The holiday week was short but not without news. An impressive 20-year Treasury auction on Monday kicked off the week with vigor. Decent demand for the $16 billion auction of often-ignored 20-year bonds dragged long-term yields down yet again. The 20-year yield fell almost 10bps on the day to the lowest level since September 22nd. Benchmark 10-year year yields also nudged lower in solidarity.

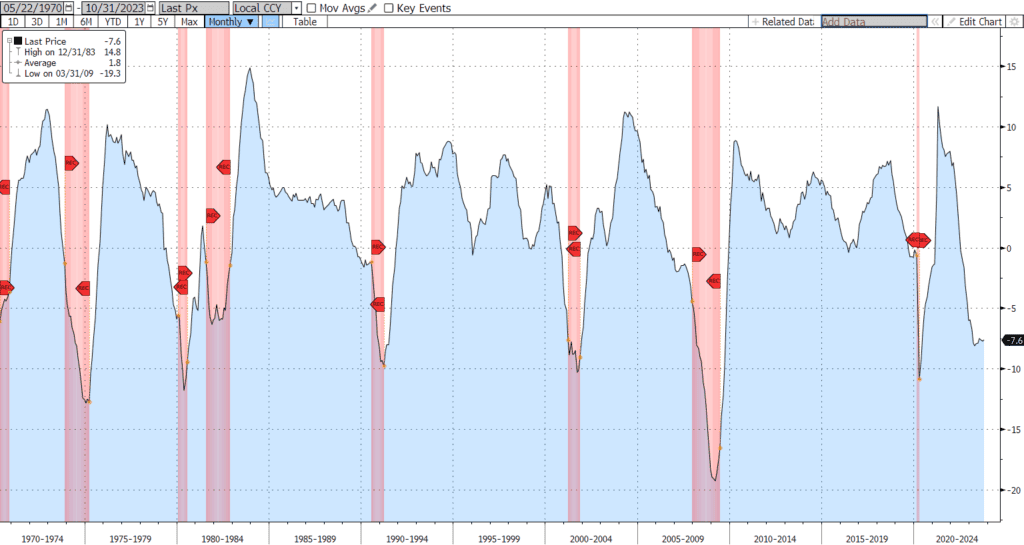

Monday also brought the reading of October’s Leading Economic Indicators (LEI), which is a group of economic variables that typically portend the direction of the U.S. economy. The index fell yet again in October by -0.8% MoM (consensus was -0.7%). It also marked the nineteenth consecutive decline in the index. Historically, every time the index has reached the current YoY reading of -7.6% there has been a recession so if the U.S. manages to avoid a recession this round, it will be the first time in history that the LEI has given us a false prediction.

On Tuesday, Existing Home Sales disappointed, coming in at 3.79M vs. 3.90M consensus. The report showed sales of previously owned homes falling by the most in nearly a year for the month of October to a fresh 13-year low. By now we all know the impetus for the sluggishness, elevated mortgage rates keeping existing homeowners from selling and persistently high prices further eroding affordability. However, the National Association of Realtors (NAR) expects inventory to improve as mortgage rates come down. Mortgage rates have fallen for three straight weeks and the NAR expects that to start stirring up buying interest, especially as we head into spring.

Tuesday also brought minutes from the FOMC’s October 31st - November 1st meeting, although the minutes provided little new news for policy watchers to digest. The FOMC reiterated that monetary policy will need to stay “restrictive” until data shows inflation is on a convincing track back to the central bank’s 2% goal. “In discussing the policy outlook, participants continued to judge that it was critical that the stance of monetary policy be kept sufficiently restrictive to return inflation to the Committee’s 2 percent objective over time,” the minutes noted.

Markets opened quietly Friday morning after the Thanksgiving break with many participants still celebrating the holiday. Treasuries are down slightly on the day and yields are up in the neighborhood of a half a basis point at the time of this writing. The yield on the 2-year UST is currently 4.94%. The 5-year yield is 4.50% and the 10-year is currently yielding 4.47%. Futures markets are little changed on the week with the market still convinced that the next move from the FOMC will be a cut rather than another hike, which is expected to hit next summer.

Next week, activity and data will pick up again. New Home Sales numbers will kick off the week on Monday, followed by home price data on Tuesday, mortgage applications on Wednesday, and Pending Home Sales on Thursday to round out the week’s housing data. We will also get key readings on GDP, as well as the Personal Consumption Expenditure (PCE) inflation data and Personal Income and Spending numbers. Hope everyone had a wonderful Thanksgiving and that most of you are still off celebrating rather than at your desks reading this!

The Baker Group is one of the nation’s largest independently owned securities firms specializing in investment portfolio management for community financial institutions.

Since 1979, we’ve helped our clients improve decision-making, manage interest rate risk, and maximize investment portfolio performance. Our proven approach of total resource integration utilizes software and products developed by Baker’s Software Solutions* combined with the firm’s investment experience and advice.

Author

Andrea F. Pringle

Financial Strategist/MBS Analyst

The Baker Group LP

800.937.2257

*The Baker Group LP is the sole authorized distributor for the products and services developed and provided by The Baker Group Software Solutions, Inc.

INTENDED FOR USE BY INSTITUTIONAL INVESTORS ONLY. Any data provided herein is for informational purposes only and is intended solely for the private use of the reader. Although information contained herein is believed to be from reliable sources, The Baker Group LP does not guarantee its completeness or accuracy. Opinions constitute our judgment and are subject to change without notice. The instruments and strategies discussed here may fluctuate in price or value and may not be suitable for all investors; any doubt should be discussed with a Baker representative. Past performance is not indicative of future results. Changes in rates may have an adverse effect on the value of investments. This material is not intended as an offer or solicitation for the purchase or sale of any financial instruments.