What a difference a week makes. Following Fed Chairman Jerome Powel’s speech in Jackson Hole last Friday, the 2-Year Treasury hit 5.08%, the highest level in 16 years, as traders bet the Fed would hike rates again in November and keep them there for longer than previously anticipated. One week later, following a slew of weak employment data and the 2-Year Treasury yield has fallen 22bp and traders are now betting the Fed is finished with the most aggressive tightening cycle in nearly forty years.

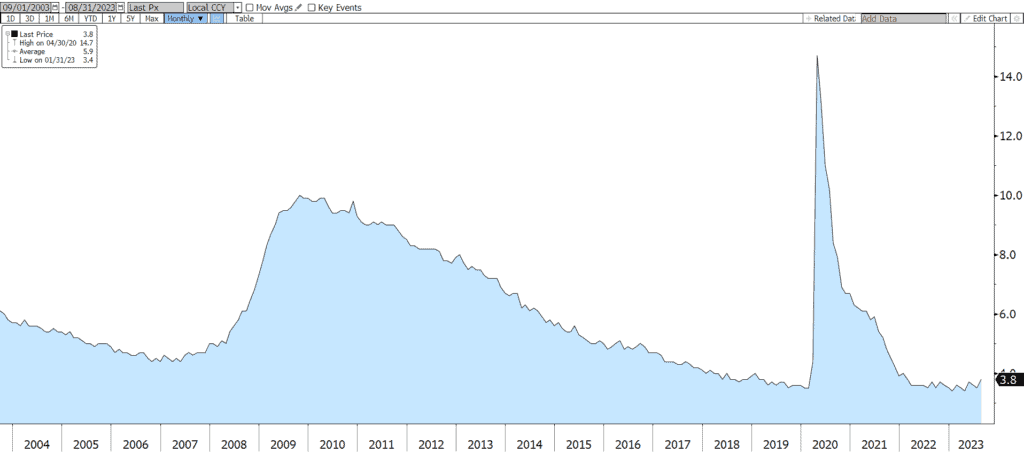

This week’s economic releases were all about the labor market and more specifically, the weakening labor market. On Tuesday, the BLS’s Job Openings and Labor Market Turnover Survey (JOLTS) showed job openings plunged by 338,000 to the lowest level since March 2021 and the number of people voluntarily quitting their job fell by 253,000. The report suggests there are less job opportunities available and employees are less confident in their ability to land another job and are more often deciding to stay put. On Wednesday, ADP reported that private payrolls increased by 177,000 in August, less than economists had expected and a big drop from the 371,000 added the prior month. And finally on Friday, the Labor Department reported that non-farm payrolls rose just 187,000 in August and the prior two months were revised lower by 110,000 jobs. This marks the third month in a row payrolls have increased less than 200k and shows the pace of job gains has clearly slowed from the torrid pace of the last several years. The Unemployment Rate also unexpectedly jumped to 3.8%, the highest level in 18 months, as more people reentered the labor force. The Labor Force Participation Rate jumped to 62.8% in August and is now just 0.5% lower than the pre-pandemic peak of 63.3%. All of this is good news for the Fed. There are more people looking for jobs just as there are fewer jobs available and that has helped to limit wage inflation, which rose just 0.2% in August, the smallest monthly increase in 18 months.

After digesting all the employment data released this week, traders are now betting the Federal Reserve will not hike rates again. The probability of a rate hike is just 7% in September and less than 40% in November. For the week, the 2-Year Treasury yield fell 20bp to 4.88% and the 10-Year Treasury fell 5bp to 4.19%.

Unemployment Rate Last 20 Years

The Baker Group is one of the nation’s largest independently owned securities firms specializing in investment portfolio management for community financial institutions.

Since 1979, we’ve helped our clients improve decision-making, manage interest rate risk, and maximize investment portfolio performance. Our proven approach of total resource integration utilizes software and products developed by Baker’s Software Solutions* combined with the firm’s investment experience and advice.

Author

Ryan W. Hayhurst

President

The Baker Group LP

800.937.2257

*The Baker Group LP is the sole authorized distributor for the products and services developed and provided by The Baker Group Software Solutions, Inc.

INTENDED FOR USE BY INSTITUTIONAL INVESTORS ONLY. Any data provided herein is for informational purposes only and is intended solely for the private use of the reader. Although information contained herein is believed to be from reliable sources, The Baker Group LP does not guarantee its completeness or accuracy. Opinions constitute our judgment and are subject to change without notice. The instruments and strategies discussed here may fluctuate in price or value and may not be suitable for all investors; any doubt should be discussed with a Baker representative. Past performance is not indicative of future results. Changes in rates may have an adverse effect on the value of investments. This material is not intended as an offer or solicitation for the purchase or sale of any financial instruments.