The weather has not been the only thing to heat up this week. After last week’s inflation data showed inflation pressures easing, markets are now assigning a 99.8% probability of a 25bp rake hike when the Fed meets next week, according to CME’s FedWatch Tool. They are also assigning a 64% probability that July’s hike will be the last and a 98% probability that rates will be cut by next year.

The week started off with a positive surprise on U.S. economic sentiment with the New York Fed's manufacturing index comfortably beating estimates for July as reported prices paid fell and new orders picked up. The index dropped to 1.1 over the month but remained positive which indicates growth. Expectations were for the index to fall into negative territory at -3.5.

On Tuesday, June’s retail rales increased less than expected, coming in at +0.2% month-over-month (MoM) vs. +0.5% consensus. Retail spending showed clear signs of deceleration as the second quarter slowed to a standstill on an annualized basis and sales have now declined in three of the past four quarters. However, control-group sales, which exclude vehicles, gas, food services, and building materials, and also feed into GDP, rose a much stronger +0.6% MoM. Still, on a quarterly basis that represents a drop to +2.1% in the second quarter from +5.1% in Q1.

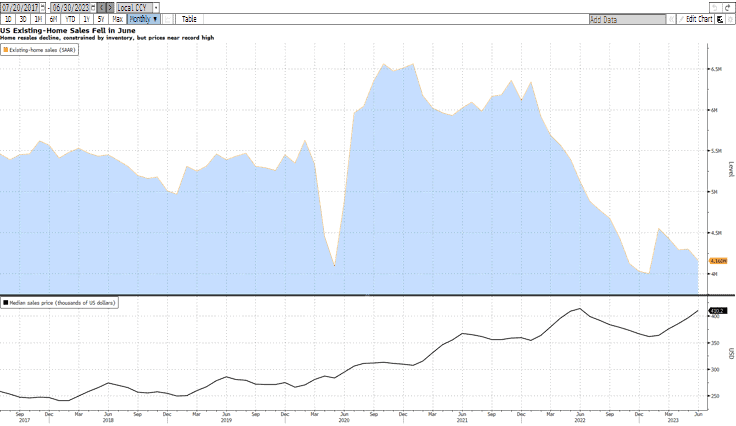

On the housing front, housing starts fell in June after surging just a month earlier. The pace is still above the pre-pandemic trend and reflects builders working to fill the void created by the limited inventory of existing homes for sale. Building permits also underwhelmed forecasts but remained near pre-pandemic levels as well. Existing home sales retreated in June, falling to a five-month low, as limited inventory continues to restrain sales and keep prices near record highs. Sales declined -3.3% to a 4.16M annualized pace. The number of homes for sale held at 1.08M, which is the lowest June inventory on record.

June’s industrial production report, also showed continued weakness, reflecting a -0.5% decline for the second month in a row, as did the Conference Board’s index of leading economic indicators which also came in light at -0.7% MoM. This marks the fifteenth month in a row of decline for LEI, which is widely viewed as a recessionary signal. However, an unexpectedly tight weekly reading of the number of initial jobless claims on Thursday showed lingering resilience in the labor market.

Next week will be all about inflation again as the FOMC will announce its rate decision and we will get the Personal Consumption Expenditures (PCE) report, which is the Fed’s preferred measure of inflation.

The Baker Group is one of the nation’s largest independently owned securities firms specializing in investment portfolio management for community financial institutions.

Since 1979, we’ve helped our clients improve decision-making, manage interest rate risk, and maximize investment portfolio performance. Our proven approach of total resource integration utilizes software and products developed by Baker’s Software Solutions* combined with the firm’s investment experience and advice.

Author

Andrea F. Pringle

Financial Strategist/MBS Analyst

The Baker Group LP

800.937.2257

*The Baker Group LP is the sole authorized distributor for the products and services developed and provided by The Baker Group Software Solutions, Inc.

INTENDED FOR USE BY INSTITUTIONAL INVESTORS ONLY. Any data provided herein is for informational purposes only and is intended solely for the private use of the reader. Although information contained herein is believed to be from reliable sources, The Baker Group LP does not guarantee its completeness or accuracy. Opinions constitute our judgment and are subject to change without notice. The instruments and strategies discussed here may fluctuate in price or value and may not be suitable for all investors; any doubt should be discussed with a Baker representative. Past performance is not indicative of future results. Changes in rates may have an adverse effect on the value of investments. This material is not intended as an offer or solicitation for the purchase or sale of any financial instruments.