There’s nothing like a Friday the thirteenth in the month of October to bring strange vibes. And after an incredibly tense week, markets have reason to feel on edge. The bond market has been hit with volatility all week, weathering competing crosswinds from upside data surprises and flight to quality bids as investors weigh the potential geopolitical and economic impacts of the Israel-Hamas war.

Bond yields, especially the long end of the curve, have been moving higher recently but retraced sharply to start the week amid concerns over the situation in the Middle East. For most individuals, the chief concern is the horrendous humanitarian impact but for markets, the concern is energy prices. The potential for oil sanctions and higher energy prices would undoubtedly complicate the path to lower inflation.

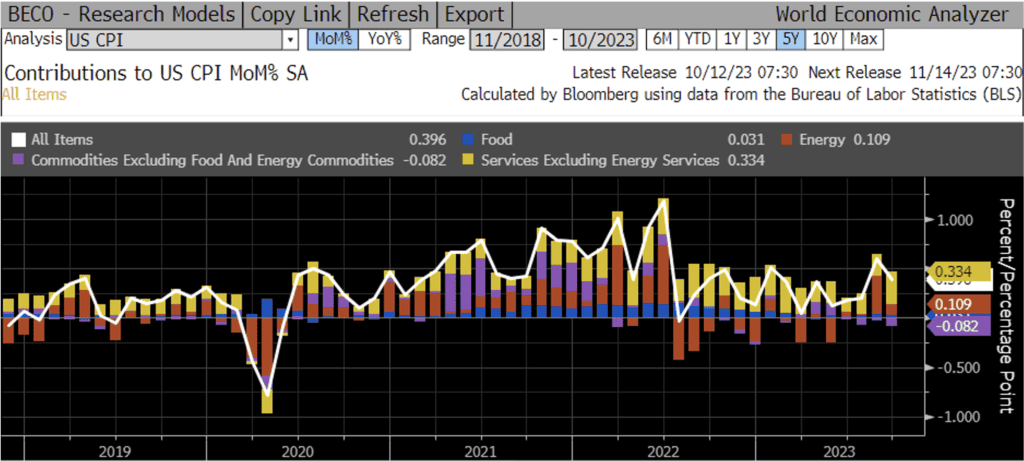

The 10yr Treasury yield opened after the holiday weekend almost a quarter point below the peak set last Friday after the blowout September jobs report and traded lower from there. However, another upside surprise in US economic data brought on another selloff and reversed some of the move down. Thursday’s Consumer Price Index (CPI) report showed that headline inflation rose more than expected in September due to a surge in rental costs and gasoline. CPI rose 0.4% (vs. 0.3% estimate) in September and 3.7% from a year ago (vs. 3.6% estimate). However, Core CPI, which the Fed has said they believe is a better indicator of the overall trend in consumer inflation, was in line with estimates at 0.3% MoM and 4.1% YoY. September’s Producer Price Index (PPI) also rose more than forecast led by higher energy costs. PPI rose 0.5% (vs. 0.3% expected) MoM and 2.2% YoY (vs. 1.6% expected). Cost pressures had been trending down, but now higher energy costs are risking a reversal of the trend.

We also got minutes from the last FOMC meeting in September, which seem less relevant than usual this week given how much the world has changed since they met. However, more current comments from Fed officials suggest that the recent surge in treasury yields may lessen the need for further rate hikes as the market is doing the tightening work for them on its own. That is certainly what the market believes. Despite the CPI and PPI data this week showing higher than expected inflation, Fed Funds futures markets are betting a more than 90% probability the Fed will not hike rates in November and a nearly 70% probability they will not hike in December either.

After all the volatility, we end the week with rates down, especially the long end of the curve. At the time of this writing, the 2yr UST is down 3bps to 5.05%, the 5yr is down 11bps to 4.64%, the 10yr is down 17bps to 4.63%, and the 30yr is down 18bps to 4.79%. Next week, we will get retail sales and housing data which are expected to show continued slowing in those sectors.

The Baker Group is one of the nation’s largest independently owned securities firms specializing in investment portfolio management for community financial institutions.

Since 1979, we’ve helped our clients improve decision-making, manage interest rate risk, and maximize investment portfolio performance. Our proven approach of total resource integration utilizes software and products developed by Baker’s Software Solutions* combined with the firm’s investment experience and advice.

Author

Andrea F. Pringle

Financial Strategist/MBS Analyst

The Baker Group LP

800.937.2257

*The Baker Group LP is the sole authorized distributor for the products and services developed and provided by The Baker Group Software Solutions, Inc.

INTENDED FOR USE BY INSTITUTIONAL INVESTORS ONLY. Any data provided herein is for informational purposes only and is intended solely for the private use of the reader. Although information contained herein is believed to be from reliable sources, The Baker Group LP does not guarantee its completeness or accuracy. Opinions constitute our judgment and are subject to change without notice. The instruments and strategies discussed here may fluctuate in price or value and may not be suitable for all investors; any doubt should be discussed with a Baker representative. Past performance is not indicative of future results. Changes in rates may have an adverse effect on the value of investments. This material is not intended as an offer or solicitation for the purchase or sale of any financial instruments.