’d hope, but it’s moving in the right direction. Other economic releases this week included retail sales which declined from the prior month, and leading economic indicators which remains negative for the eighth consecutive month.

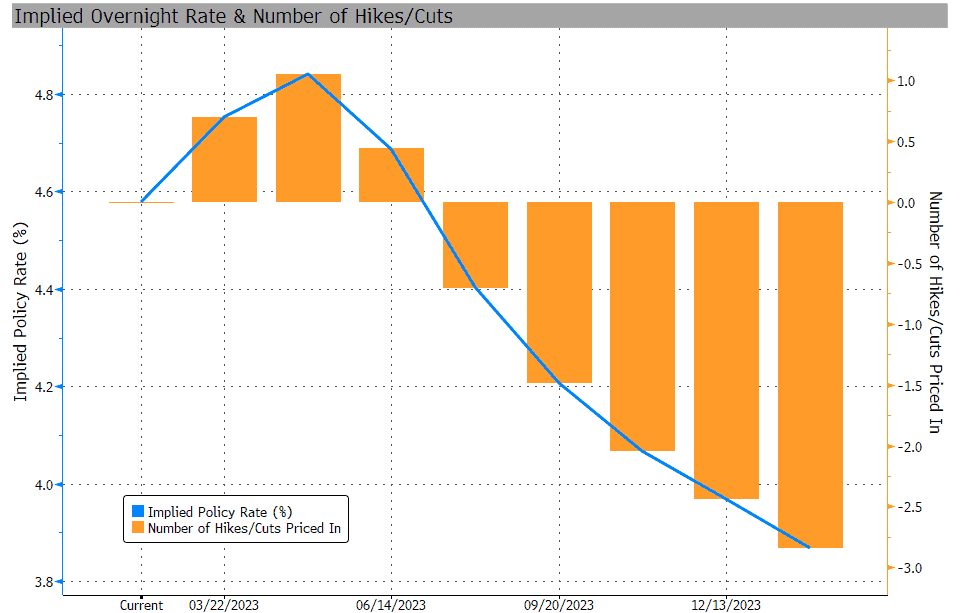

So where does this leave the Fed? There is an argument to be made that they must maintain their credibility and do one more rate hike to show their continued seriousness about bringing down inflation. However, it seems to make little sense when inflation is clearly trending lower to crank up borrowing costs even further on an already stressed banking system, while the yield curve remains deeply inverted and much economic data is flashing red. To be sure, markets are projecting the likelihood of no change from the Fed next week, and at least 50bps of cuts later in the year. Next week will be a tough call for the Fed, but it seems the coal mine canaries are dying and the frog is pretty much boiled. Maybe if they stop tightening now they’ll avoid a mistake and enjoy some luck o’ the Irish.

Fed Funds Futures Probabilities: March 17, 2023

The Baker Group is one of the nation’s largest independently owned securities firms specializing in investment portfolio management for community financial institutions.

Since 1979, we’ve helped our clients improve decision-making, manage interest rate risk, and maximize investment portfolio performance. Our proven approach of total resource integration utilizes software and products developed by Baker’s Software Solutions* combined with the firm’s investment experience and advice.

Author

Jeffrey F. Caughron

Senior Partner

The Baker Group LP

800.937.2257

*The Baker Group LP is the sole authorized distributor for the products and services developed and provided by The Baker Group Software Solutions, Inc.

INTENDED FOR USE BY INSTITUTIONAL INVESTORS ONLY. Any data provided herein is for informational purposes only and is intended solely for the private use of the reader. Although information contained herein is believed to be from reliable sources, The Baker Group LP does not guarantee its completeness or accuracy. Opinions constitute our judgment and are subject to change without notice. The instruments and strategies discussed here may fluctuate in price or value and may not be suitable for all investors; any doubt should be discussed with a Baker representative. Past performance is not indicative of future results. Changes in rates may have an adverse effect on the value of investments. This material is not intended as an offer or solicitation for the purchase or sale of any financial instruments.