The big news this Friday morning is whether the groundhog (aka Punxsutawney Phil) saw his shadow or not. After years of seeing his shadow, he did not see his shadow, which we all know means an early spring! As Bill Murray says in the hilarious 1993 comedy, Groundhog Day, “This is the one time where television really fails to capture the true excitement of a large squirrel predicting the weather.”

The other big news this Friday morning was the release of the first Friday of the month employment report. The US economy defied expectations again and added a much stronger than expected 353,000 jobs in January (est = 185k) and the prior two months were revised higher by 126k. Jobs gains were broad based with the largest gains in Education & Health Services (+112k), Professional & Business Services (+74k) and Trade & Transportation (+64k). With most of the gains occurring in higher paying sectors, wage gains came in stronger than expected, up 0.6% for the month (est = 0.3%) and 4.5% from a year ago (est = 4.1%). As was the case the prior month, the separate survey of households (the main nonfarm payrolls number comes from a survey of businesses) showed a drop of -31,000 jobs. The household survey has now shown a decline in jobs in 3 of the last 4 months. The Unemployment Rate held steady at 3.7% (est = 3.8%) and the Labor Force Participation Rate also held steady at 62.5% (est = 62.6%). A less focused-on data point showed unexpected weakness with the Average Weekly Hours Worked unexpectedly falling to 34.1 (est = 34.3) from 34.3 the prior month. That is the lowest weekly hours worked since the depth of the pandemic and the Global Financial Crisis. That is not something you normally see in a strong labor market and suggests businesses are cutting worker hours rather than laying off workers.

Two days ago, the FOMC did as expected and left rates unchanged for the 4th consecutive meeting, but they made significant changes to the statement indicating their formal adjustment from a tightening bias to an easing bias. They feel risks are more balanced and they want more evidence inflation will not bounce back before cutting rates. Here are some of the highlights from the Fed meeting this week:

- Leaves rates unchanged at 5.25-5.5% for 4th consecutive meeting

- Vote was unanimous

- Upgraded assessment of the economy that has “been expanding at a solid pace”

- Removed language related to the banking system and tighter credit and financial conditions

- Added: “The Committee judges that the risks to achieving its employment and inflation goals are moving into better balance. The economic outlook is uncertain, and the Committee remains highly attentive to inflation risks.”

- Added: “The Committee does not expect it will be appropriate to reduce the target range until it has gained a greater confidence that inflation is moving sustainably toward 2 percent.”

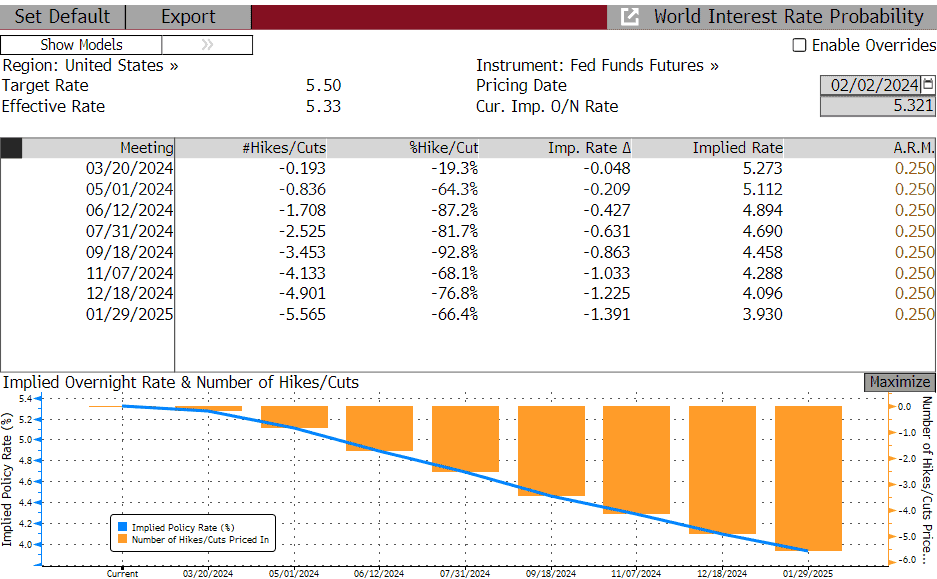

This morning bond yields are rising because of the strong jobs report. The 2yr yield had surged 18bp to 4.39% and the 10yr was up 16bp to 4.04%. Fed funds futures have now “unpriced” one full rate cut in 2024 and now expect a total of about 125bp of cuts this year with the probability of a March cut down to just 19%.

Enjoy your Groundhog’s Day Weekend!

World Interest Rate Probability Screen

The Baker Group is one of the nation’s largest independently owned securities firms specializing in investment portfolio management for community financial institutions.

Since 1979, we’ve helped our clients improve decision-making, manage interest rate risk, and maximize investment portfolio performance. Our proven approach of total resource integration utilizes software and products developed by Baker’s Software Solutions* combined with the firm’s investment experience and advice.

Author

Dale Sheller

Managing Director

Director of Financial Strategies Group

The Baker Group LP

800.937.2257

*The Baker Group LP is the sole authorized distributor for the products and services developed and provided by The Baker Group Software Solutions, Inc.

INTENDED FOR USE BY INSTITUTIONAL INVESTORS ONLY. Any data provided herein is for informational purposes only and is intended solely for the private use of the reader. Although information contained herein is believed to be from reliable sources, The Baker Group LP does not guarantee its completeness or accuracy. Opinions constitute our judgment and are subject to change without notice. The instruments and strategies discussed here may fluctuate in price or value and may not be suitable for all investors; any doubt should be discussed with a Baker representative. Past performance is not indicative of future results. Changes in rates may have an adverse effect on the value of investments. This material is not intended as an offer or solicitation for the purchase or sale of any financial instruments.