May started out with a bang with the first week of the month giving us a bank failure, a debt ceiling crisis, a Fed rate decision, and head scratching employment numbers. We learned on Monday that the banking sector is not yet out of the woods as First Republic Bank failed, marking the largest bank collapse since the 2008 financial crisis and the third bank failure since March. Similar to its fallen peers, First Republic was a specialty lender of sorts, catering to the ultra-wealthy. It enticed customers with low-rate mortgages in exchange for deposits in a business model that worked well…until it didn’t. Ultimately, its high level of uninsured deposits left the bank vulnerable in the wake of the collapse of SVB and Signature Bank and its clients withdrew more than $100 billion in deposits in Q1. Despite a last-ditch effort to save it by some of the country’s biggest banks, who banded together to inject $30 billion of deposits in March, regulators took possession of the bank and helped broker a deal for its deposits and most of its assets to be acquired by JPMorgan Chase.

If that weren’t enough of a jittery start to the week, we also learned Monday from Treasury Secretary Janet Yellen that the U.S. could run out of money to pay its bills sooner than we thought, as early as June 1 if Congress does not raise or suspend the debt limit. This added to the mounting pressure on President Biden and lawmakers to reach some sort of agreement to avoid defaulting on the nation’s debt. Given the contentiousness of the issue, it seems likely we will come down to the wire on any sort of resolution. The most straightforward way out of the current impasse seems to be a bipartisan deal to raise the cap alongside some modest spending cuts. It is possible some moderate Republicans will step in to help push through a ‘clean’ debt limit increase without any accompanying cuts but that is only likely to happen once it is clear that negotiations have failed. In either case, it is sure to be a tough slog right up to the end.

On Wednesday, we got the much-expected 25bp rate hike from the Fed, increasing the Fed Funds target range to 5.00%-5.25%. The accompanying policy statement also provided the clearest hint yet that this may be the last rung higher on the Fed’s inflation-flighting ladder. Guidance in the Fed’s previous statement that “some additional policy firming may be appropriate” was dropped this time around. The updated statement explained that, “In determining the extent to which additional policy firming may be appropriate… the Committee will take into account the cumulative tightening of monetary policy, the lags with which monetary policy affects economic activity and inflation, and economic and financial developments.” This suggests that after the break-neck pace with which the Fed has been raising rates, it may finally be willing to stop and assess the damage. However, they did leave the door open for further tightening in the future if economic conditions compel.

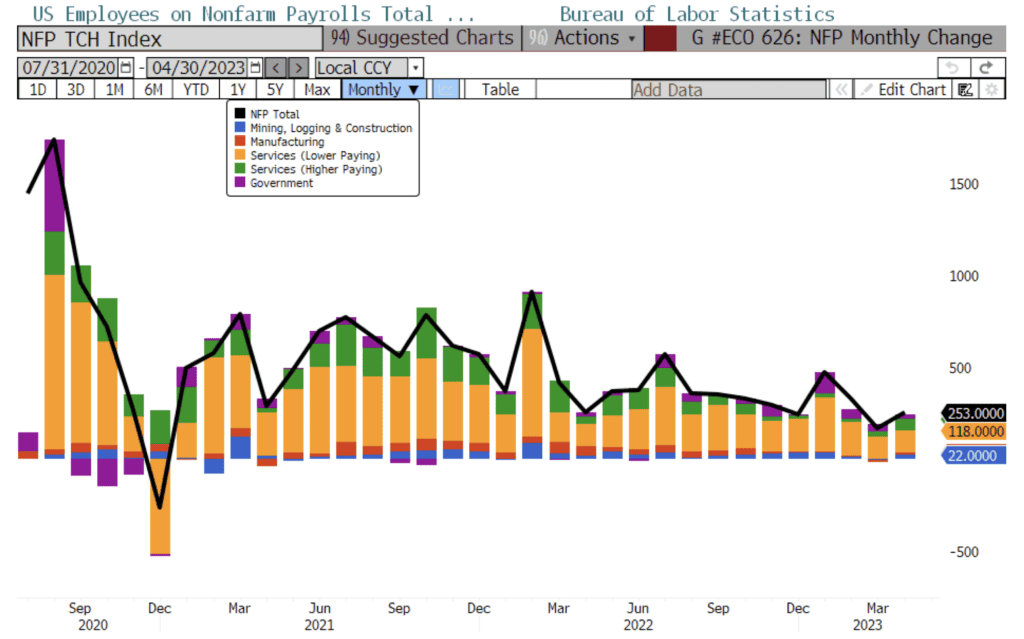

This week also gave us an interesting mix of jobs data with some dramatic misses and dramatic revisions. Wednesday’s ADP report showed that private employment increased much more than expected in April, surprising the market with a +296k print vs. +150k expected. That was more than double the +142k gain of the previous month. The report showed big gains in the leisure & hospitality, health care, construction, and mining sectors while the manufacturing, financial, and professional & business services sectors all posted sizable declines. Despite the gains, ADP also showed continued cooling in wage growth, with the median annual change for job changers falling to a 17-month low of 13.2%, from 14.2%.

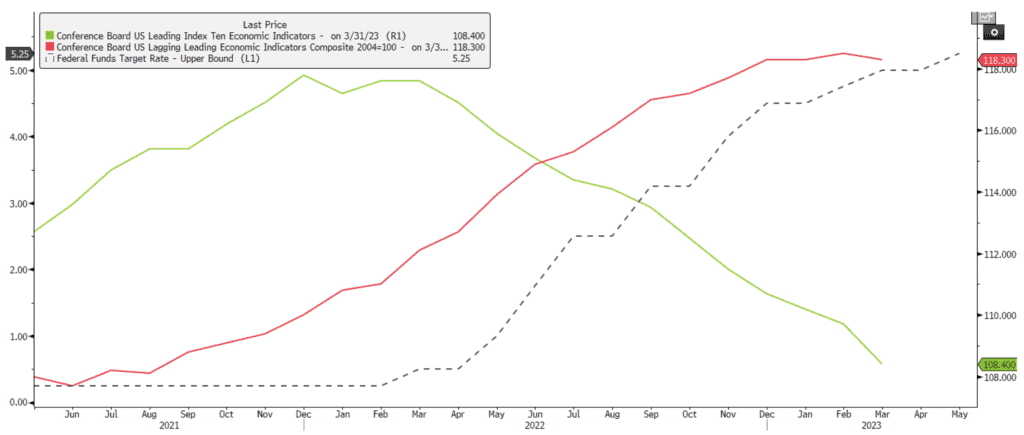

Today’s official Non-farm Payrolls report suggests continued resilience in the labor market as job gains came in big at +253k vs. +185k expected. The Unemployment Rate also fell to 3.4% vs. 3.6% expected and Average Hourly Earnings showed another strong increase of +0.5% vs. +0.3% expected. However, the stronger than expected gain in jobs (+68k) was completely offset by a sharp downward revision to the previous month (-71k). Jobs data is also a lagging economic indicator, and while this was certainly a strong reading, there is a huge disconnect between lagging and leading indicators right now.

Fed funds futures moved slightly on this morning’s report, but are still pricing in less than a 10% chance the Fed will hike rates again this year. The market seems doubtful these numbers are reason enough for the Fed to reconsider its plan for a pause in hikes, given the lagging nature of employment stats and wider evidence of cooling economic conditions. Next week we get the all-important CPI and PPI numbers and the market will also be closely watching the regional bank sector for any signs that continued stress will cause further drag on the economy.

The Baker Group is one of the nation’s largest independently owned securities firms specializing in investment portfolio management for community financial institutions.

Since 1979, we’ve helped our clients improve decision-making, manage interest rate risk, and maximize investment portfolio performance. Our proven approach of total resource integration utilizes software and products developed by Baker’s Software Solutions* combined with the firm’s investment experience and advice.

Author

Andrea F. Pringle

Financial Strategist/MBS Analyst

The Baker Group LP

800.937.2257

*The Baker Group LP is the sole authorized distributor for the products and services developed and provided by The Baker Group Software Solutions, Inc.

INTENDED FOR USE BY INSTITUTIONAL INVESTORS ONLY. Any data provided herein is for informational purposes only and is intended solely for the private use of the reader. Although information contained herein is believed to be from reliable sources, The Baker Group LP does not guarantee its completeness or accuracy. Opinions constitute our judgment and are subject to change without notice. The instruments and strategies discussed here may fluctuate in price or value and may not be suitable for all investors; any doubt should be discussed with a Baker representative. Past performance is not indicative of future results. Changes in rates may have an adverse effect on the value of investments. This material is not intended as an offer or solicitation for the purchase or sale of any financial instruments.