Summertime officially arrived this week with the solstice, and the Fed Chairman celebrated by delivering his semi-annual Humphry Hawkins testimony on consecutive days to both houses of Congress. Having just completed the June FOMC meeting the prior week, Chair Powell clarified to legislators that while Fed policymakers decided not to raise the funds rate after ten consecutive hikes, that doesn’t mean they’re finished or ready to declare victory over inflation. He was unequivocal in framing the decision as a slow-down in a continuing tightening process. This gives Fed officials more time to assess economic conditions and trends, and to allow lagged effects of previous rate hikes to filter through into the data. Powell also had the task of explaining the FOMC’s “Dot Plot” projections which indicate two more hikes yet to come. That, however, is something the bond market seems to dispute. Indeed, market-based indicators continue to signal that the Fed is at substantial risk of pushing the economy into recession in the second half of the year, short-circuiting any expectations of further tightening. Time will tell.

As for economic trends and indicators, we know that various measures of headline inflation continue to fall steadily. CPI, for example, is now down to 4% year-over-year from a high of 9.1%. But the less-volatile core measures are falling too slowly for anyone to get too excited. This “stickiness” was specifically referenced by Powell and again by Treasury Secretary Janet Yellen in a separate interview. Meanwhile, we got some surprisingly good news this week on housing starts, tempered by further bad news on home prices. Housing starts soared 21.7% for the month, bringing the year-over-year change to 7.5%, the highest since early last year. However, we also found that the median home sales price fell 3.1% in May, the largest drop since 2011. Existing home sales are down 20.4% from a year earlier, and are down about one-third since the beginning of 2022. The Conference Board’s Index of Leading Economic Indicators was also released this week showing another recessionary level of -.8% for May, the 14th consecutive month of negative readings. For those waiting on- and expecting to see the onset of recession and/or a sudden return to 2%-ish inflation, it’s like tapping the Ketchup bottle… drip, drip, drip at first, then a flood. At this point we’re still dripping.

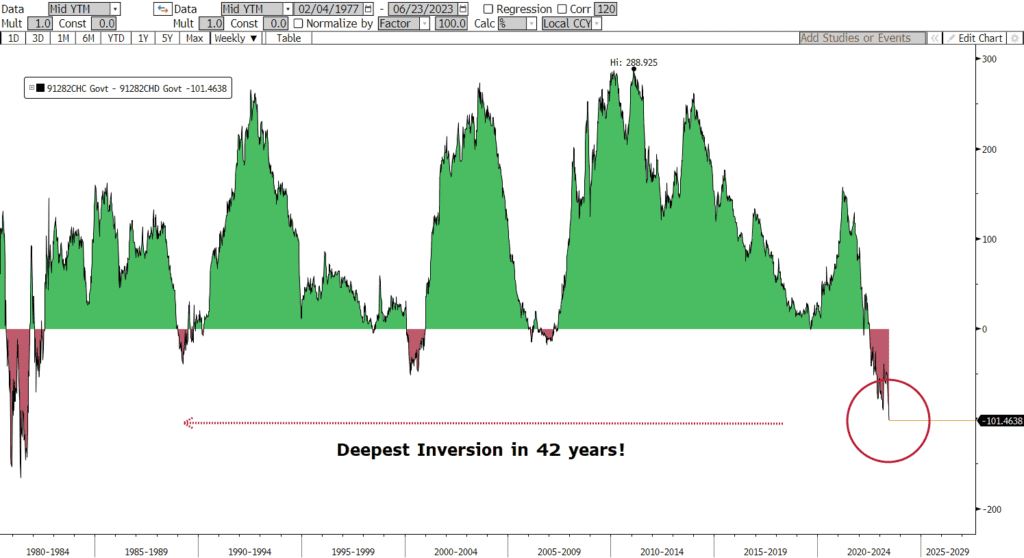

As to market behavior, it’s worth noting that the deeply inverted yield curve is flirting with a new low. The 10yr T-Note yield sits at 3.75% versus the 2yr yield at 4.77%. That negative yield difference is back to -102bps… within spittin’ distance of the 42-year low of 108bps. The message is clear, but it’s the timing that’s uncertain. Yield curve inversions can linger for a long time before the recessions they predict becomes manifest. And until the Fed is clearly finished tightening, the lingering will continue.

Next week will bring, among other things, the latest PCE Inflation data which is the Fed’s preferred measure. We’ll also get durable goods, capital expenditures, new home sales and revised GDP data for the first quarter.

US Treasury Yield Curve Slope: 2yr vs 10yr - 1977 to Today

The Baker Group is one of the nation’s largest independently owned securities firms specializing in investment portfolio management for community financial institutions.

Since 1979, we’ve helped our clients improve decision-making, manage interest rate risk, and maximize investment portfolio performance. Our proven approach of total resource integration utilizes software and products developed by Baker’s Software Solutions* combined with the firm’s investment experience and advice.

Author

Jeffrey F. Caughron

Senior Partner

The Baker Group LP

800.937.2257

*The Baker Group LP is the sole authorized distributor for the products and services developed and provided by The Baker Group Software Solutions, Inc.

INTENDED FOR USE BY INSTITUTIONAL INVESTORS ONLY. Any data provided herein is for informational purposes only and is intended solely for the private use of the reader. Although information contained herein is believed to be from reliable sources, The Baker Group LP does not guarantee its completeness or accuracy. Opinions constitute our judgment and are subject to change without notice. The instruments and strategies discussed here may fluctuate in price or value and may not be suitable for all investors; any doubt should be discussed with a Baker representative. Past performance is not indicative of future results. Changes in rates may have an adverse effect on the value of investments. This material is not intended as an offer or solicitation for the purchase or sale of any financial instruments.