Our friends at The Bureau of Economic Analysis reported this week that the US economy slowed sharply in the first quarter of the year. After clipping along at a solid 2.5%-ish growth pace for the entire second half of 2022, we now seem to be stuck in the mud. Real GDP increased at just 1.1% in Q1 despite strong consumer spending, an abrupt deceleration and well below expectations of a 2% increase. The slowdown suggests the Fed’s year-long battle against inflation is beginning to take effect in terms of demand destruction. Since March of last year, the Fed has lifted the funds rate nine times from near zero to just under 5%, the fastest increase in decades, and unprecedented in terms of the relative increase in the cost of borrowing.

To be sure, there was some noise in the GDP data. Peeling back the layers, we find that real final sales (which strips out net exports and inventory changes to focus purely on domestic demand) jumped 3.4%, offsetting a dismal 1.1% in Q422. But the weakness in inventories is likely a reflection of falling confidence on the part of businesses regarding demand going forward. And the trade data looks extremely recessionary. US imports have hit a wall and now exports are rolling over as well. Regional measures of manufacturing activity in Dallas and Philadelphia are both down more than 20%, exceeding even low end expectations. Suffice to say that the trend is clearly weakening as we move into the middle of the year. The teeth of the Fed’s tightening campaign are sinking deeper into the economy and recession probabilities are steadily rising. And speaking of weakening trends, let’s look at inflation.

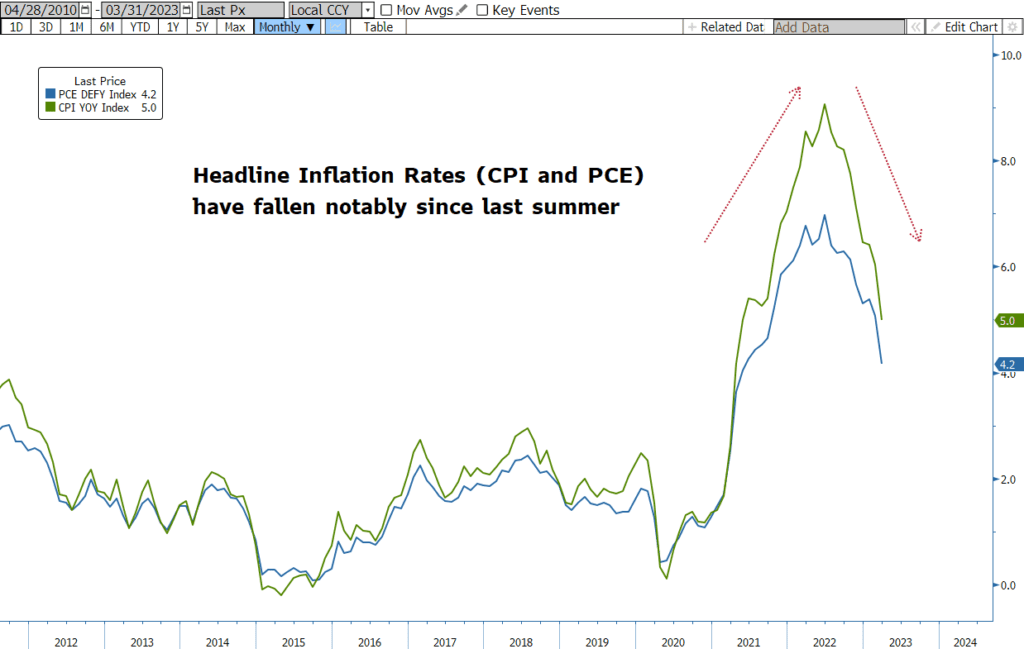

We learned this morning that headline PCE (Personal Consumption Expenditure) inflation fell to 4.2% year-over-year, the lowest level in nearly two years. This follows the same pattern we’ve seen in the CPI index and others. Trimmed-mean inflation rose just 3.37% annualized, for example, and Fed Chair Powell’s “Supercore” measure only moved up two-tenths of a percent last month… that annualizes to just 2.4%. These levels are all far below what we saw even just a few months ago. There can be no question that inflation is steadily falling, and if the pace of disinflation continues, the Fed could see a 2% handle on many measures of by year-end. Still, policymakers insist that at least one more rate hike is needed to seal the deal… insurance that the inflation genie is bottled up again for a good long time.

That’s all fine and well, but as former Treasury Secretary Larry Summers notes, the likelihood of a US recession is rising and the Fed needs to “engage in some serious soul searching about the very, very difficult decisions ahead of it.” Presumably that’s a reference to the question of when to pause, and how long to allow the pain of recession to linger before granting relief. The FOMC meeting next week will be instructive, coming in the midst of a slew of economic data… ISM, JOLTS, CAPEX, and of course the employment report on Friday. Yes, the lusty month of May will begin with much for markets to ponder in an active week indeed.

US Inflation Rates - CPI and PCE: 2010 to Today

The Baker Group is one of the nation’s largest independently owned securities firms specializing in investment portfolio management for community financial institutions.

Since 1979, we’ve helped our clients improve decision-making, manage interest rate risk, and maximize investment portfolio performance. Our proven approach of total resource integration utilizes software and products developed by Baker’s Software Solutions* combined with the firm’s investment experience and advice.

Author

Jeffrey F. Caughron

Senior Partner

The Baker Group LP

800.937.2257

*The Baker Group LP is the sole authorized distributor for the products and services developed and provided by The Baker Group Software Solutions, Inc.

INTENDED FOR USE BY INSTITUTIONAL INVESTORS ONLY. Any data provided herein is for informational purposes only and is intended solely for the private use of the reader. Although information contained herein is believed to be from reliable sources, The Baker Group LP does not guarantee its completeness or accuracy. Opinions constitute our judgment and are subject to change without notice. The instruments and strategies discussed here may fluctuate in price or value and may not be suitable for all investors; any doubt should be discussed with a Baker representative. Past performance is not indicative of future results. Changes in rates may have an adverse effect on the value of investments. This material is not intended as an offer or solicitation for the purchase or sale of any financial instruments.