While the top news headline of the week likely belongs to Donald Trump’s latest indictment (despite it being his fourth one this year), there was plenty of notable economic news as well. Tuesday’s Retail Sales numbers started the week off with a bang. Sales surprised to the upside, rising 0.7% in July vs. 0.4% consensus. Control-group sales, which exclude vehicles, gas, food services, and building materials, and also feeds into GDP, rose an even stronger 1.0% vs. 0.5% consensus. The report highlighted how a strong labor market and strong wages can continue to fuel spending despite higher borrowing costs.

Stock and bond markets seemed to shift back into a “good news is bad news” mindset where stronger economic data, particularly labor and consumer data, spooks markets. The implication is that good economic news gives the Fed more ammunition to hold to the “higher for longer” mantra they have been trying to sell to markets.

Investors are clearly concerned the Fed will keep rates elevated longer than necessary to ensure inflation does not reverse its decline and Wednesday’s release of the July FOMC minutes did little to assuage their fears. The minutes indicated the FOMC may not be finished raising interest rates as, “Most participants continued to see significant upside risks to inflation, which could require further tightening of monetary policy.” There was no definitive guidance on the next rate decision in September, but the Committee notably scrapped their forecasts of a “mild recession” next year. However, the minutes did reveal that the quarter point rate hike in July was not unanimous among the broader panel of 18 officials as two favored leaving rates unchanged.

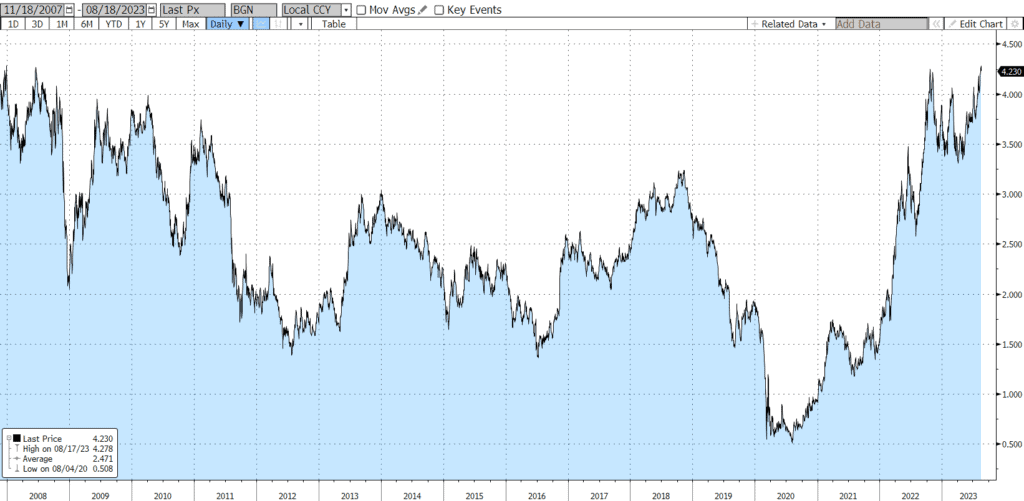

Bond yields pushed higher on Tuesday following the Retail Sales report and rose further following the FOMC minutes on Wednesday. By Thursday morning, the 10yr US Treasury rate had hit the highest level since 2007. As of this writing, bond yields have retreated from Thursdays highs and the 10yr is back below 2007 levels. Investors seem to be drawn back into the market on the notion that booking some bonds at 15+yr highs in yields is prudent and timing the top is impossible.

This week’s housing data provided far less excitement, though Housing Starts were stronger than expected. Starts increased 3.9% in July to a 1.45 million annualized rate, which was well above the median consensus estimate of 1.1%. However, the upside surprise was really due to a downward revision of the June data, which took most of the luster out of the report. Building permits, a leading indicator of housing demand, were up only 0.1% in July to an annualized pace of 1.44 million units, much weaker than the consensus estimate of 1.5%.

Next week, all eyes will turn to the annual Jackson Hole Symposium where we will undoubtedly get more from Fed Chair Jerome Powell as he’ll have another opportunity to reinforce much of the central bank’s core messaging about higher for longer rates and upside risks to inflation. We will also get more data on the housing front with both new and existing home sales reports.

The Baker Group is one of the nation’s largest independently owned securities firms specializing in investment portfolio management for community financial institutions.

Since 1979, we’ve helped our clients improve decision-making, manage interest rate risk, and maximize investment portfolio performance. Our proven approach of total resource integration utilizes software and products developed by Baker’s Software Solutions* combined with the firm’s investment experience and advice.

Author

Andrea F. Pringle

Financial Strategist/MBS Analyst

The Baker Group LP

800.937.2257

*The Baker Group LP is the sole authorized distributor for the products and services developed and provided by The Baker Group Software Solutions, Inc.

INTENDED FOR USE BY INSTITUTIONAL INVESTORS ONLY. Any data provided herein is for informational purposes only and is intended solely for the private use of the reader. Although information contained herein is believed to be from reliable sources, The Baker Group LP does not guarantee its completeness or accuracy. Opinions constitute our judgment and are subject to change without notice. The instruments and strategies discussed here may fluctuate in price or value and may not be suitable for all investors; any doubt should be discussed with a Baker representative. Past performance is not indicative of future results. Changes in rates may have an adverse effect on the value of investments. This material is not intended as an offer or solicitation for the purchase or sale of any financial instruments.