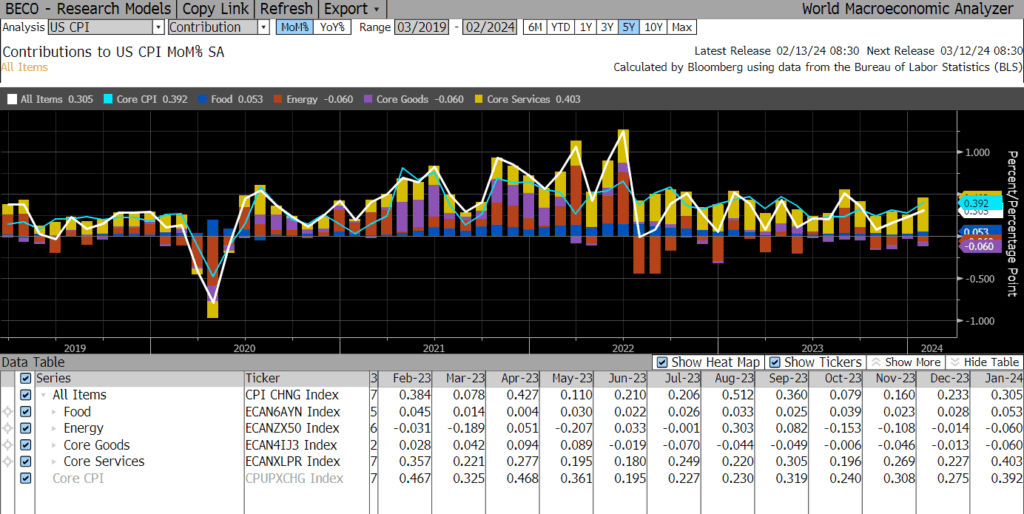

The upcoming three-day weekend could not come soon enough after a whipsaw week for the markets. The stock market was yanked back from record highs and Treasury yields rocketed to new highs of the year on Tuesday after January’s Consumer Price Index (CPI) came in hotter than expected. Fed officials have been touting the importance of ensuring inflation is on a “sustainable” path to 2% in the wake of their January meeting and markets clearly had that in mind on Tuesday. Given the dramatic response, you would be forgiven for thinking CPI had increased in the month of January rather than fallen from 3.4% to 3.1%. However, expectations were for the inflation reading to come in at 2.9% and fall below 3.0% for the first time in three years. The 3.1% print obviously disappointed.

The core measure, which excludes volatile food and energy prices in order to better track inflation’s underlying trend, also disappointed. Core CPI increased 0.4% in January, the most in eight months, and 3.9% from a year ago. Markets took this as evidence that the Fed will wait longer to cut rates and took almost a full quarter-point cut out of their easing expectations for the year. Some of that was given back on Wednesday and Thursday as things settled down and participants remembered that the Fed targets the Personal Consumption Expenditure (PCE) measure of inflation, not CPI, and PCE is not as heavily influenced by housing costs. Shelter costs were responsible for much of the increase in January’s CPI reading and those costs have a much lower weight in the PCE measure.

The spotlight on January’s PCE reading, which comes out on February 29th, will be even brighter than usual as markets will be looking for a reality check on the CPI print. The question will be whether inflation is in fact more stubborn than expected or whether the subtle differences between CPI and PCE, as well as the change in the weights of the elements in the CPI basket that are adjusted each January, are enough to write off January’s elevated CPI print.

There is evidence that CPI’s shelter costs should be expected to come down, but there is a significant lag in the data. The high-frequency data on rents, which give a better picture of what is happening with rents in real time, shows that they are already falling but that data captures what is happening with “new leases” (the price renters would have to pay if they were to move right now). The CPI data measures a lot more “existing leases,” which captures renters who rented at high prices and are still paying that elevated price. Eventually, when those renters move and sign “new leases,” CPI’s shelter costs should better catch up with current market measures.

After calming on Wednesday and Thursday, markets were thrown for a loop yet again this morning as the Producer Price Index (PPI), which can offer some insights into possible future movements in PCE, jumped more than expected in January. PPI rose 0.3% MoM and 0.9% from a year earlier. Expectations were for a 0.1% MoM increase and a 0.6% annual increase. The bump was led by increases in services categories. The portfolio management and investment advice category, which feeds directly into PCE, jumped 5% in January on the back of the stock market rally late last year. The category, which is calculated using market returns, indicates that PCE may get an undesirable boost from equity performance in the January print.

Next week, we have only four market days and little economic data. The Leading Economic Indicator Index will come out on Tuesday and Existing Home Sales data will be released on Thursday. We will also get the minutes from the FOMC’s January meeting on Wednesday.

The Baker Group is one of the nation’s largest independently owned securities firms specializing in investment portfolio management for community financial institutions.

Since 1979, we’ve helped our clients improve decision-making, manage interest rate risk, and maximize investment portfolio performance. Our proven approach of total resource integration utilizes software and products developed by Baker’s Software Solutions* combined with the firm’s investment experience and advice.

Author

Andrea F. Pringle

Senior Vice President

The Baker Group LP

800.937.2257

*The Baker Group LP is the sole authorized distributor for the products and services developed and provided by The Baker Group Software Solutions, Inc.

INTENDED FOR USE BY INSTITUTIONAL INVESTORS ONLY. Any data provided herein is for informational purposes only and is intended solely for the private use of the reader. Although information contained herein is believed to be from reliable sources, The Baker Group LP does not guarantee its completeness or accuracy. Opinions constitute our judgment and are subject to change without notice. The instruments and strategies discussed here may fluctuate in price or value and may not be suitable for all investors; any doubt should be discussed with a Baker representative. Past performance is not indicative of future results. Changes in rates may have an adverse effect on the value of investments. This material is not intended as an offer or solicitation for the purchase or sale of any financial instruments.