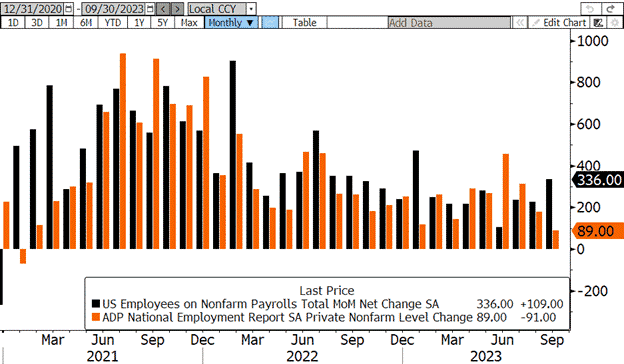

It may not be a true “October Surprise” but this morning’s September jobs report was quite the shocker. Job gains came in nearly twice the estimate as the US economy added a whopping 336k jobs in September (vs. 170k forecast). The strong headline number and upward revisions to prior months suggest the labor market may not be weakening in the orderly fashion many expected. However, there was also some weakness in the underlying data. Most importantly for the inflation fight, wage growth underwhelmed estimates. Average Hourly Earnings rose just 0.2% (vs. 0.3% forecast) and 4.2% year-over-year (vs. 4.3% forecast).

Additionally, the household survey failed to confirm the headline number, coming in soft at +86k. The non-farm payrolls survey and the household survey are both conducted by the Bureau of Labor Statistics (BLS) but they measure employment using different methodologies. Non-farm payrolls is much larger and it surveys businesses while the household survey surveys private households and tends to be more susceptible to sampling error and volatility. However, despite these differences, the divergence between the two for the same sampling period is quite striking. The BLS also reported that the Unemployment Rate held steady at 3.8% despite the increase in jobs and the Labor Force Participation Rate also held at 62.8%.

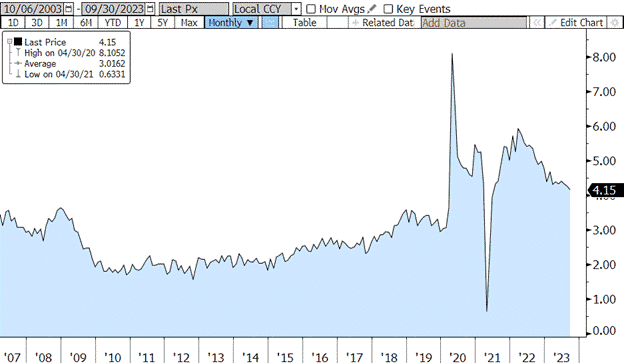

Bond yields initially surged on the news but had given back much of the increase at the time of this writing. Interestingly, and somewhat surprisingly, the impressive jobs report has not been enough to persuade traders that the Fed will implement another rate hike this year. Fed Funds Futures still show a less than 50% probability there will be any more rate hikes in 2023 and a less than 30% chance of one at the November meeting.

Earlier in the week, private payroll processing firm ADP reported that US companies added just 89k jobs in September, far fewer than the 150k forecast and the smallest growth since January 2021. This is obviously in stark contrast to the non-farm payrolls report we got this morning and further muddies the waters as to where the labor market actually stands. Also unlike this morning’s NFP report, the ADP job gains were not widespread. The largest gains came in small businesses and leisure & hospitality (+92k) while large companies and professional & business services saw 32k of job losses.

As the markets continue to digest the report and try to ascertain the true state of the labor market, there is much to look ahead to next week for direction. Not only will we get the release of the minutes from the latest FOMC meeting, but there are several Fed speakers on the docket as well. We will also get the all-important CPI readings which will give us the first insight into how inflation fared in September. Hope everyone has a great week!

The Baker Group is one of the nation’s largest independently owned securities firms specializing in investment portfolio management for community financial institutions.

Since 1979, we’ve helped our clients improve decision-making, manage interest rate risk, and maximize investment portfolio performance. Our proven approach of total resource integration utilizes software and products developed by Baker’s Software Solutions* combined with the firm’s investment experience and advice.

Author

Andrea F. Pringle

Financial Strategist/MBS Analyst

The Baker Group LP

800.937.2257

*The Baker Group LP is the sole authorized distributor for the products and services developed and provided by The Baker Group Software Solutions, Inc.

INTENDED FOR USE BY INSTITUTIONAL INVESTORS ONLY. Any data provided herein is for informational purposes only and is intended solely for the private use of the reader. Although information contained herein is believed to be from reliable sources, The Baker Group LP does not guarantee its completeness or accuracy. Opinions constitute our judgment and are subject to change without notice. The instruments and strategies discussed here may fluctuate in price or value and may not be suitable for all investors; any doubt should be discussed with a Baker representative. Past performance is not indicative of future results. Changes in rates may have an adverse effect on the value of investments. This material is not intended as an offer or solicitation for the purchase or sale of any financial instruments.