Don’t unfasten your seatbelts just yet, the rollercoaster ride of 2023 may not be over. The first week of 2024 is already off to a ruckus start with a mixed bag of jobs data and minutes from the FOMC’s December meeting giving markets much to digest. As always, the first week of the month has given us a plethora of employment data but unfortunately no cohesive picture of the state of the labor market this time around.

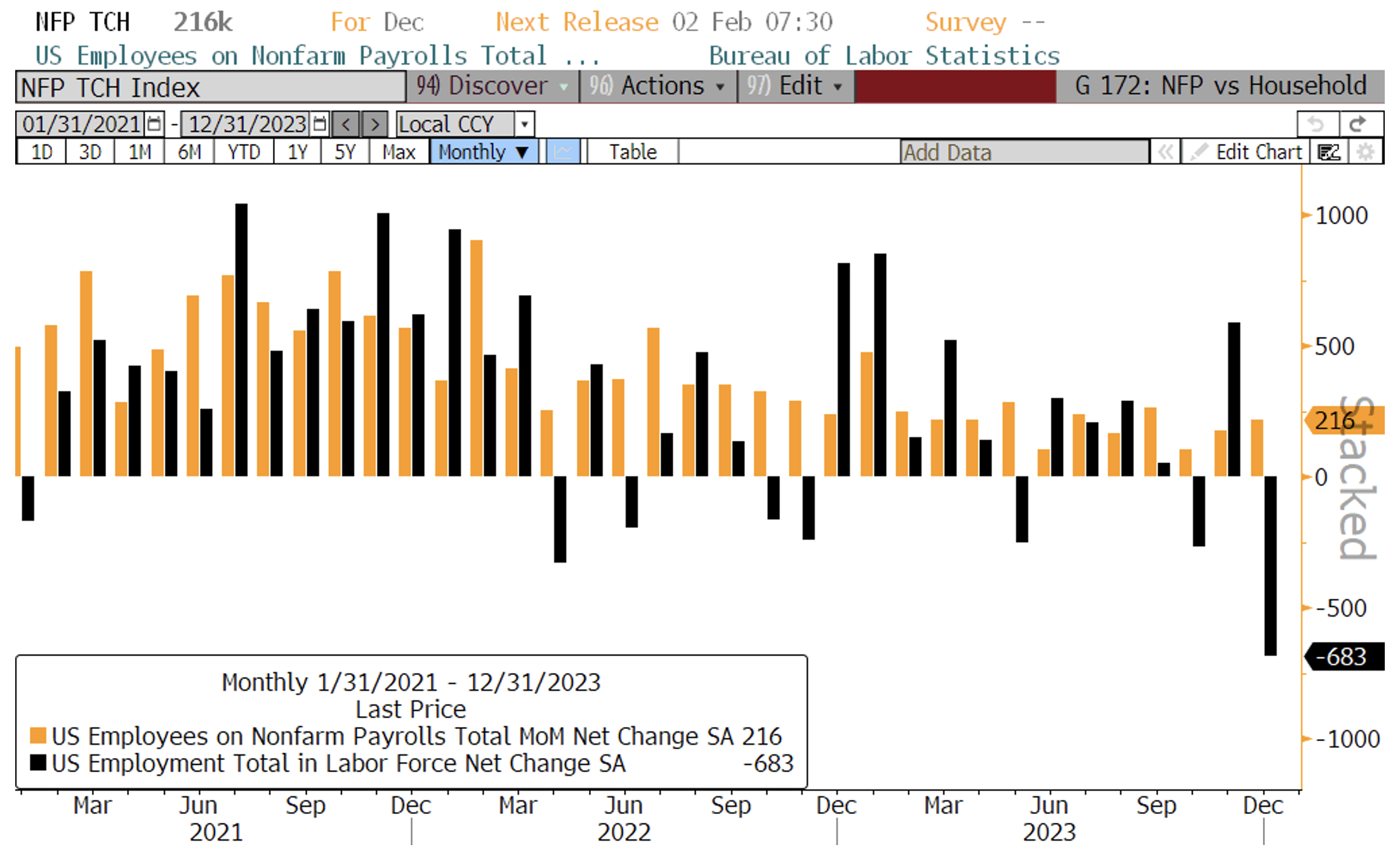

Several of the week’s readouts of U.S. hiring showed signs of weakness but this morning’s unexpectedly strong nonfarm payrolls data painted a much different picture, at least in the headline numbers. The report showed the economy added 216k jobs in December vs. a consensus estimate of 175k, suggesting the labor market, which has been the main driver behind resilient consumer spending, finished the year in strong territory. The Unemployment Rate also remained at 3.7% vs. expectations of a tick up to 3.8% and Average Hourly Earnings rose 0.4% for the month (vs. 0.3% consensus), reversing the downward trend of wage gains in place throughout 2023.

However, there were some signs of weakness. The last 2 months of job gains were revised lower by 71k, which more than offsets the 41k beat in the nonfarm payrolls number. Also, the separate Household Survey showed the economy actually lost a massive 683k jobs. The Labor Force Participation rate unexpectedly fell to 62.5% (vs. 62.8% consensus) as 845k people left the labor force, a move not generally seen in a strong labor market. In fact, without the big drop in Labor Force Participation, the Unemployment Rate would have likely risen by 0.1% or 0.2%. Average Weekly Hours Worked, which can be a leading indicator for labor market conditions as employers tend to cut workers’ hours before actually cutting workers, also fell to 34.3 from 34.4.

The JOLTS job openings report came in shy of expectations this week, falling 62k to 8.79mm, the lowest level since March 2021. Federal Reserve Chairman Powell has often cited the JOLTS report as a key indicator they are watching for signs the labor market is loosening and this report gives evidence that the supply and demand for labor are becoming more balanced. However, private payrolls numbers from the ADP Research Institute increased more than expected in December, up 164k vs. 125k survey, the most since August, suggesting private firms continued to hire at a healthy pace last month. But the report showed further cooling in wage growth as wages for both workers who stayed in their jobs and those who changed jobs grew at the slowest pace since 2021.

Also of note this week was the release of the latest FOMC minutes, which brought to light additional dovish signs from their December meeting. Several members acknowledged risks from an “abrupt downshift” in labor market conditions which could lead to a significant slowdown. They also noted improved balance in the supply and demand of labor which has helped reduce wage pressures, key to bringing inflation to the Fed’s 2% target. However, this week’s mixed jobs data will give the Fed plenty to debate about the strength of the labor market at their next meeting on January 31st.

Next week will also be an important one on the data front as we get key inflation numbers on Thursday with the Consumer Price Index and on Friday with the Producer Price Index.

The Baker Group is one of the nation’s largest independently owned securities firms specializing in investment portfolio management for community financial institutions.

Since 1979, we’ve helped our clients improve decision-making, manage interest rate risk, and maximize investment portfolio performance. Our proven approach of total resource integration utilizes software and products developed by Baker’s Software Solutions* combined with the firm’s investment experience and advice.

Author

Andrea F. Pringle

Financial Strategist/MBS Analyst

The Baker Group LP

800.937.2257

*The Baker Group LP is the sole authorized distributor for the products and services developed and provided by The Baker Group Software Solutions, Inc.

INTENDED FOR USE BY INSTITUTIONAL INVESTORS ONLY. Any data provided herein is for informational purposes only and is intended solely for the private use of the reader. Although information contained herein is believed to be from reliable sources, The Baker Group LP does not guarantee its completeness or accuracy. Opinions constitute our judgment and are subject to change without notice. The instruments and strategies discussed here may fluctuate in price or value and may not be suitable for all investors; any doubt should be discussed with a Baker representative. Past performance is not indicative of future results. Changes in rates may have an adverse effect on the value of investments. This material is not intended as an offer or solicitation for the purchase or sale of any financial instruments.