Happy Jobs Friday everyone! Investors were uneasy this week after recent economic data and comments from Minneapolis Federal Reserve President, Neel Kashkari, suggested that interest rate cuts may not be coming if inflation continues to “move sideways”. Stocks were down across the board over the last few days as investors awaited the monthly BLS Jobs Report, with the Dow having its worst day since March 2023. The belief was that a stronger than expected jobs market could add more fuel to the Fed’s fire, as increased spending power could further fuel inflation and a strong labor market gives the Fed more reasons to pause before cutting rates.

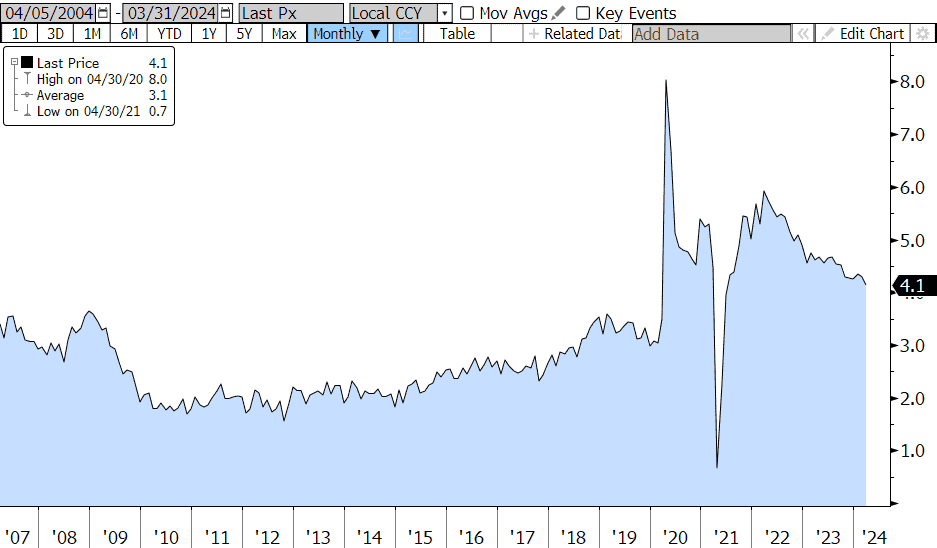

The stock market seems to be enjoying the report as the Dow Jones Industrial Average is up over 400 points this morning. However, bonds are selling off with yields rising this morning as the 10yr yield hit 4.38%. US job growth came in stronger than expected last month, with the US economy adding 303,000 jobs in March versus an estimated 214,000. The sectors with the largest gains were health care (+72,000), government (+71,000) and leisure & hospitality (+49,000). We also saw the prior two months jobs figures revised higher by 22,000, a positive change from the downward revisions we saw for the end of 2023. The unemployment rate fell to 3.8% from February’s 3.9%, matching expectations. Average hourly earnings also ticked up 0.3% in March giving us a 4.1% change year over year, which is the smallest gain since June of 2021. Continuing to add to the strength of the March report, the labor force participation rate rose 0.2% up to 62.7%. The overall strength of this report should give the Fed some pause on cutting rates as they wait to see further signs of inflation cooling and moving towards their target of 2%.

The Fed has two goals, maximum employment and stable prices. With the strong jobs numbers this week, next week’s focus will be on Wednesday and the release of March’s CPI data as well as Thursday’s PPI report. Currently CPI is expected to tick up to 3.5% YOY from the prior figure of 3.2%. CPI came in hotter than expected in both January and February, so expect there to be a close eye on this data to see if the trend continues.

Federal Reserve Chairman Jerome Powell commented on the recent inflation data in a speech at Stanford this past week and stated that the hotter CPI data is not going to “materially change the overall picture” and that reaching the inflation target of 2% can sometimes be a “bumpy path”. Powel also echoed similar statements to Kashkari, stating that “We do not expect that it will be appropriate to lower our policy rate until we have greater confidence that inflation is moving sustainably down toward 2 percent”. The market is currently pricing in a 5.7% chance of a rate cut at the May 1st meeting, with a coin flip at the June and July meetings.

University of Michigan’s Consumer Sentiment report is also on next week’s slate of data releases. Consumer sentiment is expected to tick down slightly to 78.7% from 79.4%, following a relatively steady rise in the index since the end of 2023.

Before we get to next week’s data though, we have the Final Four of both the women’s and men’s NCAA basketball tournament. My eyes will be on the unlikely #11 seeded North Carolina State Wolfpack and their unstoppable force DJ Burns as they take on #1 seeded Purdue and their immovable object, reigning National Player of the Year Zach Edey.

US Average Hourly Earnings Percent Change YoY (2004-current)

The Baker Group is one of the nation’s largest independently owned securities firms specializing in investment portfolio management for community financial institutions.

Since 1979, we’ve helped our clients improve decision-making, manage interest rate risk, and maximize investment portfolio performance. Our proven approach of total resource integration utilizes software and products developed by Baker’s Software Solutions* combined with the firm’s investment experience and advice.

Author

Luke Mikles

Senior Vice President, Financial Strategies Group

The Baker Group LP

800.937.2257

*The Baker Group LP is the sole authorized distributor for the products and services developed and provided by The Baker Group Software Solutions, Inc.

INTENDED FOR USE BY INSTITUTIONAL INVESTORS ONLY. Any data provided herein is for informational purposes only and is intended solely for the private use of the reader. Although information contained herein is believed to be from reliable sources, The Baker Group LP does not guarantee its completeness or accuracy. Opinions constitute our judgment and are subject to change without notice. The instruments and strategies discussed here may fluctuate in price or value and may not be suitable for all investors; any doubt should be discussed with a Baker representative. Past performance is not indicative of future results. Changes in rates may have an adverse effect on the value of investments. This material is not intended as an offer or solicitation for the purchase or sale of any financial instruments.