The last week of June had all the makings for extreme volatility but managed to stay relatively calm to end the quarter, despite an attempted coup in Russia over the weekend and comments from Fed Chair Jerome Powell that all but promised more rate hikes are to come. Markets stayed mostly sideways this week, torn between embracing the occasional signs of resilience we keep seeing from the US economy and fearing those signs of resilience will embolden the central bank’s tightening resolve. After a week of somewhat mixed data, we are ending the week with rates marginally higher from where we started. The 2yr UST up ~10bps to 4.85% and the 10yr UST is up ~10bps to 3.82% at the time of this writing.

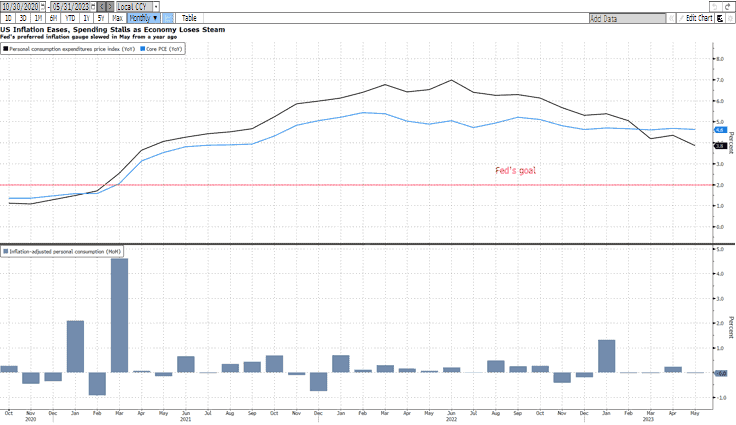

This morning we got the all-important PCE and Personal Income and Spending readings, which showed that inflation cooled in May and consumer spending stagnated, which suggests the economy may be starting to lose steam. The PCE Deflator, which is the Fed’s preferred measure of inflation, rose as expected, up +0.1% MoM and +3.8% YoY. This marks the lowest annual rate of inflation since April 2021 and is down materially since peaking at +7.0% in June 2022. Personal income rose a bit more than expected, up +0.4% in May vs. +0.3% survey while spending rose slightly less than expected, up just +0.1% vs. +0.2% survey. April spending was also revised lower by -0.2%.

Yesterday, we saw jobless claims post their biggest drop in 20 months. Claims for unemployment benefits fell to 239k for the week ended 6/24/23, much lower than expectations of 265k. However, it bears mentioning that the week was shortened by the Juneteenth holiday. Despite the drop in claims, demand for labor has been steadily easing. Chair Powell said this week that the labor market has been cooling in the way the central bank would have hoped, which if maintained, could curb future job losses. Continuing claims, which captures those who have received unemployment benefits for more than a week, also dropped to 1.7 million.

On Wednesday, we got the final reading of Q1 GDP, which showed the US economy grew at a +2% annualized rate in the first quarter, up from the previous estimate of +1.3%. We also heard from world's four most powerful central bankers on their final policy push to rein in inflation. Powell said this week that he, "wouldn't take…moving at consecutive meetings off the table at all," and noted "the committee clearly believes that there's more work to do, that there are more rate hikes that are likely to be appropriate". This has been sobering to markets, which until recently were defiantly convinced that rate hikes would turn to cuts before the end of the year. Now, we have a little over half of the market expecting rates to be a quarter-point higher at year end and nearly a third expecting them to be a half-point higher, according to the CME FedWatch Tool.

Tuesday brought a wave of buoyant economic releases showing consumer confidence surging past last month’s reading, a big pick up in goods orders, and continued evidence of a rebounding housing market. Consumer confidence surprised at 109.7 for the month of June, up from 104 survey and 102.3 in the prior month. Durable goods orders also jumped, up +1.7% in May vs. -0.9% survey, marking the third straight month of increases. The FHFA House Price Index showed home prices rose in April, up +0.7% MoM and the S&P Case-Shiller Index also showed prices up +0.5% MoM in April, and now just 2.4% below their June 2022 peak.

Next week, will be a short one with fourth of July falling on Tuesday and markets likely to be quiet on the Monday ahead of the holiday. But we’ll have to snap back quickly from holiday mode as next week is also employment week. The ADP And JOLTs numbers are due out on Thursday and Nonfarm Payrolls come out Friday morning. Happy fourth to all! May your fireworks be bright, your drinks cold, and your heat dome receding!

The Baker Group is one of the nation’s largest independently owned securities firms specializing in investment portfolio management for community financial institutions.

Since 1979, we’ve helped our clients improve decision-making, manage interest rate risk, and maximize investment portfolio performance. Our proven approach of total resource integration utilizes software and products developed by Baker’s Software Solutions* combined with the firm’s investment experience and advice.

Author

Andrea F. Pringle

Financial Strategist/MBS Analyst

The Baker Group LP

800.937.2257

*The Baker Group LP is the sole authorized distributor for the products and services developed and provided by The Baker Group Software Solutions, Inc.

INTENDED FOR USE BY INSTITUTIONAL INVESTORS ONLY. Any data provided herein is for informational purposes only and is intended solely for the private use of the reader. Although information contained herein is believed to be from reliable sources, The Baker Group LP does not guarantee its completeness or accuracy. Opinions constitute our judgment and are subject to change without notice. The instruments and strategies discussed here may fluctuate in price or value and may not be suitable for all investors; any doubt should be discussed with a Baker representative. Past performance is not indicative of future results. Changes in rates may have an adverse effect on the value of investments. This material is not intended as an offer or solicitation for the purchase or sale of any financial instruments.