Markets are relatively calm as we close out the last week of the quarter. And oh, what a quarter it’s been. Following a year that marked the biggest annual jump in the 10yr Treasury yield on record, we saw in the last 90 days a series of tremors in the banking system that sent bonds into a frenzied rally. The 10yr yield dropped from 4.06% at the beginning of this month to a low of 3.37% last week. As we approach this weekend, it had drifted back up to 3.53%, while the 2yr yield sits at 4.11%. The yield curve as measured by the yield difference between 2s and 10s had inverted to a historic level of -108bps. It has now come in to less than -60bps, an indication that we’ve seen a significant change in sentiment with respect to Fed policy going forward. The good news as we close out March is that concerns about systemwide problems in the banking sector have lessened notably over the last couple of weeks.

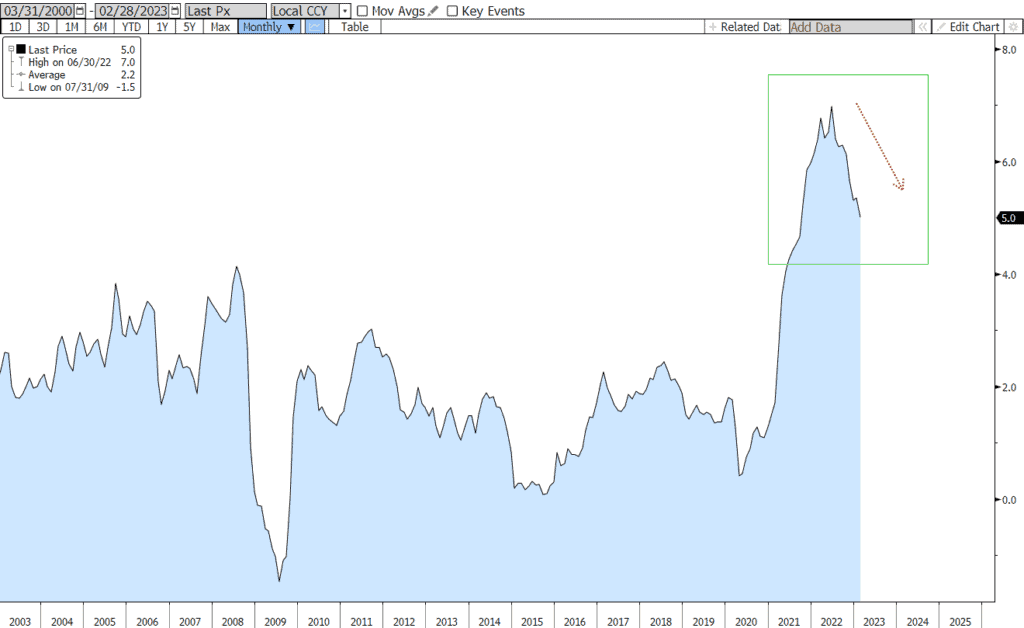

So, what about our old nemesis, inflation? This morning we got the latest reading on the Fed’s preferred measure, the PCE inflation index. It showed a 5% year-over-year pace, a deceleration from January but still higher than the Fed’s 2% target. Excluding food and energy, the core PCE index rose 4.6%, matching the smallest increase in a year and a half. And a nuanced measure preferred by the Fed Chairman (services inflation minus housing and energy) was clocked at 4.6% as well. This was the eighth consecutive drop in PCE inflation… we’re trending in the right direction for sure.

Alongside the release of PCE inflation data was information about incomes and spending for the month. On spending, households continue to open their wallets as personal consumption expenditures rose a respectable 2.5% year-over-year. However, that’s nominal, not adjusted for inflation. Expenditures for goods and services alike fell when adjusted for inflation. This week also brought us the final GDP number for Q4 which was revised down to 2.6%. Importantly, stripping out net exports and inventory buildup, we saw that Real Final Sales were a feeble 1.1%. This particular devil in the details indicates that the output of the economy is not as robust as headlines suggest.

Another concern that’s reared up in the wake of the banking turmoil has to do with a general tightening of financial conditions. As banks shore up their balance sheets, liquidity and capital positions, they also raise lending standards which limits the availability of credit and constricts growth of the economy. This can lead to a vicious cycle where credit constraint leads to declining asset values which leads to non-performing loans and even more credit constriction. Another conundrum for the Fed.

So, inflation is trending lower while growth, spending, and employment remain intact but certainly not vigorous. And the Fed’s massive increase in rates over the last year is just now starting to stress the banking system and constrain credit, the lifeblood of the economy. Maybe it’s time to hit the pause button on the rate hikes, sit back and marvel as the “long- and variable-time lags” of policy do their thing. Otherwise, the next quarter could be another wild one.

US Personal Consumption Expenditures (PCE) Inflation: 2000 - Today

The Baker Group is one of the nation’s largest independently owned securities firms specializing in investment portfolio management for community financial institutions.

Since 1979, we’ve helped our clients improve decision-making, manage interest rate risk, and maximize investment portfolio performance. Our proven approach of total resource integration utilizes software and products developed by Baker’s Software Solutions* combined with the firm’s investment experience and advice.

Author

Jeffrey F. Caughron

Senior Partner

The Baker Group LP

800.937.2257

*The Baker Group LP is the sole authorized distributor for the products and services developed and provided by The Baker Group Software Solutions, Inc.

INTENDED FOR USE BY INSTITUTIONAL INVESTORS ONLY. Any data provided herein is for informational purposes only and is intended solely for the private use of the reader. Although information contained herein is believed to be from reliable sources, The Baker Group LP does not guarantee its completeness or accuracy. Opinions constitute our judgment and are subject to change without notice. The instruments and strategies discussed here may fluctuate in price or value and may not be suitable for all investors; any doubt should be discussed with a Baker representative. Past performance is not indicative of future results. Changes in rates may have an adverse effect on the value of investments. This material is not intended as an offer or solicitation for the purchase or sale of any financial instruments.