Memorial Day weekend marks the unofficial start of summer and a chance to honor the contribution of fallen service members. And if rumors are true that an end to the U.S. debt ceiling saga is in sight, we may have extra reason to celebrate this weekend. There are reports this morning that that the White House and congressional leaders are close to reaching a deal to lift the debt ceiling just before the Treasury Department runs out of cash next week. We will most certainly get more details as the day progresses, but as of this morning the two sides are reportedly just $70 billion apart.

But before we can truly celebrate, we have to reckon with another bend in the roller-coaster that has been Fed Policy expectations this year. After the last rate hike, futures markets were pricing in virtually no chance of another hike in the Fed Funds rate. However, after a spattering of better-than-expected economic data and hawkish comments from policymakers this week, the market has a new outlook.

Minneapolis Fed chief Neel Kashkari said this week that entrenched services inflation means "it may be that we have to go north of 6%," which certainly surprised market participants who had begun to believe that 6% was off the table in the aftermath of the spring banking turmoil. St. Louis Fed President James Bullard also talked repeatedly of favoring 50bps more of rate hikes before peaking. Even JPMorgan CEO, Jamie Dimon, weighed in this week that, "Five percent's not high enough for Fed Funds - I've been advising this to clients, and banks, you should be prepared for six, seven."

Futures markets are currently pricing in another quarter point rate hike to the 5.25-5.50% range by the end of July. That hike may come at the July meeting if the debt ceiling standoff and its aftermath sidelines Fed action in June. The CME Group Fed Watch tool is assigning a 52.8% probability of getting to 5.25%-5.50% at the June meeting and 50.2% by the late July meeting. Despite all the hawkish comments dominating the airwaves this week, the market is still expecting that we end the year at 5.25-5.50%.

Fed minutes released on Wednesday showed that there is appetite to pause hikes among some Fed officials as they agreed “the extent to which additional increases in the target range may be appropriate after this meeting had become less certain.” However, in the wake of strong post-meeting data releases showing a potential housing recovery, continued tight labor market conditions, and persistently high inflation, more recent comments from Fed officials suggest they are open to continued tightening.

In data, New Home Sales came in slightly stronger than expected this week at 683k vs. 665k expected. This marks the highest level for new home sales in just over a year, since March 2022. However, the prior month was revised down from 683k to 656k, which more than offsets the April increase. Additionally, the median sales price for new homes fell 8.2% YoY, the biggest decline since April 2020.

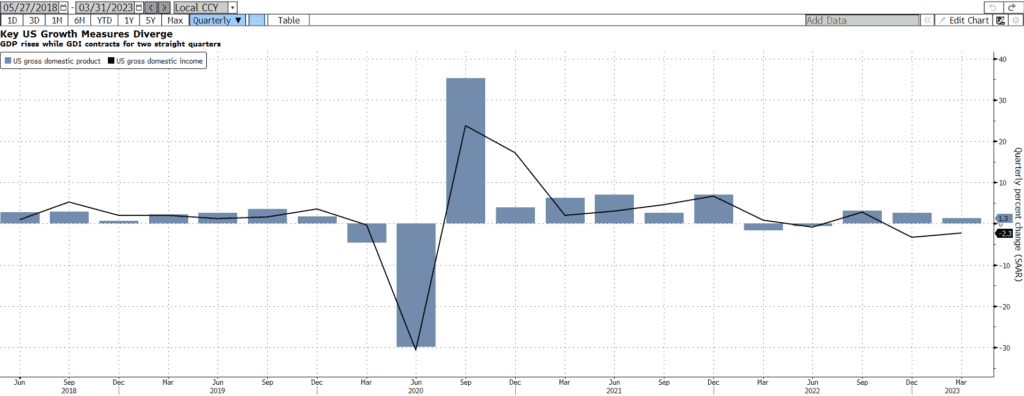

GDP growth for the first quarter was revised up this week from an annualized rate of 1.1% to 1.3%, suggesting the U.S. economy had slightly more momentum than originally reported. However, real gross domestic income (GDI), which is gauges the income generated and costs incurred from producing goods and services, was a stark contrast. GDI decreased 2.3% after falling 3.3%, the worst back-to-back declines since the start of the pandemic.

Initial Jobless Claims surprised to the downside this week, coming in at 229k vs. 245k consensus. Jobless claims had been generally trending up since September 2022 but appear to have leveled off or even fall since early April. Last week’s number was also revised sharply lower from 242k to 225k. The strong labor landscape undoubtedly emboldens hawkish policymakers at the Fed. That, combined with the hotter than expected Personal Income and Spending and PCE numbers released this morning, adds credence to the camp that believes the Fed still has more tightening left to do.

Personal Income for April remained flat at 0.4%, but up from 0.3% in March. Spending, however, increased considerably more than expected, up 0.8% in the month of April vs. 0.5% consensus. Last month’s reading was also revised up from 0.0% to 0.1%. The all-important personal income expenditures (PCE) inflation gauge, which is what the Fed is actively trying to return to a 2% YoY target, ticked up to 4.4% vs. 4.3% expected. The MoM reading as well as the Core readings (MoM an YoY) were all 0.1% higher than consensus as well. Markets will take this as more evidence that the Fed could tighten policy even further this summer.

Next week we will get several important jobs numbers and the market will be looking for any signs of weakness in the labor market that could give the Fed reason to pause. We will also hopefully have some sort of deal on the debt ceiling issue to digest. Commentators are suggesting we may have a deal as soon as today but that it could fall to the weekend to iron out final points. Additionally, even if the debt ceiling is raised soon, the Treasury Department may still have to rush to issue up to $1 trillion of new debt securities to meet short-term funding needs.

The Baker Group is one of the nation’s largest independently owned securities firms specializing in investment portfolio management for community financial institutions.

Since 1979, we’ve helped our clients improve decision-making, manage interest rate risk, and maximize investment portfolio performance. Our proven approach of total resource integration utilizes software and products developed by Baker’s Software Solutions* combined with the firm’s investment experience and advice.

Author

Andrea F. Pringle

Financial Strategist/MBS Analyst

The Baker Group LP

800.937.2257

*The Baker Group LP is the sole authorized distributor for the products and services developed and provided by The Baker Group Software Solutions, Inc.

INTENDED FOR USE BY INSTITUTIONAL INVESTORS ONLY. Any data provided herein is for informational purposes only and is intended solely for the private use of the reader. Although information contained herein is believed to be from reliable sources, The Baker Group LP does not guarantee its completeness or accuracy. Opinions constitute our judgment and are subject to change without notice. The instruments and strategies discussed here may fluctuate in price or value and may not be suitable for all investors; any doubt should be discussed with a Baker representative. Past performance is not indicative of future results. Changes in rates may have an adverse effect on the value of investments. This material is not intended as an offer or solicitation for the purchase or sale of any financial instruments.