Markets are basking in the warm holiday glow of easing Fed policy ahead this morning as fresh data on inflation came in softer than expected. Policymakers have been on the speaking circuit trying to rein in some of the optimism since their meeting last week as Treasury notes and bond yields have fallen dramatically since. Even the dovish Chicago Fed President, Austan Goolsbee, warned that markets were getting “a little ahead of themselves” and promised that inflation progress would dictate the pace of Fed easing. But news this morning that the Personal Consumption Expenditure Price Index (PCE), the Fed’s preferred inflation measure, fell more than forecast in November, gave markets just what they needed to feel cheery heading into the year-end holidays.

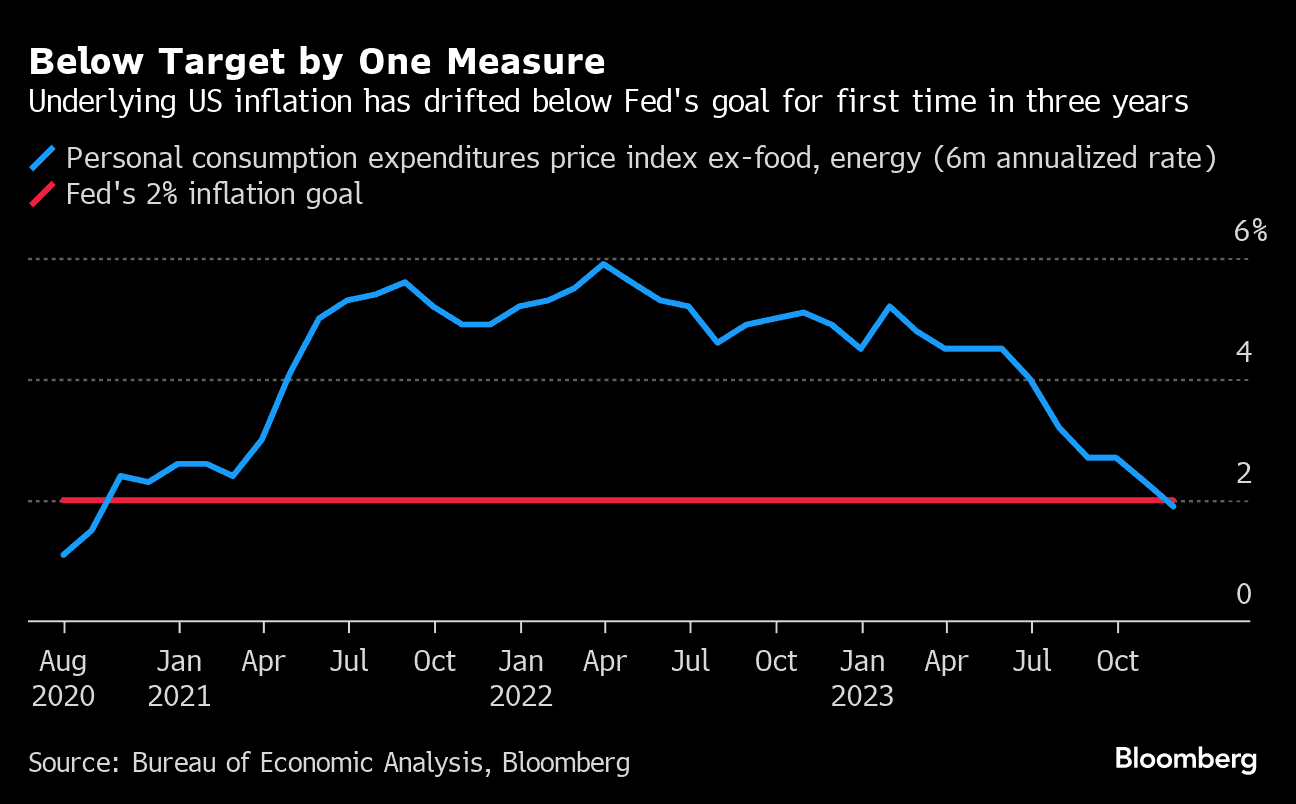

The PCE Deflator fell 0.1% in November vs. expectations of a flat 0.0% change. Year over year, PCE rose just 2.6% vs. estimates of 2.8%, edging closer to the Fed’s 2.0% target. That marks the lowest reading on PCE since February 2021 and a significant decline from its peak at 7.1% in June 2022. Excluding food and energy, Core PCE rose 0.1%, shy of the consensus estimate of 0.2%, and 3.2% from a year ago, shy of the estimate of 3.3%. Interestingly, on a six-month annualized basis, the core metric rose just 1.9%, which marks the first time in more than three years that this measure has come in below the Fed’s 2.0% target.

There is an early market close today and activity is light, but Treasuries have still managed to spawn a little bit of a post-PCE rally. At the time of this writing, yields are down around 1.5-3bps across the curve. The 10-year Treasury yield now sits at 3.87%, the lowest level since July. Fed Funds futures markets are also increasing their rate cut bets for 2024. At the moment, the highest probability in the futures market is for 175bps of cuts next year, twice what last week’s Fed dot plot projected. Futures also appear convinced that the cuts will begin in March. They are predicting 25bps of cuts at the March 20th meeting with 74% probability.

Other important economic data releases this week have been primarily on the housing front. Building Permits came in marginally shy of expectations while Housing Starts jumped 14.8% in November, beating the consensus forecast, which called for a 0.9% decline. Existing Home Sales edged up from a 13-year low to 3.82mm annual pace in November. Sales were up 0.8% from a month earlier, which marked the first respite in two years as higher borrowing costs and low inventory have kept many would-be-buyers on the sidelines. However, New Home Sales unexpectedly fell in November, suggesting the road to recovery for the housing market will be a bumpy one.

Next week will likely be another light one with many out on holiday. However, there is still data to digest. We will get a few more numbers on the housing front, with FHFA and Case-Shiller house price indexes coming out on Tuesday. There is also a spattering of business and manufacturing data due throughout the week. Hope everyone enjoys the long weekend. Happy holidays to all!

The Baker Group is one of the nation’s largest independently owned securities firms specializing in investment portfolio management for community financial institutions.

Since 1979, we’ve helped our clients improve decision-making, manage interest rate risk, and maximize investment portfolio performance. Our proven approach of total resource integration utilizes software and products developed by Baker’s Software Solutions* combined with the firm’s investment experience and advice.

Author

Andrea F. Pringle

Financial Strategist/MBS Analyst

The Baker Group LP

800.937.2257

*The Baker Group LP is the sole authorized distributor for the products and services developed and provided by The Baker Group Software Solutions, Inc.

INTENDED FOR USE BY INSTITUTIONAL INVESTORS ONLY. Any data provided herein is for informational purposes only and is intended solely for the private use of the reader. Although information contained herein is believed to be from reliable sources, The Baker Group LP does not guarantee its completeness or accuracy. Opinions constitute our judgment and are subject to change without notice. The instruments and strategies discussed here may fluctuate in price or value and may not be suitable for all investors; any doubt should be discussed with a Baker representative. Past performance is not indicative of future results. Changes in rates may have an adverse effect on the value of investments. This material is not intended as an offer or solicitation for the purchase or sale of any financial instruments.