This was a fairly quiet week in the bond market with very little economic data to move markets. The only noteworthy data points for the week were the 22nd consecutive monthly decline in leading economic indicators (has never happened without a recession) and a 3.1% increase in existing home sales which are still down nearly 40% from the 2021 peak. Bond yields finished the week mixed the 2yr and 10yr yields up 6bp and 1bp respectively while the 1mo bill and 30yr bond yields were down slightly.

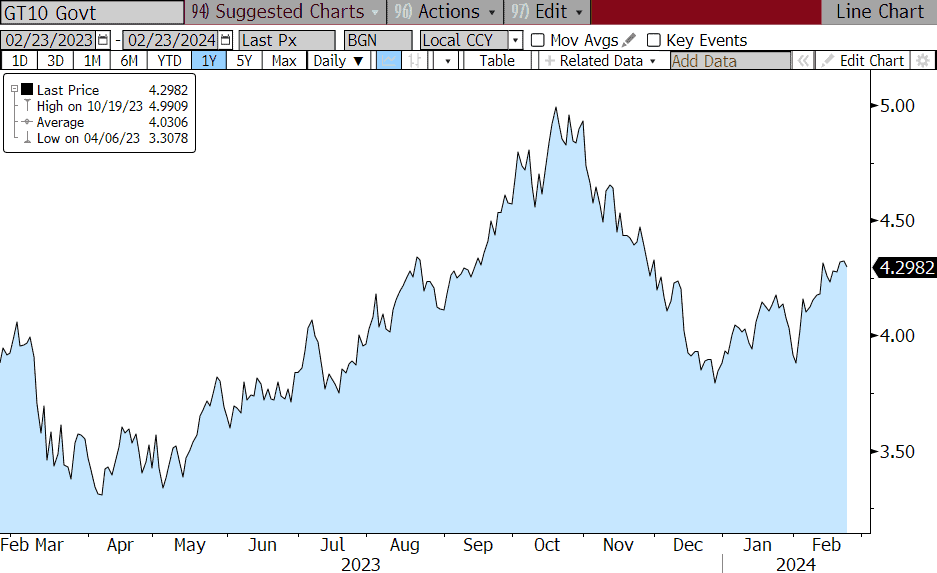

The real headline lately has been the market’s repricing of Fed rate cut expectations this year and the resulting upward move in bond yields. At the end of 2023, fed funds futures were pricing in 150bp of rate cuts in 2024 and a greater than 80% chance the Fed would cut rates by March. That helped to drive the 10yr Treasury yield down to 3.8% at the end of December and the 1yr yield down to 4.15% in mid-January. But in the last two months, we have seen an exceptionally strong January nonfarm payrolls gain (+353k) and a couple of hotter than expected inflation reports. Just those few economic reports were enough for markets to “price out” 50bp of rate cuts this year and move closer to the Fed’s last Dot Plot that showed FOMC officials wanted just 75bp in rate cuts this year. Fed funds futures are now pricing in less than 100bp of rate cuts this year and the first rate cut isn’t fully priced in until July. As a result, the 10yr yield has risen about 50bp to 4.3% and the 2yr has risen about 55bp to 4.7%.

Next week markets will have a slew of economic data to digest with reports on New Home Sales, Durable Goods, House Prices, Consumer Confidence, ISM Manufacturing PMI, Personal Income/Spending and the Fed’s preferred inflation gauge – the Personal Consumption Expenditure Deflator. Current expectations are for the PCE Deflator to fall to 2.4% for January (very close to the Fed’s target of 2%) and the Core PCE to drop to 2.8%.

10yr Treasury Yield – Last 12 Months

The Baker Group is one of the nation’s largest independently owned securities firms specializing in investment portfolio management for community financial institutions.

Since 1979, we’ve helped our clients improve decision-making, manage interest rate risk, and maximize investment portfolio performance. Our proven approach of total resource integration utilizes software and products developed by Baker’s Software Solutions* combined with the firm’s investment experience and advice.

Author

Ryan W. Hayhurst

President

The Baker Group LP

800.937.2257

*The Baker Group LP is the sole authorized distributor for the products and services developed and provided by The Baker Group Software Solutions, Inc.

INTENDED FOR USE BY INSTITUTIONAL INVESTORS ONLY. Any data provided herein is for informational purposes only and is intended solely for the private use of the reader. Although information contained herein is believed to be from reliable sources, The Baker Group LP does not guarantee its completeness or accuracy. Opinions constitute our judgment and are subject to change without notice. The instruments and strategies discussed here may fluctuate in price or value and may not be suitable for all investors; any doubt should be discussed with a Baker representative. Past performance is not indicative of future results. Changes in rates may have an adverse effect on the value of investments. This material is not intended as an offer or solicitation for the purchase or sale of any financial instruments.