Happy Friday everyone! The economic calendar was rather light this week and professional golf has gotten more headlines this week than the economy. As my good friend James always says, “money talks and people mumble…” Money seemed to be doing all the talking as news broke Tuesday with the announcement of the merger of the PGA Tour and LIV Tour.

On Monday, the latest data for business conditions in the service sector was released. The S&P Global Service Purchase Managers Index came in slightly lower than expectations at 54.9 (est. 55.1), a drop from the prior month’s reading of 55.1. The reading keeps the index in expansion territory for the fourth straight month (expansionary is greater than 50) and is the strongest reading in over a year. On the other hand, the ISM Services Index was also released on Monday and showed that the US service sector softened. The ISM Services Index fell to 50.3 last month, down from 51.9 in April. Both services index readings are important to the US Economy as the service industry accounts for more than two-thirds of the economy. Lastly on Monday, factory orders increased 0.4% after a 0.5% gain in March. Estimates were for a stronger increase of 0.8%. A 36% jump in defense capital goods lifted the somewhat lackluster factory order report. As they say, defense wins championships!

Yesterday, the initial jobless claims increased 28,000 to 261,000, well above the 2019 pre-pandemic average of 218,000 claims. It also marks the steepest level for jobless claims since October 2021. Continuing claims fell slightly to 1.76 million for the week ended May 27th, a decrease of 37,000 from the previous week. Are the latest jobless claims numbers indicative of a potentially slowing labor market? Time will tell.

All eyes are on next week’s release of the Consumer Price Index (CPI) data on Tuesday as well as the Fed’s decision on interest-rate policy. Headline CPI is expected to increase 0.2% month over month and 4.1% year over year. Additionally, the Core CPI (ex. food and energy) is expected to increase 0.4% month over month and 5.2% year over year.

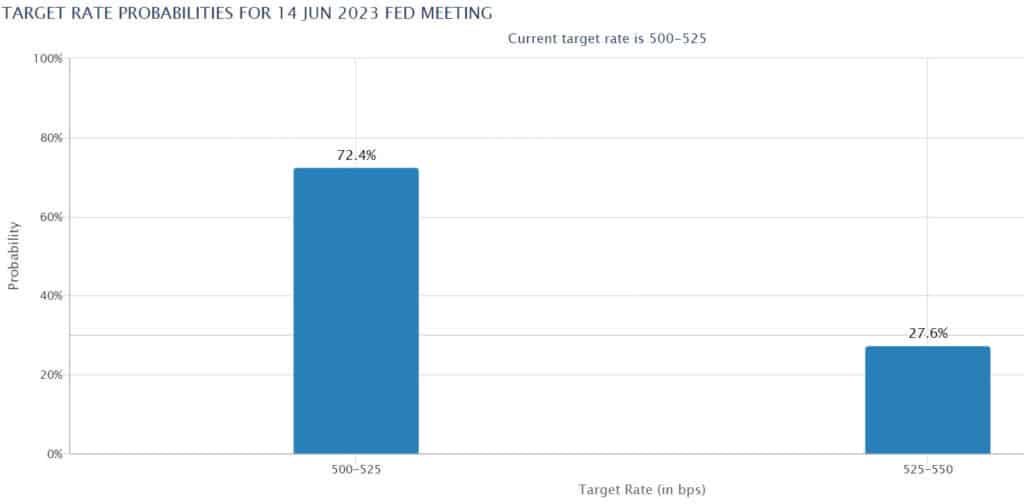

What should we expect from the Fed next week? As of this morning, the CME Group’s FedWatch Tool is calculating a 27.6% chance of a 25bp rate hike next week and a 72.4% chance of no rate hike. Federal Reserve officials have been hitting the speaking circuit lately conveying a message of the potential for “skipping a rate hike” instead of “pausing rate hikes”. The Fed is being very cautious by sending the message that the possibility for future rates hikes is not over even if no rate hike comes next week.

I hope everyone has a great weekend!

CME Group’s FedWatch Tool - Probabilities for June 14th Fed Meeting

The Baker Group is one of the nation’s largest independently owned securities firms specializing in investment portfolio management for community financial institutions.

Since 1979, we’ve helped our clients improve decision-making, manage interest rate risk, and maximize investment portfolio performance. Our proven approach of total resource integration utilizes software and products developed by Baker’s Software Solutions* combined with the firm’s investment experience and advice.

Author

Dale Sheller

Managing Director

Director of Financial Strategies Group

The Baker Group LP

800.937.2257

*The Baker Group LP is the sole authorized distributor for the products and services developed and provided by The Baker Group Software Solutions, Inc.

INTENDED FOR USE BY INSTITUTIONAL INVESTORS ONLY. Any data provided herein is for informational purposes only and is intended solely for the private use of the reader. Although information contained herein is believed to be from reliable sources, The Baker Group LP does not guarantee its completeness or accuracy. Opinions constitute our judgment and are subject to change without notice. The instruments and strategies discussed here may fluctuate in price or value and may not be suitable for all investors; any doubt should be discussed with a Baker representative. Past performance is not indicative of future results. Changes in rates may have an adverse effect on the value of investments. This material is not intended as an offer or solicitation for the purchase or sale of any financial instruments.