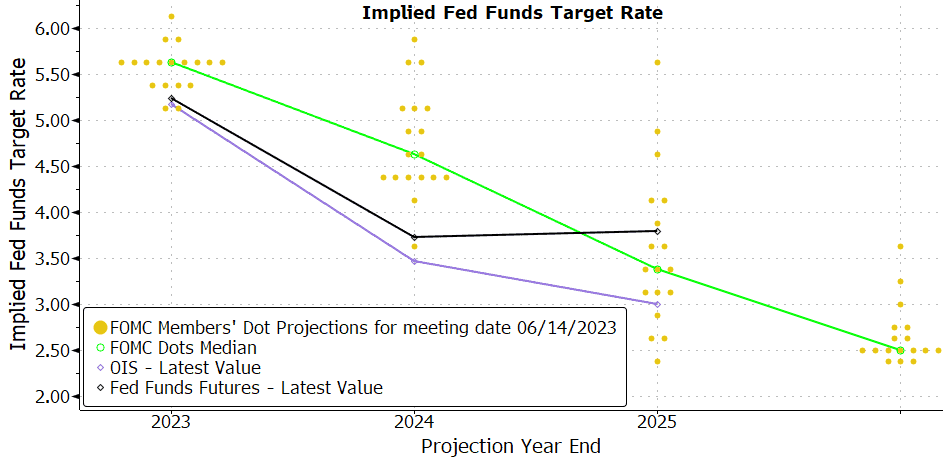

Following 10 consecutive rate hikes totaling 500bp since March 2022, the Federal Reserve decided to leave interest rates unchanged at the June FOMC meeting. Markets were expecting that outcome, but they were not expecting the new “Dot Plot” to show a majority of FOMC members now expect to hike rates an additional 50bp before year-end. This “hawkish skip” came despite the fact that both CPI (4.0% YOY) and PPI (1.1% YOY) came in lower than expected for May and Industrial Production unexpectedly fell 0.2%.

So why would the Fed say they want to raise rates another 50bp but then choose not to raise them in June? I can think of a few possibilities. First, they may have decided to simply continue their pattern of slowing their pace of rate hikes yet again by raising rates 25bp at every other meeting until they reach their target. They raised rates 75bp at four consecutive meetings between June and November 2022 before hiking just 50bp in December and then 25bp at the February, March and May meetings. Raising rates 25bp at every other meeting would further slow the pace of tightening. Another possibility is they did not want to add unnecessary market volatility following the debt ceiling showdown and the need for the Treasury to issue as much as $1 trillion of debt in coming months. Finally, they may have no intention of actually raising rates again, but want markets to believe that they will so rates remain high and financial conditions remain tight to continue bringing inflation down towards their 2% target.

Despite the Fed’s forecast they will hike rates another 50bp, markets don’t believe them. Fed funds futures are pricing in just one more rate hike in July to a peak of 5.25-5.5% with less than a 15% probability they go above that. The Fed says they are “data dependent” so markets will be hyper focused on the employment and inflation readings each month to determine the expected peak in rates. One bad employment number or another big drop in inflation could give them the cover they need to stop raising rates.

For the week, the 2-year yield rose 16bp to 4.75% and the 10-year yield rose 4bp to 3.78%, leaving the 10yr2yr spread at -97bp.

We will get more clarity on the Fed’s thinking next week with no less than 10 speeches from various Fed officials including Chairman Powell. We will also see reports on Housing Starts, Building Permits, Existing Home Sales and Leading Economic Indicators.

June 2023 Dot Plot

The Baker Group is one of the nation’s largest independently owned securities firms specializing in investment portfolio management for community financial institutions.

Since 1979, we’ve helped our clients improve decision-making, manage interest rate risk, and maximize investment portfolio performance. Our proven approach of total resource integration utilizes software and products developed by Baker’s Software Solutions* combined with the firm’s investment experience and advice.

Author

Ryan W. Hayhurst

President

The Baker Group LP

800.937.2257

*The Baker Group LP is the sole authorized distributor for the products and services developed and provided by The Baker Group Software Solutions, Inc.

INTENDED FOR USE BY INSTITUTIONAL INVESTORS ONLY. Any data provided herein is for informational purposes only and is intended solely for the private use of the reader. Although information contained herein is believed to be from reliable sources, The Baker Group LP does not guarantee its completeness or accuracy. Opinions constitute our judgment and are subject to change without notice. The instruments and strategies discussed here may fluctuate in price or value and may not be suitable for all investors; any doubt should be discussed with a Baker representative. Past performance is not indicative of future results. Changes in rates may have an adverse effect on the value of investments. This material is not intended as an offer or solicitation for the purchase or sale of any financial instruments.