Bond yields plunged this week as new signs of economic slowdown gave investors conviction that rate hikes are over and rate cuts will begin next year. That, along with news that the U.S. will avoid a long-feared government shutdown at least until next year and a continued decline in oil prices this week also contributed to the rally.

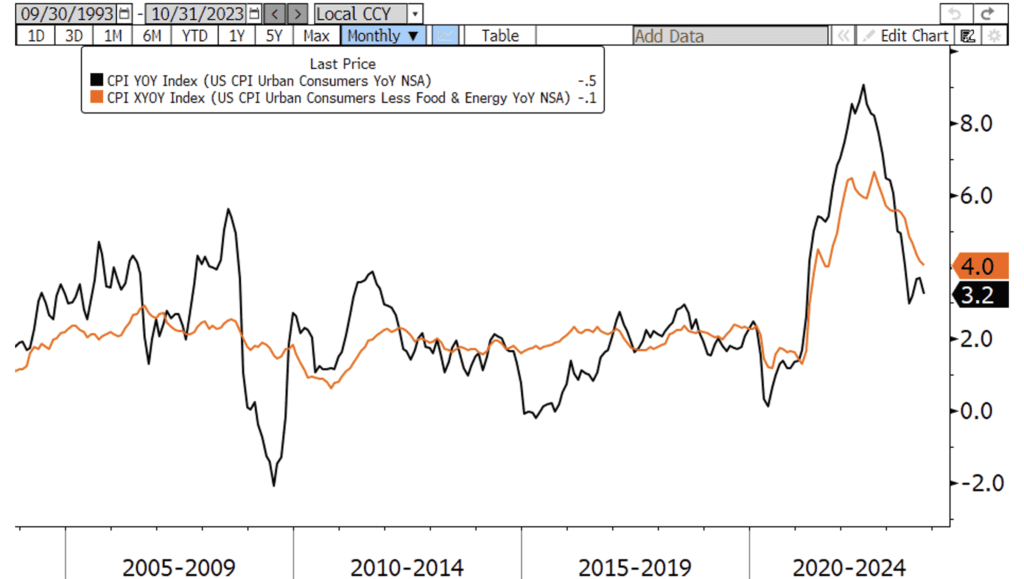

Tuesday’s Consumer Price Index (CPI) report delivered a much cooler than expected inflation picture. Forecasts were for headline CPI to rise 0.1% in October but instead the price of the basket of goods and services measured held steady at 3.2% YoY vs. 3.3% consensus and down from 3.7% last month. Core CPI, which excludes volatile food and energy prices, rose 0.2% (vs. 0.3% consensus) MoM to 4.0% YoY (vs. 4.1% consensus). The biggest declines were in energy prices and used cars. However, the Core Services measure, which captures the integral shelter component of inflation, also showed cooling, posting the smallest increase since summer 2022.

Wednesday’s data showed more evidence that the economy and inflation are moderating as wholesale prices fell more than expected and retail sales fell for the first time since March. The Producer Price Index (PPI), which is a leading indicator of inflation as it captures price changes affecting producers that will ultimately affect prices passed on to consumers, unexpectedly fell 0.5% in October vs. consensus estimates of +0.1%. That brought the YoY PPI change to 1.3% (vs. estimates of 1.9%), the biggest decline in three and a half years. Excluding food and energy, Core PPI was unchanged MoM vs. estimates of +0.3%, and was up 2.4% from a year ago vs. estimates of 2.7%.

Retail Sales fell 0.1% in the month of October, shy of the 0.3% decline expected, but the first monthly decline since the spring. The data validates what has been predicted by many economists, that the summer spending spree for the U.S. consumer is now over and the resiliency of the consumer is now questionable. Retail sales are also not inflation adjusted, which implies that “real” sales for the month of October are actually flat. In other words, the 0.1% increase can likely be attributed to increased prices rather than increased consumption.

A surprise jump in initial jobless claims this week, combined with the persistent rise in continuing claims, also showed further softening in the labor market that may ultimately lead the unemployment rate higher. Initial claims popped 13k this week to 231k vs. consensus estimates of 220k, marking the highest level in almost two years and an eighth straight week of increases.

The week’s data led futures markets to remove virtually all bets on another Fed rate hike this cycle. Markets have almost full certainty the next move from the Fed will be a cut rather than a hike, with the highest probabilities showing the first cut in May 2024. We end the week with Treasury yields down sharply. The 2-year is currently down ~16bps from last Friday’s close to 4.90%. The 5-year is down ~22bps to 4.46%. The 10-year is down ~19bps to 4.46%, and the 30-year is down ~15bps to 4.61%.

With the holiday next week, markets could be jumpy with lots of traders out and liquidity lighter than usual. There is still notable data coming out and we will get the minutes from the FOMC’s last meeting that took place the first of this month. Happy Early Thanksgiving to all!

The Baker Group is one of the nation’s largest independently owned securities firms specializing in investment portfolio management for community financial institutions.

Since 1979, we’ve helped our clients improve decision-making, manage interest rate risk, and maximize investment portfolio performance. Our proven approach of total resource integration utilizes software and products developed by Baker’s Software Solutions* combined with the firm’s investment experience and advice.

Author

Andrea F. Pringle

Financial Strategist/MBS Analyst

The Baker Group LP

800.937.2257

*The Baker Group LP is the sole authorized distributor for the products and services developed and provided by The Baker Group Software Solutions, Inc.

INTENDED FOR USE BY INSTITUTIONAL INVESTORS ONLY. Any data provided herein is for informational purposes only and is intended solely for the private use of the reader. Although information contained herein is believed to be from reliable sources, The Baker Group LP does not guarantee its completeness or accuracy. Opinions constitute our judgment and are subject to change without notice. The instruments and strategies discussed here may fluctuate in price or value and may not be suitable for all investors; any doubt should be discussed with a Baker representative. Past performance is not indicative of future results. Changes in rates may have an adverse effect on the value of investments. This material is not intended as an offer or solicitation for the purchase or sale of any financial instruments.