Spring has sprung, the days are getting longer, and everything’s starting to green up nicely. So why does the Fed Chairman looks so tired? Well, in fairness, Jay Powell has held up pretty well after a full year of rate-hikes and an unprecedented 500bps of tightened credit. He and his cohorts on the FOMC are working overtime to keep the machinery of the US banking system well-oiled and functioning as intended. But as the era of “free money” came to an end and we experienced an abrupt and grinding gear-shift, they shouldn’t be surprised that some valves are sticky and things are running rough. The speed and magnitude of the rate-hike campaign has claimed a few victims already, uncovering certain banks’ exposure to volatility in the form of flighty deposits from tech-related venture capital firms (imagine that), combined with painfully high levels of unrealized losses in otherwise liquid assets. But now the stress is bleeding overseas, and foreign central banks are tapping the Fed for dollar funding to shore up their own banking networks. Meanwhile, as banking news grabs headlines, red-alert recession signals are flashing, and some analysts like Jeffrey Gundlach see the Fed cutting rates “substantially” soon. Stranger things have happened.

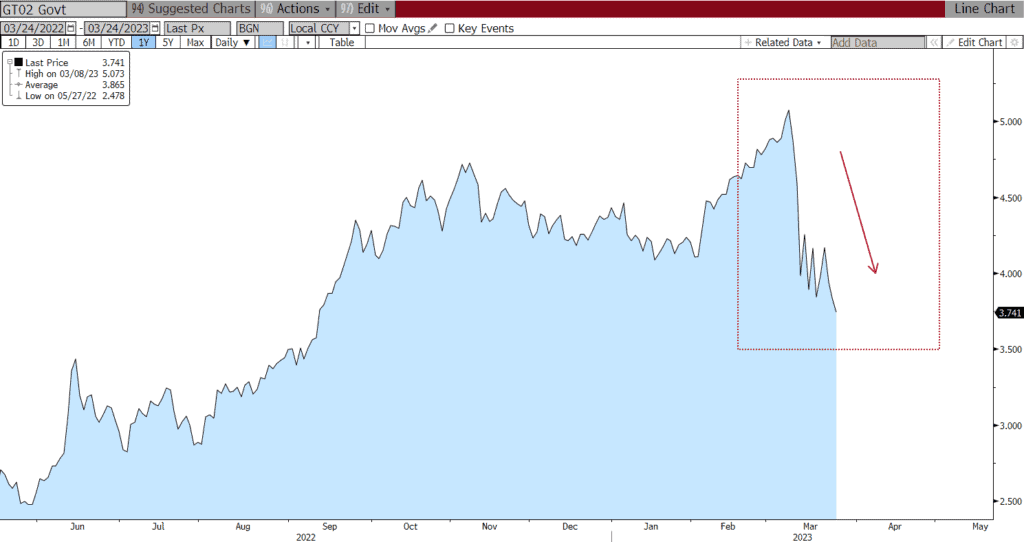

To be sure, markets behave as though Gundlach is right. The 2yr T-Note yield has fallen by 123bps in three weeks. That doesn’t happen unless there’s a sea-change in sentiment and psychology. Moreover, the futures market (a constantly moving target) currently projects a fed funds rate below 4% by year-end. Most notable, though, is the re-steepening of what was the most deeply inverted yield curve in generations. The yield spread between 2yr- and 10yr T-Notes got as negative as 108bps… historic and unprecedented since the Volker years when nominal yields were much higher generally. Now we’ve seen a sharp and sudden reversal of that spread back to just -36bps. To Gundlach’s point, this market behavior screams “ease is on the way”.

So therein lies the conundrum… is it safe and prudent to pivot away from the war on inflation in order to focus on the health of the banking system? After all, we’ve seen inflation fall from 9.1% to 6.0% in eight months… if that pace continues, we’ll be at 2% by year-end. And the full impact of the most recent rate-hikes has yet to be felt. As for the banking system, Chairman Powell noted that “Recent developments are likely to result in tighter credit conditions for households and businesses and to weigh on economic activity, hiring, and inflation… and the extent of these effects is uncertain.” Adding to the confusion is continued strong labor market performance, a head-scratcher for sure. But looking at past cycles, employment is a notorious lagging indicator… often the last thing to turn.

Some policymakers, like St. Louis Fed President James Bullard, insist that monetary policy can and should be conducted based on considerations that are separate and distinct from financial stability issues. That becomes a moot point, though, when a stressed financial system faces a likely recession.

US 2yr Treasury-Note Yield: 2022 - Today

The Baker Group is one of the nation’s largest independently owned securities firms specializing in investment portfolio management for community financial institutions.

Since 1979, we’ve helped our clients improve decision-making, manage interest rate risk, and maximize investment portfolio performance. Our proven approach of total resource integration utilizes software and products developed by Baker’s Software Solutions* combined with the firm’s investment experience and advice.

Author

Jeffrey F. Caughron

Senior Partner

The Baker Group LP

800.937.2257

*The Baker Group LP is the sole authorized distributor for the products and services developed and provided by The Baker Group Software Solutions, Inc.

INTENDED FOR USE BY INSTITUTIONAL INVESTORS ONLY. Any data provided herein is for informational purposes only and is intended solely for the private use of the reader. Although information contained herein is believed to be from reliable sources, The Baker Group LP does not guarantee its completeness or accuracy. Opinions constitute our judgment and are subject to change without notice. The instruments and strategies discussed here may fluctuate in price or value and may not be suitable for all investors; any doubt should be discussed with a Baker representative. Past performance is not indicative of future results. Changes in rates may have an adverse effect on the value of investments. This material is not intended as an offer or solicitation for the purchase or sale of any financial instruments.