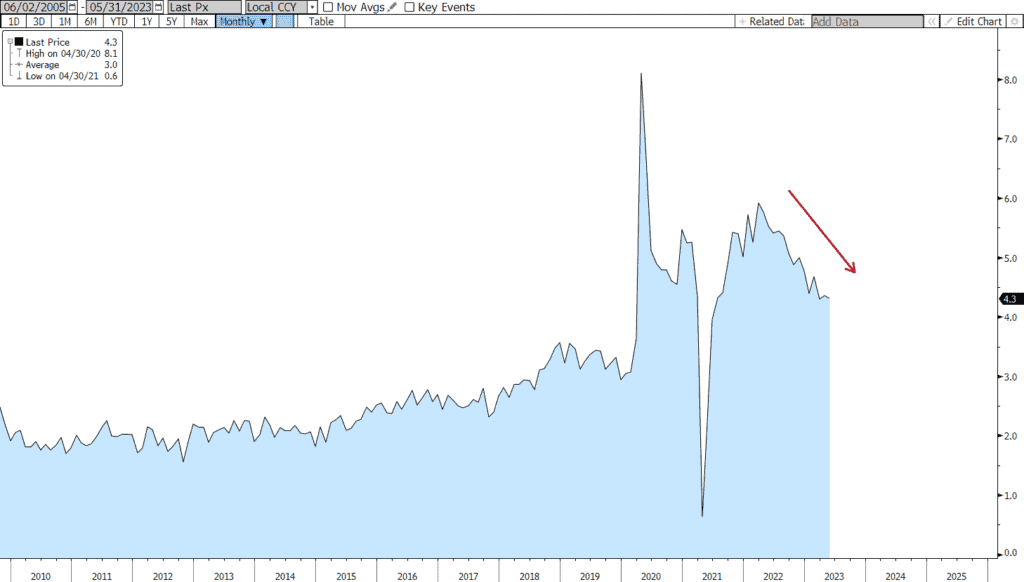

Summer is here and things are warming up. That’s certainly true of the labor market, or at least the payrolls growth component of the May jobs report. It was, to be sure, a noisy number that the labor department released this morning. Though payrolls jumped 339K last month (notably higher than the 195K expected) and prior months were revised upward, we also saw an unanticipated uptick in the unemployment rate to 3.7% and a decrease in wage inflation… both Fed friendly developments as the central bank continues to fight inflation. The head-scratching is caused by differences in methodology between the household survey (which is exactly that… a direct survey of households asking about employment status) and the establishment survey (which is derived specifically from company payrolls data). Confusion arises for surveyed households when members hold two or more jobs, hybrid part-versus full-time workers, etc. This causes inconsistencies in reporting that have been amplified by the pandemic. So, in May, we had an enormous discrepancy between job creation reported by the payrolls data, +339K, versus the household survey results, -310K. Taking a step back, we see clearly that wage growth has slowed from a peak in March ’22 of 5.92% YOY to 4.30% YOY today. At that pace, we’ll be back to pre-pandemic levels (3.6% or so) easily by year-end. That’s critical since it’s wage-inflation that the Fed is fighting, not job growth in and of itself.

Meanwhile, speaking of inflation, commodities prices continue to fall as global economic weakness spreads. The core-commodity (CRB) index has dropped back to levels not seen since the beginning of 2022, and we’ve seen sharp, recession-looking drops in balances of both US imports and exports. We also saw this week that unit labor costs of US companies were reported to be much lower (4.2% vs 6.3% prior quarter), and the prices paid component of the ISM (Institute for Supply Management) Index at 44.2% vs 53.2% previously). Inflation, still too high, is nonetheless coming down steadily by most measures, and market-based inflation expectations have fallen back to pre-COVID levels.

Also moving markets this week was the remarkably silly debate on whether the US should honor its commitments and pay its bills. Not to be confused with a meaningful debate about future fiscal policy, this silliness involved threats to simply renege on all Federal contracts, interest payments on debt, salaries of military, and other federal employees by denying the US Treasury authority for routine Treasury Bill issuance to make payment. As always happens, the fools ended up looking foolish and borrowing authority was kept intact. But serious damage was done to financial markets, particularly money markets where the Treasury must now rebuild its cash account. The unnecessary distortion is costly in many ways, but for banks it means further pressure on reserves in the system at a time when the Fed is engaged in aggressive credit tightening, putting further upward pressure on cost of funds. The effect is thought to be similar to an additional 25bps of tightening.

And that brings us to Fed policy. Interestingly, we’ve seen and heard much talk about pausing, skipping, or (however you phrase it) not hiking rates in June. Policymakers including Philadelphia President, Patrick Harker, and Fed Governor, Philip Jefferson, both suggested as much this week, and St. Louis President Bullard suggested the current fed funds rate is “arguably sufficiently restrictive” given current conditions. Harker said it well when he noted that “we are close to a point where we can hold rates in place and let monetary policy do its work to bring inflation back to the target in a timely manner.”

Next week we’ll get data on factory orders, capital expenditures, and trade, as well as the ISM services report.

US Average Hourly Earnings Growth (YOY): 2005 - Today

The Baker Group is one of the nation’s largest independently owned securities firms specializing in investment portfolio management for community financial institutions.

Since 1979, we’ve helped our clients improve decision-making, manage interest rate risk, and maximize investment portfolio performance. Our proven approach of total resource integration utilizes software and products developed by Baker’s Software Solutions* combined with the firm’s investment experience and advice.

Author

Jeffrey F. Caughron

Senior Partner

The Baker Group LP

800.937.2257

*The Baker Group LP is the sole authorized distributor for the products and services developed and provided by The Baker Group Software Solutions, Inc.

INTENDED FOR USE BY INSTITUTIONAL INVESTORS ONLY. Any data provided herein is for informational purposes only and is intended solely for the private use of the reader. Although information contained herein is believed to be from reliable sources, The Baker Group LP does not guarantee its completeness or accuracy. Opinions constitute our judgment and are subject to change without notice. The instruments and strategies discussed here may fluctuate in price or value and may not be suitable for all investors; any doubt should be discussed with a Baker representative. Past performance is not indicative of future results. Changes in rates may have an adverse effect on the value of investments. This material is not intended as an offer or solicitation for the purchase or sale of any financial instruments.