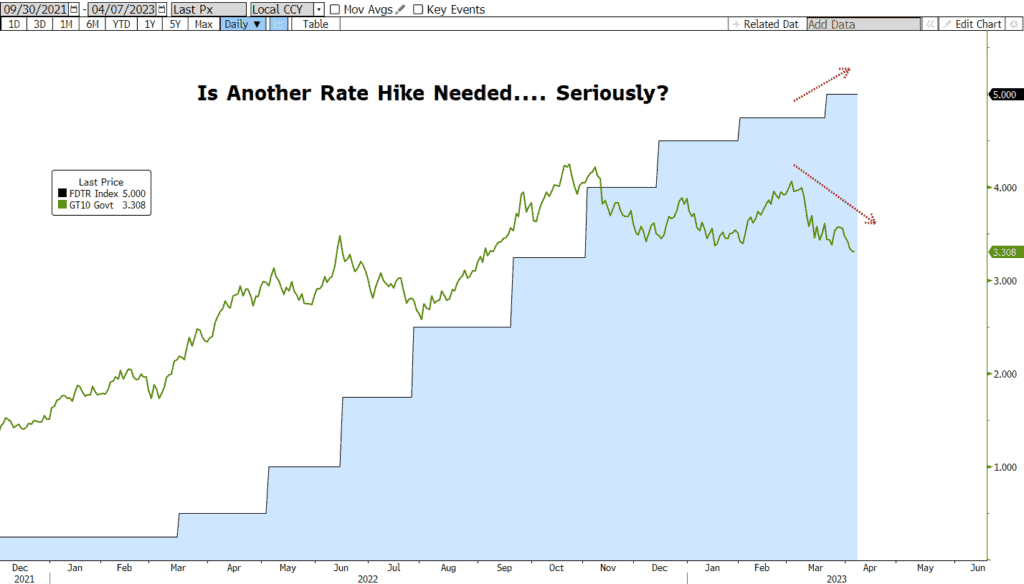

Less than six months ago the US 10yr Treasury Note yield hit an intraday high of 4.33%. Yesterday it ended the session more than 100bps lower at 3.30%. There is clearly a growing conviction in the bond market that the Fed’s enormous increase in interest rates over the last twelve months is having the desired impact of crushing demand and bringing down rates of inflation. Indeed, virtually every measure of inflation has steadily moved lower in recent months. The consumer price index has fallen from more than 9% to 6%, PCE inflation (the Fed’s preferred measure) is down from 6.98% to 5%. Average hourly earnings, prices paid by manufacturers and services industries, oil and gas prices, trimmed-mean inflation measures… you name it, if it measures inflation it’s fallen.

Meanwhile, a steady drumbeat of economic indicators are showing a loss of momentum or growing weakness across sectors. Even the labor market, a lagging indicator if there ever was one, is now showing cracks in the foundation. The Labor Department told us this morning that the pace of hiring cooled in March as new non-farm payrolls rose just 236K… the lowest monthly reading in well over two years. You have to go back to December of 2020 to see a monthly payrolls number that weak. However, due to continuing post-pandemic noise in labor market statistics (mainly the participation rate), we still sit at an official unemployment rate of 3.5%… an impressive data-point and the lowest level in over half a century. That likely won’t be the case much longer, however, as the preponderance of data is pointing toward a weakening jobs picture. Examples abound: Average Hourly Earnings (YOY) fell from nearly 6% one year ago to just 4.2% today. The ISM Employment index fell to 46.9 indicating contraction, and now sits at the lowest level since July 2020. The Job Opening and Labor Turnover Survey (a favorite of Chairman Powell’s) showed Job Openings fell 632k to below 10 million for first time since May 2021. Private Employment rose 145k vs 210k expectation and 261k the prior month according to ADP data. Challenger Job Cut Announcements were up 319% vs a year ago. Continuing Jobless Claims rose to 1.823mm, the highest level since December 2021.

So given this landscape, what’s the Fed’s next move? To hear some of them speak, you’d think inflation had risen, not fallen for eight consecutive months… and you’d think that “long- and variable-time lags” have nothing to do with the impact of monetary policy. Some (Bullard or Meister) seem to believe that the economy needs to be pounded with the sledge hammer at least one more time for good measure. Maybe they’re right… perhaps another blow would accelerate the disinflationary process and ensure success. But it might also mean the coming recession arrives more quickly, inflicts more pain, and lasts longer than would otherwise be the case. And bond yields would also fall further and more quickly. As always… anticipate, don’t predict. And Happy Easter weekend!

US 10yr T-Note Yield and Fed Funds Rate

The Baker Group is one of the nation’s largest independently owned securities firms specializing in investment portfolio management for community financial institutions.

Since 1979, we’ve helped our clients improve decision-making, manage interest rate risk, and maximize investment portfolio performance. Our proven approach of total resource integration utilizes software and products developed by Baker’s Software Solutions* combined with the firm’s investment experience and advice.

Author

Jeffrey F. Caughron

Senior Partner

The Baker Group LP

800.937.2257

*The Baker Group LP is the sole authorized distributor for the products and services developed and provided by The Baker Group Software Solutions, Inc.

INTENDED FOR USE BY INSTITUTIONAL INVESTORS ONLY. Any data provided herein is for informational purposes only and is intended solely for the private use of the reader. Although information contained herein is believed to be from reliable sources, The Baker Group LP does not guarantee its completeness or accuracy. Opinions constitute our judgment and are subject to change without notice. The instruments and strategies discussed here may fluctuate in price or value and may not be suitable for all investors; any doubt should be discussed with a Baker representative. Past performance is not indicative of future results. Changes in rates may have an adverse effect on the value of investments. This material is not intended as an offer or solicitation for the purchase or sale of any financial instruments.