If March is the month of madness and April the month of fools, many of us are eager to usher in a new season of sanity and stability soon. Perhaps we are on our way there, with the week of April 7-14 proving fairly calm. Much of the data released this week suggests the Fed has reason pause rate hikes at their next meeting but the market is still expecting an additional 25bp hike. The CME FedWatch tool shows a strong 82% probability of a hike to the 5%-5.5% range when the Fed meets again on May 3rd. However, with mounting evidence that the economy is weakening, this could mark the end of the road for hikes.

On Wednesday, the BLS reported that the Consumer Price Index rose 0.1% in March, cooler than the expected 0.2%. The YoY was up 5.0% from a year ago (survey 5.1%). Core CPI came in right on target at 0.4% for the month and 5.6% for the year. Producer prices also surprised to the downside in March, with Headline PPI falling 0.5% MoM after a flat February. The consensus was looking for an unchanged number for last month and the -0.5% drop marks the biggest decline since the start of the pandemic. Notably, Core PPI was down 0.1% vs a +0.3% forecast. This is the first time it's been in negative territory since the start of the pandemic. On the heels of the softer than expected CPI and PPI numbers, Initial Jobless Claims for the week also came in higher than expected at 239k vs. 235k expected.

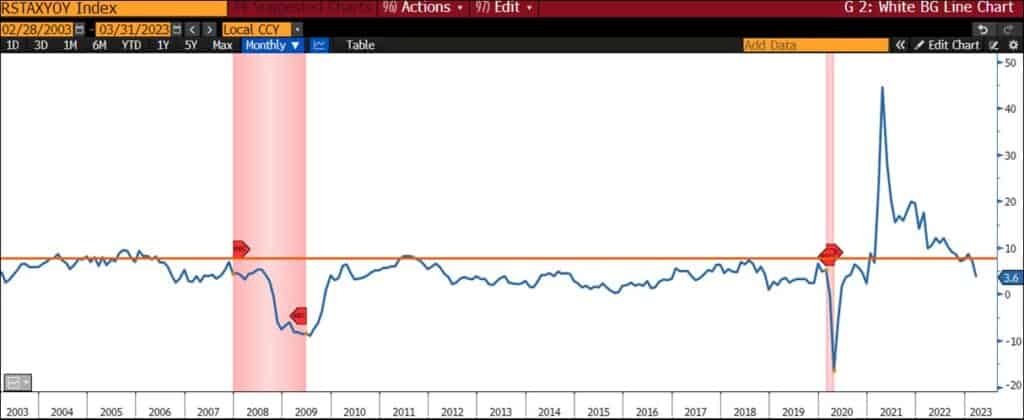

Finally on Friday, we got a host of other important releases to close out the week. The release of Retail Sales for March this morning gave us yet more evidence of a softening economy, falling for a second straight month at -1.0% vs. -0.5% survey. This suggests household spending is cooling in the face of high inflation and rising borrowing costs. Eight out of 13 retail categories declined over the month, led by gasoline stations, general merchandise, and electronics. In a separate report out from Bank of America this week, data showed credit and debit card usage declined to the weakest pace in two years as slower wage growth, fewer tax refunds, and the end of pandemic-related benefits weighed on spending.

Core Retail Sales Now Thru 20yr Average Level

There was a small rebound in the University of Michigan Consumer Sentiment Index for April released this morning, suggesting that easing tensions in the banking sector has reassured consumers somewhat. However, confidence still remains considerably lower than it was in February before the issues with SVB and Signature Bank hit the newswires; and it is still well below the long-term average of 87.0. The headline index for April came in at 63.5, up from 62.0 in March, and 67.0 in February.

Industrial Production for the month of March was also released this morning, showing that the US grew at a stronger pace than expected in March, coming in at 0.4% for the month vs. 0.2% expected and prior. However, the manufacturing and mining output each fell -0.5%, which serves as another piece of evidence that economic momentum going into the second quarter is waning.

Despite the weakness in recent economic data, the market sold off Friday morning on comments from Jamie Dimon that the market should expect higher rates for longer and a speech from Fed Governor Waller this morning where he made the case for more rate hikes saying, “Because financial conditions have not significantly tightened, the labor market continues to be strong and quite tight, and inflation is far above target, [so] monetary policy needs to be tightened further.” “How much further will depend on incoming data on inflation, the real economy, and the extent of tightening credit conditions.”

Next week, we’ll get a variety of housing data that is expected to show a drop in Building Permits, Housing Starts, as well as Homes Sales. Empire Manufacturing and Leading Index are also out next week and expected to show drops as well. Investors will also be watching closely for any additional guidance from the Fed and as they continue to balance efforts to quash inflation with growing evidence of economic weakness

The Baker Group is one of the nation’s largest independently owned securities firms specializing in investment portfolio management for community financial institutions.

Since 1979, we’ve helped our clients improve decision-making, manage interest rate risk, and maximize investment portfolio performance. Our proven approach of total resource integration utilizes software and products developed by Baker’s Software Solutions* combined with the firm’s investment experience and advice.

Author

Andrea F. Pringle

Financial Strategist/MBS Analyst

The Baker Group LP

800.937.2257

*The Baker Group LP is the sole authorized distributor for the products and services developed and provided by The Baker Group Software Solutions, Inc.

INTENDED FOR USE BY INSTITUTIONAL INVESTORS ONLY. Any data provided herein is for informational purposes only and is intended solely for the private use of the reader. Although information contained herein is believed to be from reliable sources, The Baker Group LP does not guarantee its completeness or accuracy. Opinions constitute our judgment and are subject to change without notice. The instruments and strategies discussed here may fluctuate in price or value and may not be suitable for all investors; any doubt should be discussed with a Baker representative. Past performance is not indicative of future results. Changes in rates may have an adverse effect on the value of investments. This material is not intended as an offer or solicitation for the purchase or sale of any financial instruments.