The days can be long, but the years seem to fly by! As we wind down another year and continue to draft our 2024 New Years Resolutions, this week has been a rather quiet week in the markets and economic data releases. The 10-Year Treasury has sold off a little this morning and is seeing a yield of 3.88%. Let’s have a quick look at our week in review.

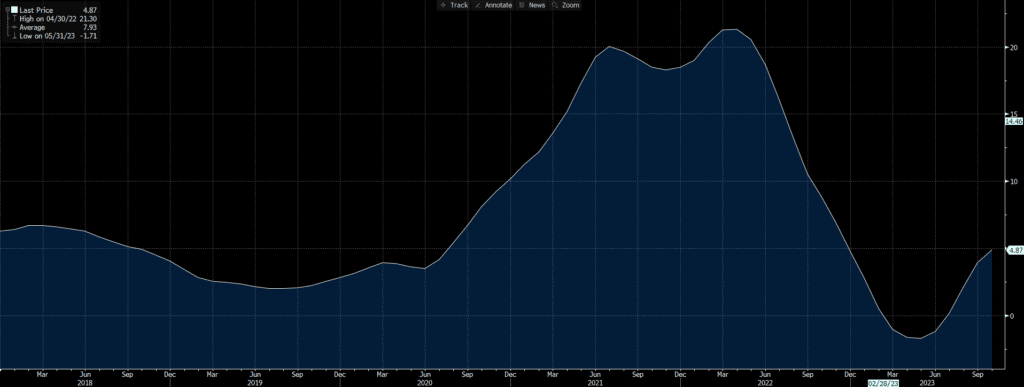

On Tuesday, the S&P CoreLogic Case-Shiller Index showed the persistence of home prices amid limited inventory even in the face of lower sales activity. The 10- and 20-city composite indices were up 5.7% and 4.8%, respectively. Keep in mind that this month’s index data tracks August, September, and October, a period through which mortgage rates climbed sharply from 6.9% in August to 8% by the end of October. Since October, we’ve seen a strong rally in the 10-Year Treasury (prices up and yields down), pushing the average 30-year mortgage rate below 7%.

On Wednesday, Federal Reserve Bank of Dallas released Dallas Fed Manufacturing Index report. The report indicated that the Dallas Fed Manufacturing Index declined from -19.9 in November to -9.3 in December, compared to analyst consensus of -20.5. Additionally, the Richmond Federal Reserve Bank released its Manufacturing Index for December. The index saw a notable slowdown in Fifth District manufacturing activity, as the composite manufacturing index, a key indicator of the sector’s health, dropped further into negative territory, moving from -5 in November to -11.

Yesterday’s weekly initial jobless claims for the week ended Dec. 23 increased 12K to 218K, exceeding the 210K expected and compared with 206K prior (revised from 205K) in the previous week. The four-week moving average was 212K, a small decrease of 250 from the prior week's average of 212.25K (revised from 212K). Continuing claims rose to 1.875M from 1.861M prior (revised from 1.866M) and matched the consensus estimate.

Additionally on Thursday, pending home sales in November were unchanged compared with October and 5.2% lower than November of last year, according to the National Association of Realtors. The reading, which is based on signed contracts during the month, is a forward-looking indicator of closed sales as well as the most current look at what potential homebuyers are thinking. As I mentioned previously, the recent decline in mortgage rates should have some impact on home sales reports going forward.

Looking ahead to next week’s releases, we will get the latest insight on the labor market via the Job Openings and Labor Turnover Survey which provides data on job openings, hires, and separations. The FOMC Meeting Minutes for the December meeting will be released next Wednesday, giving us further insights into the committee’s thoughts. Finishing up next week will be the monthly jobs reports. The change in nonfarm payrolls is expected to show an increase of 168K for the month of December and a small decline in the headline unemployment rate to 3.8%.

See you next year!

S&P CoreLogic Case-Shiller 20-City Composite Index

(Year over Year % Change) - 2018 to Present

The Baker Group is one of the nation’s largest independently owned securities firms specializing in investment portfolio management for community financial institutions.

Since 1979, we’ve helped our clients improve decision-making, manage interest rate risk, and maximize investment portfolio performance. Our proven approach of total resource integration utilizes software and products developed by Baker’s Software Solutions* combined with the firm’s investment experience and advice.

Author

Dale Sheller

Managing Director

Director of Financial Strategies Group

The Baker Group LP

800.937.2257

*The Baker Group LP is the sole authorized distributor for the products and services developed and provided by The Baker Group Software Solutions, Inc.

INTENDED FOR USE BY INSTITUTIONAL INVESTORS ONLY. Any data provided herein is for informational purposes only and is intended solely for the private use of the reader. Although information contained herein is believed to be from reliable sources, The Baker Group LP does not guarantee its completeness or accuracy. Opinions constitute our judgment and are subject to change without notice. The instruments and strategies discussed here may fluctuate in price or value and may not be suitable for all investors; any doubt should be discussed with a Baker representative. Past performance is not indicative of future results. Changes in rates may have an adverse effect on the value of investments. This material is not intended as an offer or solicitation for the purchase or sale of any financial instruments.