Following last week’s trading volatility, the markets were relatively calm this week. As of the time of this writing, yields across the Treasury curve were within a few basis points of where they started on Monday. Markets may not have reflected it, but there was plenty of opportunity for volatility with some of the economic data that was released this week.

The Conference Board’s Leading Economic Indicators Index was released for December and fell 0.1%, continuing the negative streak by falling for the 21st consecutive month. This remains a closely watched data point for Investors looking to explain the large gap between the market’s expectations for rate cuts in 2024 vs the Fed’s. Markets currently see one path for the economy that leads to a potential recession while the Fed is focused on navigating a soft landing.

On a broader level, the US economy finished on a strong note with GDP growing 3.3% in Q4 (est = 2.0%) while the broadest measure of inflation fell below the Fed’s long term target of 2.0%. The GDP Price Index, which measures the price change of every good and service in the economy, rose just 1.5% in Q4 (est = 2.2%), the lowest level since June of 2020 and below the 20-year average of 2.3%. Excluding food and energy, the Core GDP Price index rose just 2.0% (est = 2.0%). Consumer spending was strong in Q4, adding 1.91 percentage points to GDP while business investment added 0.26 points and inventories unexpectedly grew.

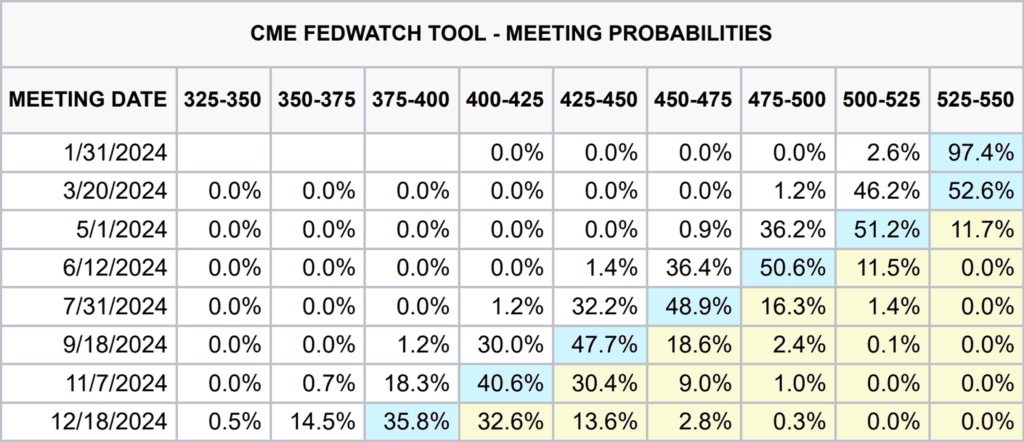

The PCE Deflator (the inflation metric the Fed uses to target 2% inflation) rose 0.2% in December and 2.6% from a year ago. That matches last month’s reading and is the lowest since February 2021. Excluding food and energy, Core PCE rose 0.2% for the month and 2.9% from a year ago, the first time Core PCE has been below 3% since March 2021. For reference, the core PCE number was sitting at 4.9% a year ago. While still above the Fed’s target of 2% inflation, the steady drop in both the headline and core PCE should give the Fed comfort that higher rates are having the desired effect. Fed funds futures are still pricing in about a 50% chance the Fed will cut rates in March and will cut rates 125-150bp for all of 2024. We will get more clarity on that when the FOMC meets on Wednesday of next week.

The Baker Group is one of the nation’s largest independently owned securities firms specializing in investment portfolio management for community financial institutions.

Since 1979, we’ve helped our clients improve decision-making, manage interest rate risk, and maximize investment portfolio performance. Our proven approach of total resource integration utilizes software and products developed by Baker’s Software Solutions* combined with the firm’s investment experience and advice.

Author

Dillon Wiedemann

Senior Vice President

Financial Analyst

The Baker Group LP

800.937.2257

*The Baker Group LP is the sole authorized distributor for the products and services developed and provided by The Baker Group Software Solutions, Inc.

INTENDED FOR USE BY INSTITUTIONAL INVESTORS ONLY. Any data provided herein is for informational purposes only and is intended solely for the private use of the reader. Although information contained herein is believed to be from reliable sources, The Baker Group LP does not guarantee its completeness or accuracy. Opinions constitute our judgment and are subject to change without notice. The instruments and strategies discussed here may fluctuate in price or value and may not be suitable for all investors; any doubt should be discussed with a Baker representative. Past performance is not indicative of future results. Changes in rates may have an adverse effect on the value of investments. This material is not intended as an offer or solicitation for the purchase or sale of any financial instruments.