A full week of jobs data and congressional testimony from Fed Chairman Jerome Powell gave markets much to digest this week. Powell delivered the Federal Reserve's semiannual Monetary Policy Report to Congress at the House Financial Services Committee on Wednesday and the Senate Banking Committee on Thursday. His comments primarily reiterated the FOMC’s commitment to carefully assess data until they build confidence that inflation is moving sustainably toward the 2% target. However, he did state that the Fed expects rate cuts to begin later in the year if the economy develops as intended and he said that rates have likely reached their peak. Those two facts themselves are not particularly newsworthy but perhaps it is newsworthy that he said them because fed funds futures markets have now pulled all remaining doubts about a summer rate cut from the table. As of this morning, markets have almost fully priced in a rate cut by the June 12th meeting.

Also giving markets some confidence that easing from the Fed is on its way was this week’s jobs data which showed some softening in the U.S. labor market amidst a few signs of strength. The ADP National Employment Report on private payrolls showed that U.S. companies hired fewer than expected workers in February. ADP gives insight on private sector job growth using payroll data from ADP clients, which covers about 42% of the private sector. Forecasts were for a +150k print and the actual figure came in just shy at +140k, still an upward move from January but an underwhelming one.

The Job Openings and Labor Turnover Survey (JOLTS), which gives insight into worker movement, showed job openings were strong in the month of January, coming in at 8.863M vs. 8.850M survey. However, the prior month was revised down from 9.026M to 8.889M. This month’s JOLTS release also included the annual revision of monthly data for the last five years which showed openings were revised down for most of 2023. JOLTS also showed that 3.39 million people voluntarily left their job in January, the lowest number in three years, suggesting workers have less confidence in their ability to find a new job in the current environment. That is good news for the inflation fight as wage pressures ease when workers are more inclined to stay in their current jobs.

The week’s biggest news on the labor market came with this morning’s release of the monthly Employment Situation Report, which is generally considered the most comprehensive indicator of the health of the U.S. labor market. The report combines data from two main surveys, the Household Survey, which focuses on the individual labor force status of people in the U.S. and provides data for the unemployment rate and the labor force participation rate, and the Establishment Survey, which collects data on the number of employees on the payrolls of businesses and government agencies and is used to calculate the nonfarm payrolls figure.

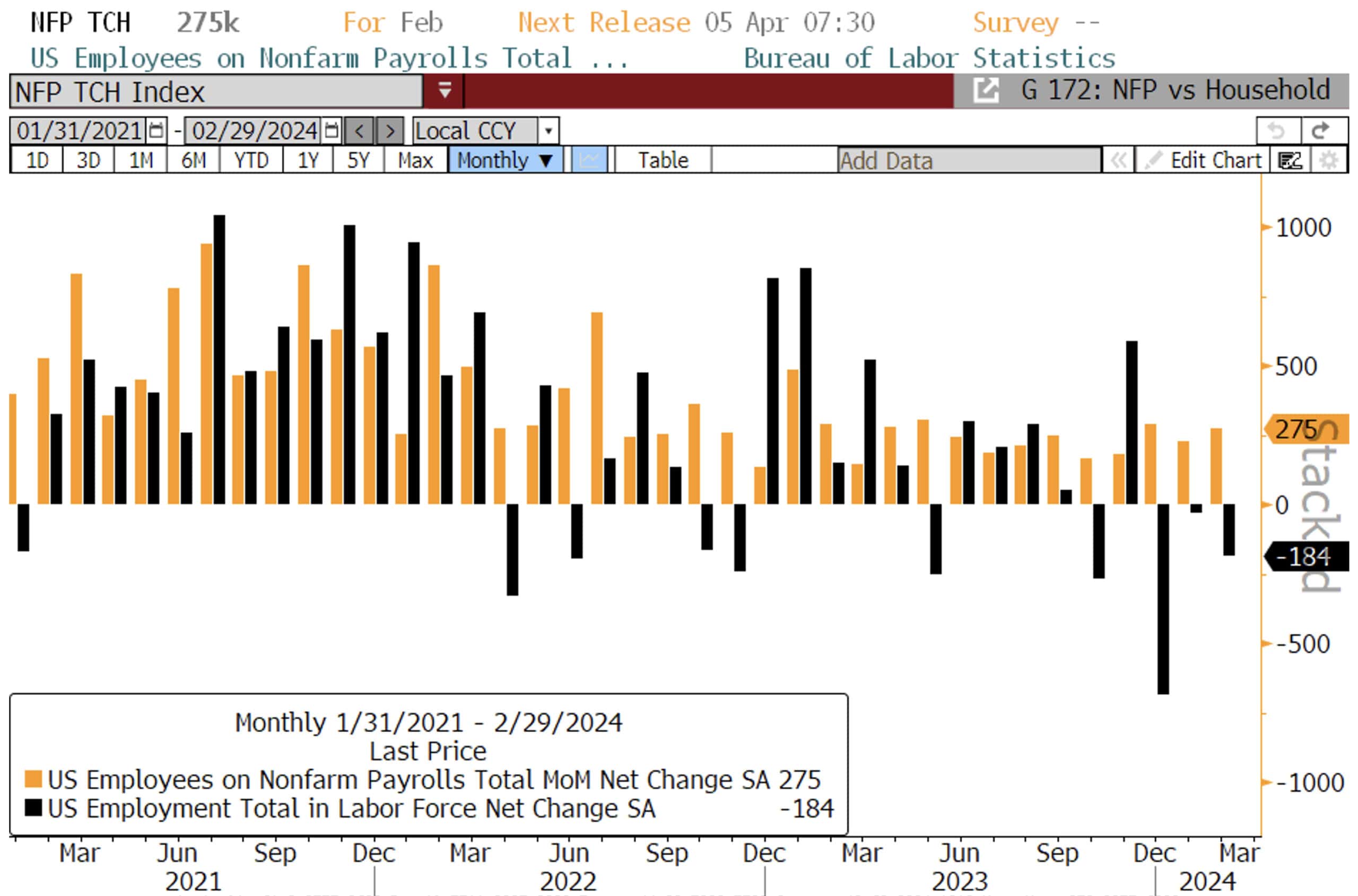

Interestingly, the two surveys gave us opposing signals on the health of the labor market in February, as has been the case for the last few months. Nonfarm payrolls came in better than expected, showing 275k job gains for the month (vs. 200k expected). The Household survey showed an entirely different picture, reporting a loss of 184k jobs for the month of February. This dichotomy has been a bit of a headscratcher for the last three months, with nonfarm payrolls numbers showing robust job gains and the Household Survey showing job losses. However, the past two months’ nonfarm payrolls prints were revised down in today’s report by a total of 167k. Last month’s blowout 353k nonfarm payrolls gain that shocked markets was revised down by a massive 124k, suggesting the labor market was not as strong as the report originally reported.

The unemployment rate also unexpectedly jumped to 3.9% from 3.7% in January (and 3.7% expected). That marks the highest level of unemployment in two years. Notably, the increase in the unemployment rate came without a change in the labor force participation rate, which is the denominator in the unemployment rate calculation, which implies the increase came entirely from an uptick in the number of unemployed workers. The labor force participation rate remained unchanged at 62.5% for the month of February. Forecasts called for it to tick up to 62.6%.

Next week offers much to digest as well with the key inflation gauge, the Consumer Price Index (CPI) on Tuesday, and Retail Sales and Producer Prices on Thursday. Have a great weekend!

Source: Bloomberg, L.P.

The Baker Group is one of the nation’s largest independently owned securities firms specializing in investment portfolio management for community financial institutions.

Since 1979, we’ve helped our clients improve decision-making, manage interest rate risk, and maximize investment portfolio performance. Our proven approach of total resource integration utilizes software and products developed by Baker’s Software Solutions* combined with the firm’s investment experience and advice.

Author

Andrea F. Pringle

Financial Strategist/MBS Analyst

The Baker Group LP

800.937.2257

*The Baker Group LP is the sole authorized distributor for the products and services developed and provided by The Baker Group Software Solutions, Inc.

INTENDED FOR USE BY INSTITUTIONAL INVESTORS ONLY. Any data provided herein is for informational purposes only and is intended solely for the private use of the reader. Although information contained herein is believed to be from reliable sources, The Baker Group LP does not guarantee its completeness or accuracy. Opinions constitute our judgment and are subject to change without notice. The instruments and strategies discussed here may fluctuate in price or value and may not be suitable for all investors; any doubt should be discussed with a Baker representative. Past performance is not indicative of future results. Changes in rates may have an adverse effect on the value of investments. This material is not intended as an offer or solicitation for the purchase or sale of any financial instruments.