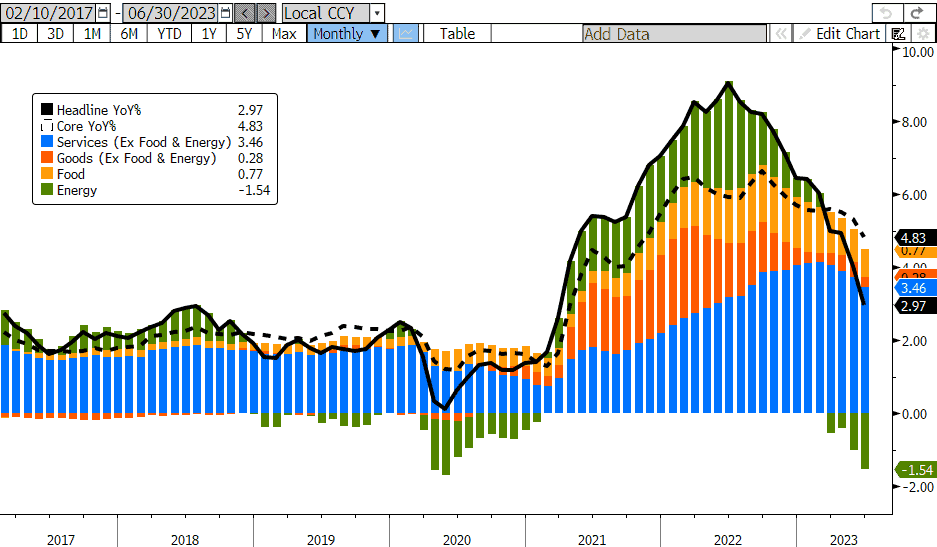

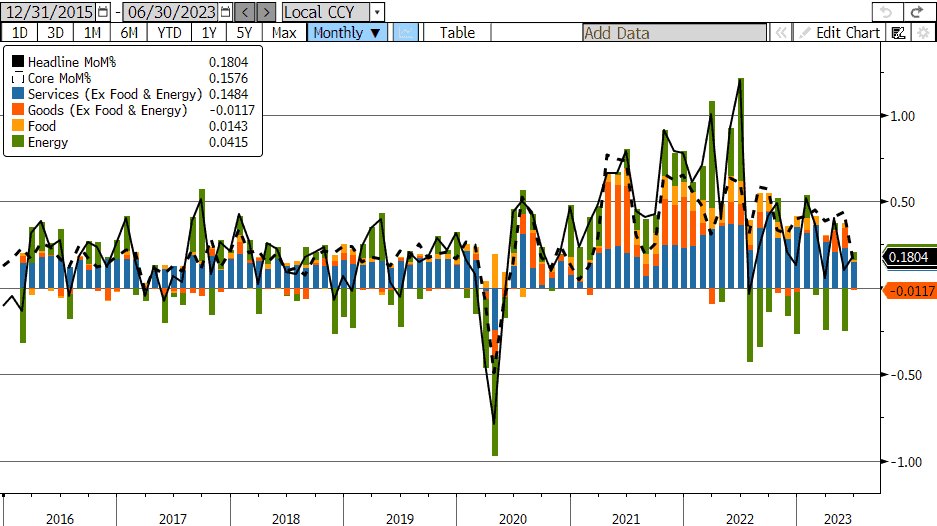

On the heels of last week’s strong-jobs-numbers-induced selloff, rates markets were looking for some evidence of disinflation this week to counter the strength of the labor market…and they got it. The US inflation rate, as measured by the Consumer Price Index (CPI), fell to a more than two-year low in June. At +3.0% (vs. +3.1% consensus), CPI is now less than a third of the four decade high it hit this time last year (+9.1%).

The details of the report were also better than expected with several key measures of underlying inflation coming in below forecasts. Core CPI, which excludes food and energy, rose just +4.8% from a year ago vs. estimates of +5.0%. Super Core CPI, which is services less housing, is of particular interest to the Fed and it fell to +4.0%, the lowest level since December 2021. The owners’ equivalent rent component, which has been stubbornly high, also showed the smallest increase since the end of 2021, suggesting the housing slowdown is finally beginning to feed into inflation.

The one downside of the June reading is it is the last month that will benefit from the “base effect”. By definition, year-on-year change in CPI depends on the value of the CPI 12 months earlier. June 2022 was the peak in inflation so starting next month, the YoY comparison will begin to include lower rates of inflation.

Thursday’s Producer Price Index (PPI) brought us another better-than-expected inflation report. PPI final demand rose just +0.1% YoY vs. estimates of +0.4%, the smallest annual increase since August 2020 and very close to deflation territory. PPI is a family of indexes that measures the average change in selling prices received by producers of goods and services so it tends to be a good leading indicator for the trajectory of consumer prices.

Fueled by signs of ebbing inflation, rates sharply recoiled over the course of the week. The two- and 10-year Treasury yields fell back well below their 5% and 4% thresholds. As of this morning, the 2-year UST was down 23bps to 4.7% and the 10-year UST was down 27bps to 3.8%. No one can claim with certainty that the inflation fight is all behind us but markets clearly believe that policy tightening is in its last lap. The Fed is widely expected to rachet rates up another 25bps later this month and futures are 96% confident in that outcome. However, the prevailing sense in futures markets now is that that a July 26th hike to 5.5% could be the last in a while. CME’s FedWatch tool is showing less than a quarter of a percent chance that we end the year above there.

Next week will be a test of resolve to see if markets can maintain their optimism and the data can support it. Focus will be on Retail Sales and a slew of housing related releases as well as any comments from Fed speakers who are largely staying on message about two more rate hikes coming, despite what markets think.

The Baker Group is one of the nation’s largest independently owned securities firms specializing in investment portfolio management for community financial institutions.

Since 1979, we’ve helped our clients improve decision-making, manage interest rate risk, and maximize investment portfolio performance. Our proven approach of total resource integration utilizes software and products developed by Baker’s Software Solutions* combined with the firm’s investment experience and advice.

Author

Andrea F. Pringle

Financial Strategist/MBS Analyst

The Baker Group LP

800.937.2257

*The Baker Group LP is the sole authorized distributor for the products and services developed and provided by The Baker Group Software Solutions, Inc.

INTENDED FOR USE BY INSTITUTIONAL INVESTORS ONLY. Any data provided herein is for informational purposes only and is intended solely for the private use of the reader. Although information contained herein is believed to be from reliable sources, The Baker Group LP does not guarantee its completeness or accuracy. Opinions constitute our judgment and are subject to change without notice. The instruments and strategies discussed here may fluctuate in price or value and may not be suitable for all investors; any doubt should be discussed with a Baker representative. Past performance is not indicative of future results. Changes in rates may have an adverse effect on the value of investments. This material is not intended as an offer or solicitation for the purchase or sale of any financial instruments.