Happy Friday Everyone! I hope everyone is finally enjoying some cooler weather and some good football games. This week brought us some key inflation releases ahead of the Federal Reserve’s Two-Day Meeting that concludes next Wednesday. Was this week’s inflation data strong enough to push the Fed to raise rates for the 12th time since March of last year? Or did this week’s inflation data give the Fed enough comfort to consider another pause in their current tightening cycle? Let’s look at this week’s key economic releases.

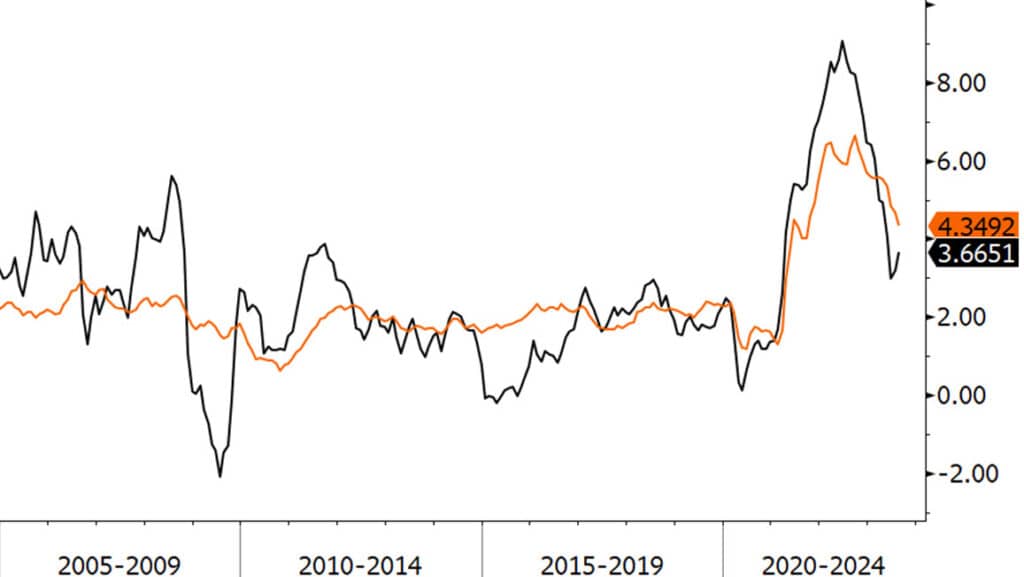

On Wednesday, a report from the Bureau of Labor Statistics showed that core consumer prices rose more than expected in August. The Consumer Price Index (CPI) rose 0.6% in August (est = 0.6%) and 3.7% from a year ago (est = 3.6%, last = 3.2%). The August increase was the largest monthly increase since June 2022, driven largely by a big jump in energy prices with gasoline up 10.6% month over month. Excluding food and energy prices, Core CPI rose 0.3% for the month (est = 0.2%) and 4.3% from a year ago (est = 4.3%, last 4.7%). The closely watched shelter component of CPI rose just 0.3% in August, the smallest increase in housing costs since March 2021. The rapid runup in rents following the pandemic has clearly peaked and many analysts expect rents to decline in the future as the record number of rental units under construction floods the market with supply. The so-called Super Core (core services less housing) rose 4% from a year ago, near the lowest reading since December 2021 and a clear indication that the trend in underlying inflation remains lower despite the monthly jump in energy prices.

On Thursday, U.S. retail sales data released increased more than expected in August as a surge in gasoline prices boosted receipts at gas stations, but the trend in underlying spending on goods slowed as Americans dealt with higher inflation and borrowing costs. Retail sales increased 0.6% month over month (est = 0.1%) in August and spending at gas stations advanced 5.2% last month. Spiking oil prices due to OPEC+ product cuts, strong demand, and disruption from floods in Libya have pushed up prices at the pump. Excluding sales at gasoline stations, retail spending advanced a more modest 0.2% in August from July. After a summer of robust spending, can the consumer continue their strong spending given some of the challenges ahead with rising credit card levels, student loan payments restarting, and tougher lending standards? Time will tell!

Additionally on Thursday, the Producer Price Index (PPI), a measure of what producers get for their goods and services, increased 0.7% in August, higher than the 0.4% estimate and the biggest monthly gain since June 2022. Excluding food and energy, core PPI rose 0.2%, in line with expectations. As with CPI, the upward pressure on PPI came largely from a big jump in energy prices.

Stocks are down early this morning with the Dow Jones Industrial Average down 172 point early in today’s trading session. Bonds are selling off modestly this morning with the longer end of the curve seeing the most price change. This morning, the 10-year Treasury is at a 4.31% yield with the 2-year Treasury at a 5.02% yield.

Next week will bring us economic releases on building permits, houses starts, and existing home sales. However, all eyes are on next week’s September Fed meeting and whether they will raise rates for the 12th time this cycle. This morning, the CMEGroup’s Fed Watch tool shows a 97% chance the Fed will not raise rates next week and only a 31% chance for a 25bp rate hike at the November 1st meeting.

Headline and Core Consumer Price Index - Year over Year Change (2005 to Current)

The Baker Group is one of the nation’s largest independently owned securities firms specializing in investment portfolio management for community financial institutions.

Since 1979, we’ve helped our clients improve decision-making, manage interest rate risk, and maximize investment portfolio performance. Our proven approach of total resource integration utilizes software and products developed by Baker’s Software Solutions* combined with the firm’s investment experience and advice.

Author

Dale Sheller

Managing Director

Director of Financial Strategies Group

The Baker Group LP

800.937.2257

*The Baker Group LP is the sole authorized distributor for the products and services developed and provided by The Baker Group Software Solutions, Inc.

INTENDED FOR USE BY INSTITUTIONAL INVESTORS ONLY. Any data provided herein is for informational purposes only and is intended solely for the private use of the reader. Although information contained herein is believed to be from reliable sources, The Baker Group LP does not guarantee its completeness or accuracy. Opinions constitute our judgment and are subject to change without notice. The instruments and strategies discussed here may fluctuate in price or value and may not be suitable for all investors; any doubt should be discussed with a Baker representative. Past performance is not indicative of future results. Changes in rates may have an adverse effect on the value of investments. This material is not intended as an offer or solicitation for the purchase or sale of any financial instruments.