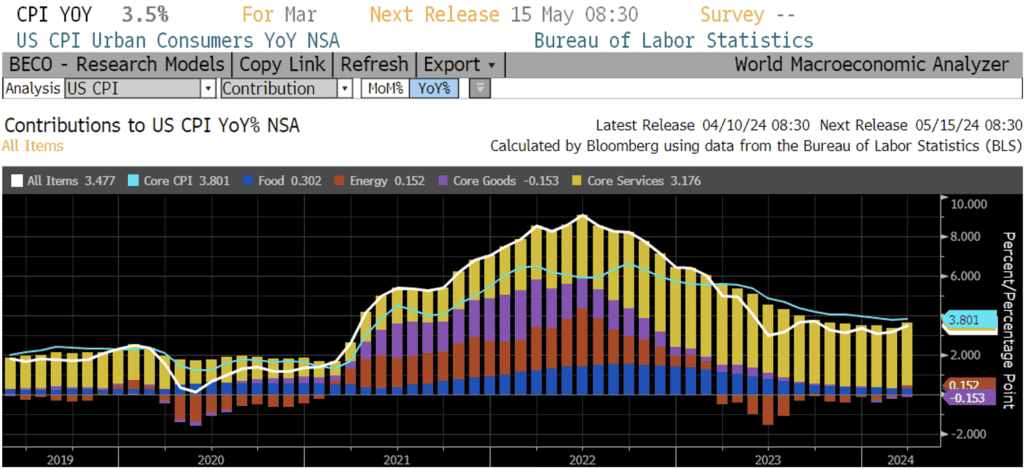

If the Fed’s job of engineering a “soft landing” for the U.S. economy wasn’t difficult enough, it just got a little trickier this week, potentially even adding a layer of political complexity to the Fed’s policy making process. Wednesday’s release of the Consumer Price Index (CPI) for the month of March showed inflation remained elevated once again. Headline CPI printed at 0.4% month-over-month (MoM) and 3.5% YoY. Core CPI, which strips out volatile food and energy prices in effort to better assess the underlying trend of inflation, came in similarly high, missing market expectations by a tenth of a point. Core CPI was up 0.4% MoM and 3.8% YoY vs. 0.3% and 3.7% expected.

The market’s reaction to the miss was swift and strong, causing rates to jump across the curve. Intraday, the 10-year UST yield popped as much as 22bps and ended the day 18bps higher. It may seem like an over-reaction to an inflation miss of less than a tenth of a percentage point, but futures markets virtually wiped the chances of a June rate cut off the map in a single day. The monthly rise in U.S. CPI was 0.359%, which rounded up to 0.4% and barely missed the 0.3% forecast. The rounded print would have been in line with expectations had the number come in less than one basis point lower. However, the print was enough to spur doubt in the futures markets about whether the Fed will be able to cut rates at all this year.

With a summer rate cut seeming more uncertain, markets have begun to question the political optics around a first rate cut in September. The Fed prefers to avoid any potential question about their motives or perceived meddling in an election, which markets believe could complicate a September cut. The next FOMC meeting after September would come on November 7th, just days after the 2024 presidential election, causing some to worry the Fed may be on hold until then. But after a better-than-expected reading of producer inflation yesterday, futures markets are back to fully pricing in a rate cut by at least September, with the probabilities split between the first cut coming at the July or September meeting. However, further sticky inflation readings could complicate (at least the market’s view of) the Fed’s next move.

Markets were able to breathe a sigh of relief yesterday when the Producer Price Index (PPI) showed producer inflation coming in cooler than expected for the month of March. Headline PPI was up just 0.2% MoM vs. estimates of 0.3% and 2.1% YoY vs. 2.2% expected. Core PPI (excluding food and energy) printed mostly in line with expectations, up 0.2% MoM and up 2.4% YoY (vs. 2.3% survey). This was welcome news as producer prices are ultimately passed on to consumer prices and can help offer some insight into the trajectory of consumer inflation numbers.

The softer producer price numbers and dovish comments from Fed speakers yesterday were enough to pull Treasury yields back off the new highs set for the year. The 2-year UST retreated from near 5% yesterday to 4.875% this morning and the 10-year UST has pulled back to 4.489% as of this writing. Next week will give us several readings on the state of the housing market as well as retail sales and manufacturing and production data. Have a great weekend!

The Baker Group is one of the nation’s largest independently owned securities firms specializing in investment portfolio management for community financial institutions.

Since 1979, we’ve helped our clients improve decision-making, manage interest rate risk, and maximize investment portfolio performance. Our proven approach of total resource integration utilizes software and products developed by Baker’s Software Solutions* combined with the firm’s investment experience and advice.

Author

Andrea F. Pringle

Financial Strategist/MBS Analyst

The Baker Group LP

800.937.2257

*The Baker Group LP is the sole authorized distributor for the products and services developed and provided by The Baker Group Software Solutions, Inc.

INTENDED FOR USE BY INSTITUTIONAL INVESTORS ONLY. Any data provided herein is for informational purposes only and is intended solely for the private use of the reader. Although information contained herein is believed to be from reliable sources, The Baker Group LP does not guarantee its completeness or accuracy. Opinions constitute our judgment and are subject to change without notice. The instruments and strategies discussed here may fluctuate in price or value and may not be suitable for all investors; any doubt should be discussed with a Baker representative. Past performance is not indicative of future results. Changes in rates may have an adverse effect on the value of investments. This material is not intended as an offer or solicitation for the purchase or sale of any financial instruments.